- Bitcoin’s 129% surge tests $100K as analysts debate late-stage bull cycle and Trump’s crypto impact.

- Dow Theory flags shift to distribution phase; MicroStrategy’s 10K BTC buy hints at institutional confidence.

Bitcoin’s price surged 129.2% over the past year, surpassing $100,000, but ETHNews analysts now debate whether it approaches a cycle peak. Ki Young Ju, founder of CryptoQuant, suggests the market enters a late-stage bull run.

“New retail investors are joining, extending the distribution phase” he states.

President Donald Trump’s pro-crypto advocacy, according to Ju, could prolong this phase for several quarters.

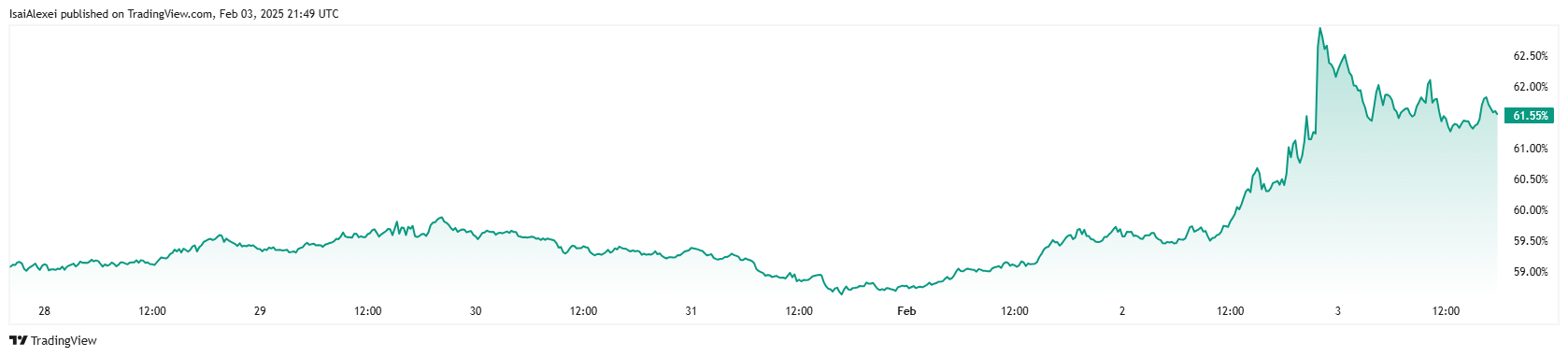

The Dow Theory, a framework analyzing market cycles, divides trends into accumulation and distribution phases. Bitcoin’s 2022 decline marked a distribution cycle, followed by accumulation from 2023 to 2024. Current data indicates a shift back to distribution, a pattern historically linked to price plateaus.

Despite this, Axel Adler Jr., a market analyst, argues Bitcoin’s funding rates remain stable. “The market isn’t overheated” he notes, adding that macroeconomic stability could support further growth.

Bitcoin’s “fair price” model, based on a power-law calculation, sits at $87,990. This level now acts as a baseline, with MicroStrategy’s aggressive purchases reinforcing institutional confidence.

The company acquired 10,107 BTC in early 2025, raising its total holdings to 471,107 BTC. Such activity often precedes broader market movements, as institutions signal long-term positioning.

The distribution phase typically coincides with retail investor participation, which has risen since mid-2024. However, leverage levels in futures markets remain subdued compared to prior cycles, reducing systemic risk. ETHNews analysts emphasize that Bitcoin’s current structure allows room for price discovery, though volatility could intensify as the cycle matures.

MicroStrategy’s strategy mirrors corporate adoption trends, where firms treat Bitcoin as a reserve asset. This behavior contrasts with retail trading patterns, which dominate short-term price swings. While distribution phases often precede corrections, prolonged institutional demand might delay or soften downward pressure.

For now, Bitcoin’s trajectory hinges on macroeconomic factors and regulatory developments. The $87,990 support level serves as a technical anchor, while MicroStrategy’s purchases highlight enduring institutional interest. Traders monitor these signals to gauge whether the bull run retains momentum or prepares for consolidation.

The post $100K Bitcoin at Risk? Why the Distribution Phase Could Crush Late Retail Investors appeared first on ETHNews.

ETHNews – Read More