- Bitcoin exchange reserves hit 2.45M BTC; holders withdraw coins, signaling potential accumulation before price shifts.

- Symmetrical triangle pattern forms: Break above $110K triggers rally; rejection risks drop to $89K support.

Bitcoin traded near $96,867 on Thursday, down 1.48% in 24 hours, as investors monitored critical price thresholds. Analysts identified immediate resistance levels at $102,806 and $110,000.

A sustained move above these could propel prices toward $120,000. Conversely, failure to breach resistance might push Bitcoin toward support at $95,801 or $89,381, extending its current consolidation phase.

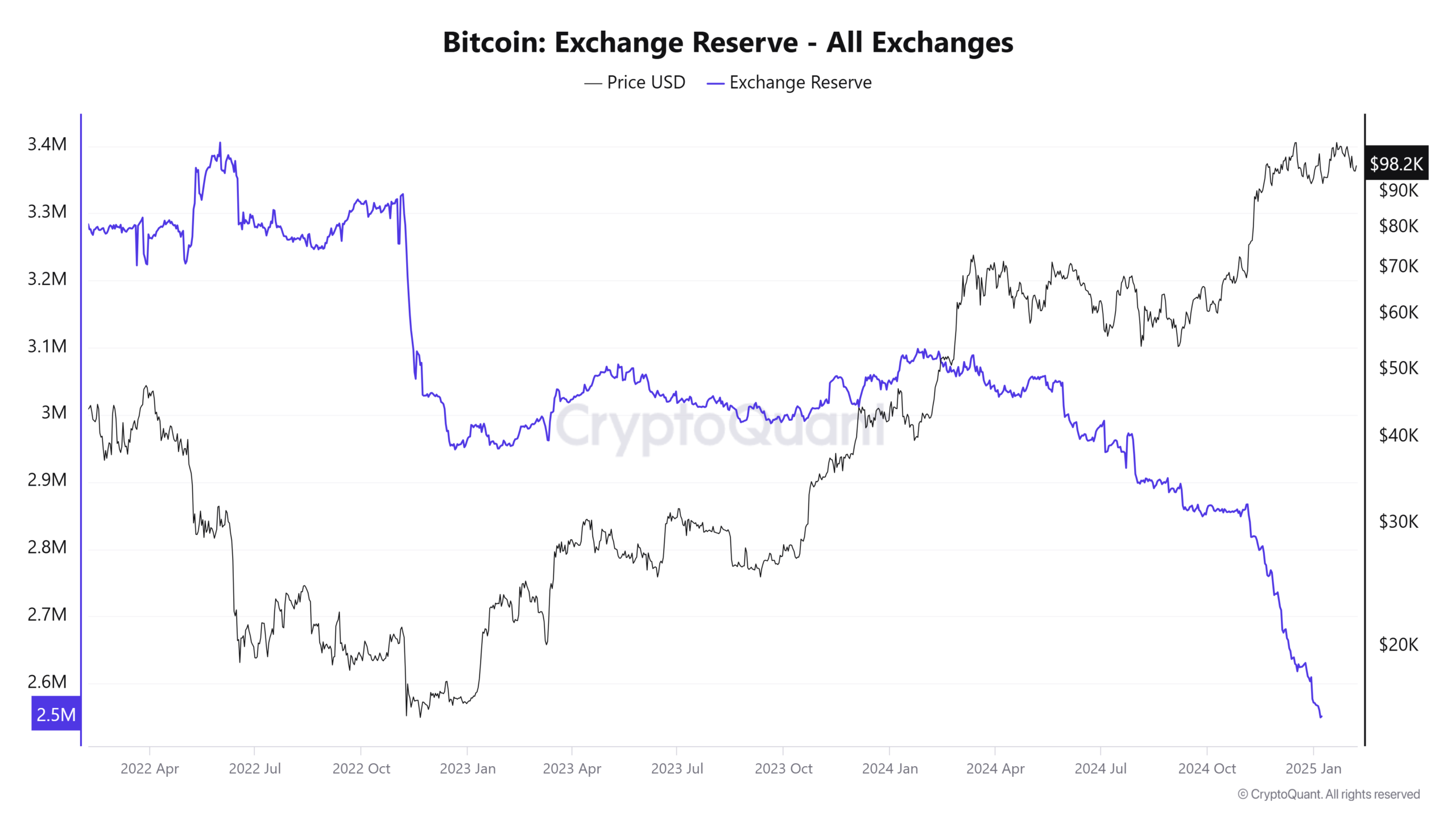

Data from CryptoQuant shows exchange reserves fell to 2.455 million BTC, a 0.28% daily drop. Reduced exchange balances often signal accumulation, suggesting holders anticipate higher prices. However, this trend also implies fewer coins available for immediate selling, creating a tug-of-war between bullish momentum and potential stagnation.

The asset’s price action currently forms a symmetrical triangle—a pattern frequently preceding breakouts. ETHNews traders note that Bitcoin’s direction hinges on whether it escapes this technical structure upward or downward.

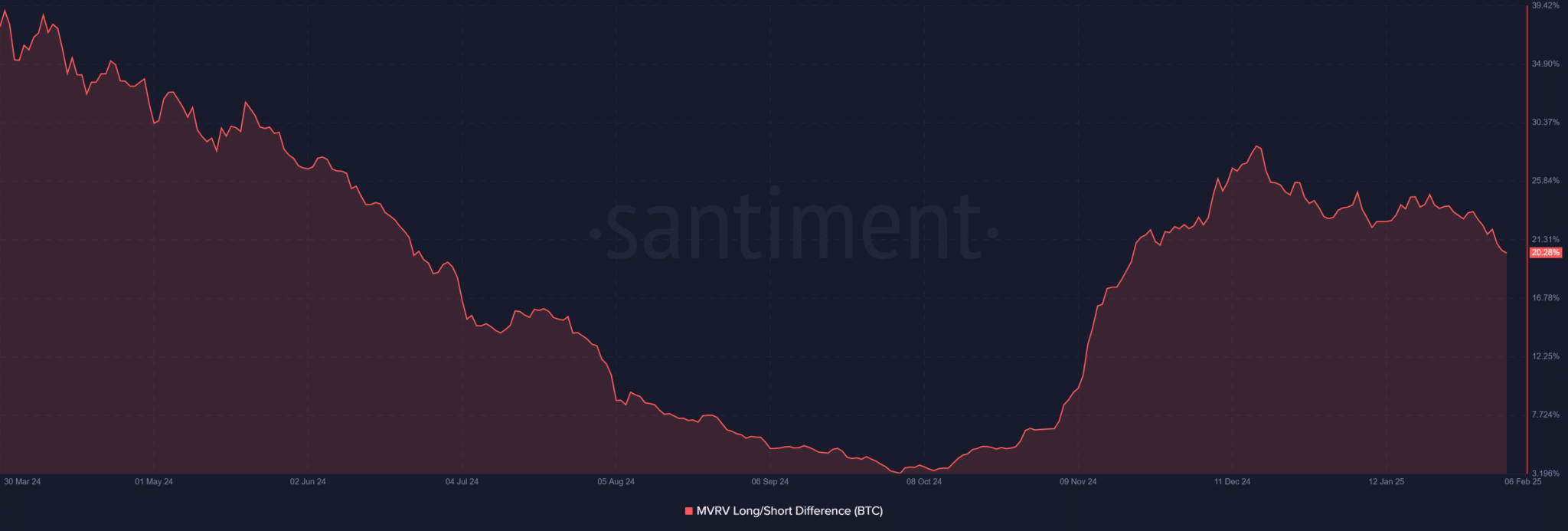

Meanwhile, the MVRV Long/Short Difference, a metric comparing holder profitability, sits at 20.28%. This balance between long-term and short-term interests reflects cautious optimism. A recent dip in long positions hints at wariness, yet a sentiment shift could reignite buying pressure.

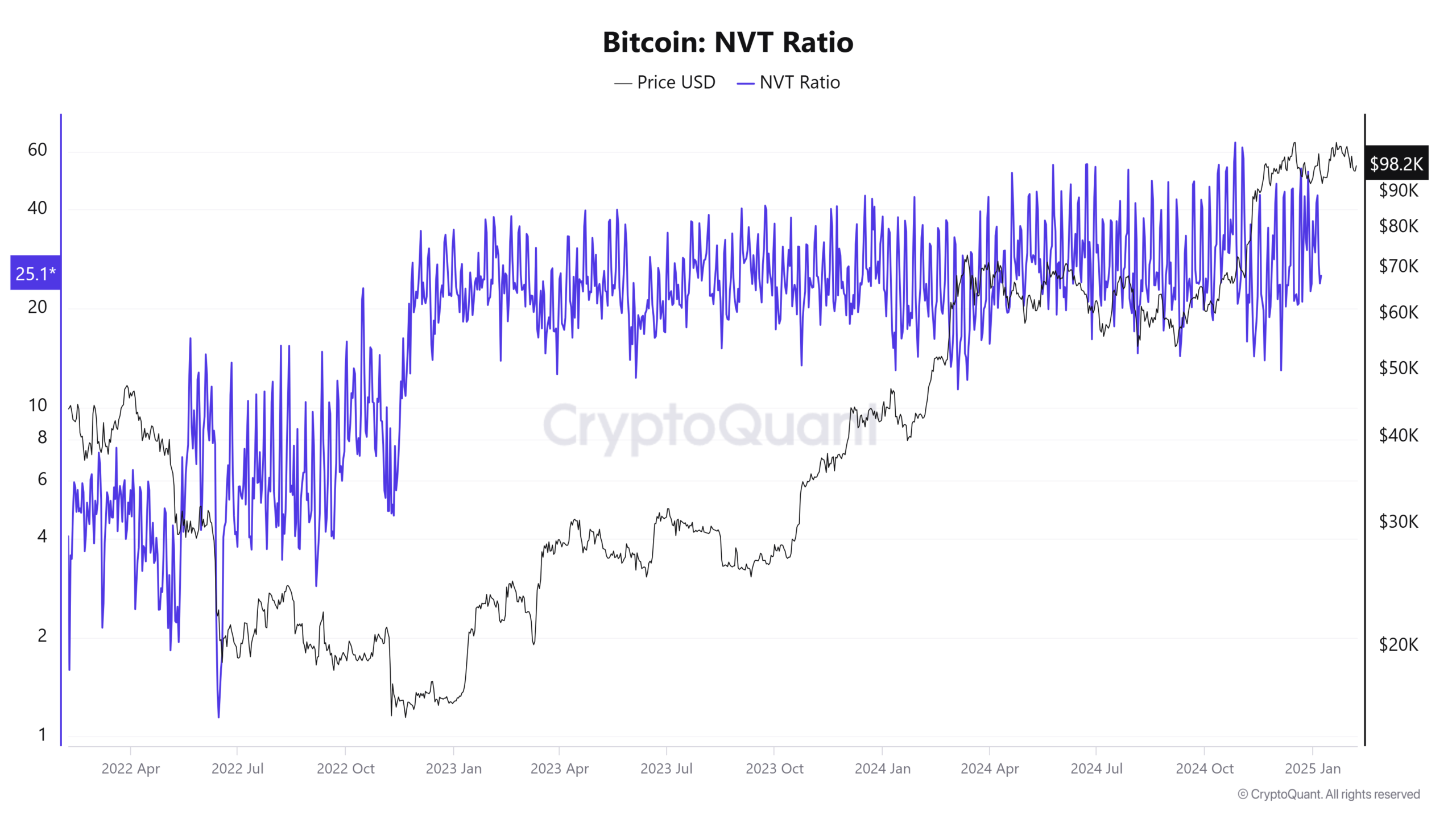

Bitcoin’s Network Value to Transaction (NVT) ratio rose 13.26% to 31.50, aligning market capitalization with transaction volume. While higher ratios sometimes signal overvaluation, the current uptick suggests network growth matches price trends—a constructive sign.

Network growth inched up 0.16%, indicating steady adoption. However, the “In the Money” metric—tracking profitable addresses—fell 2.01%, revealing pockets of investor losses. Simultaneously, large transactions edged up 0.02%, suggesting heightened activity among major holders.

ETHNews traders interpret falling exchange reserves and a balanced MVRV as precursors to upward momentum. Others caution that resistance tests and profit-taking could delay gains. For now, Bitcoin’s path relies on overcoming technical barriers or succumbing to gravitational pull toward lower supports.

As uncertainty lingers, traders brace for volatility. The coming days will test whether accumulation patterns and technical setups translate into decisive movement—or prolong the stalemate.

The post $110K BTC Breakout or $89K Crash? This Chart Pattern Decides Bitcoin’s Fate appeared first on ETHNews.

ETHNews – Read More