With 1.8 trillion PEPE tokens transacted at a loss, investors are questioning whether the meme coin can stage a comeback and reach the $0.000017 mark. Amid broader market fluctuations, PEPE faces key resistance and support levels that could determine its next major move.

Selling Pressure Mounts as 1.8T PEPE Moves at a Loss

The past week has been challenging for Pepe Coin, as significant sell-offs have dominated the market. According to CoinGape, 1.8 trillion PEPE tokens were transacted at a loss, signaling potential capitulation among holders. This trend often indicates panic selling, where investors offload their holdings to avoid further downside.

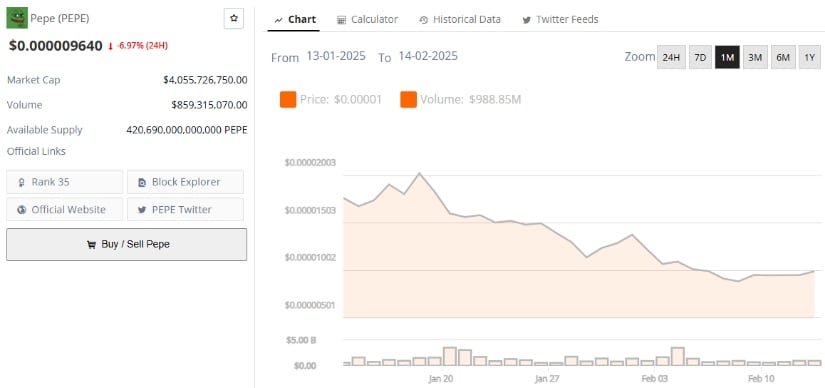

PEPE price dropped below the $0.000010 support, down 6.97% in the last 24 hours. Source: Brave New Coin

Analysts suggest that if this selling pressure persists without renewed buyer interest, PEPE could struggle to maintain current price levels. However, should the market absorb these sell-offs and demand strengthen, the meme coin might regain momentum toward its previous highs.

Key Resistance and Support Levels to Watch

Currently, PEPE is trading around $0.00001044, reflecting a 9.43% gain within the latest session. However, the token is facing a significant resistance barrier at $0.0000117. If PEPE successfully breaks above this level, it could trigger a 50% rally, pushing prices toward $0.00001785.

The PEPE price is holding above the critical support at $0.0000080. Source: MadWhale on TradingView

On the flip side, failure to hold above the crucial support level of $0.00000925 could intensify downside pressure. A drop below this threshold could lead to a 26% correction, potentially dragging PEPE to $0.00000688.

Market analysts emphasize that these price levels are crucial inflection points. “A breakout above $0.0000117 could fuel a strong uptrend, while a failure to sustain support might trigger a steep decline,” one crypto strategist noted.

Technical Indicators Hint at Possible Recovery

Despite the recent slump, Pepe Coin might not be down for the count just yet. Technical indicators are hinting at a possible comeback, with a bullish inverse head and shoulders pattern forming on the charts. If this setup plays out, PEPE could climb 23% to $0.000012. Adding to the optimism, the Relative Strength Index (RSI) has climbed out of oversold territory, signaling that momentum could be shifting in the bulls’ favor.

PEPE could plot a bullish breakout above $0.000010 as the price holds above the $0.0000080 key support. Source: Horbanbrothers on TradingView

Meanwhile, whale activity is sending mixed signals. Over the past week, large holders have scaled back their buying by 45.77%, but zooming out to a 30-day view tells a different story—accumulation has actually surged by 103.64%. This suggests that while some traders are cashing out, others see the dip as the perfect chance to load up.

Watch – Pepe Coin Price Analysis Video

Market Trends and External Influences

PEPE’s performance relies heavily on the market trend, particularly that of Bitcoin. As Bitcoin approaches $100,000, investors get optimistic about crypto. The entire cryptocurrency market’s total value is currently at $3.23 trillion, a 1% surge in 24 hours.

Major economic events continue to be a concern though. Federal Reserve actions, interest rates, and tensions in the rest of the world impact investors’ sentiments. The meme coin market took a massive hit, with PEPE plummeting 60% of its all-time high and total meme coin value decreasing to below $70 billion from $150 billion.

Will PEPE Rebound to $0.000017?

For PEPE to reach $0.000017, it must overcome immediate resistance and sustain buying momentum. While technical indicators show potential bullish signals, the market remains fragile. A decisive break above $0.0000117 would reinforce positive sentiment and could set the stage for further gains.

Market analysts anticipate $0.000017 as the immediate upside target for PEPE. Source: Hmaroudas on TradingView

On the contrary, if sellers continue to dominate and macroeconomic headwinds persist, PEPE may face prolonged consolidation or further declines.

Investors will be closely monitoring market sentiment, whale activity, and broader crypto trends to gauge whether PEPE is on the path to recovery or facing another leg down.

Brave New Coin – Read More