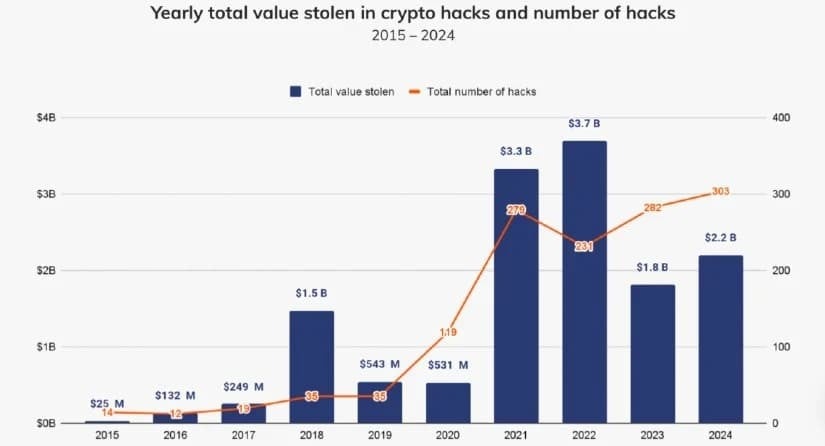

Data compiled throughout 2024 indicates that the global cryptocurrency industry experienced a sustained and significant level of criminal activity, potentially setting the stage for heightened security challenges in 2025.

According to multiple reports released this year, hackers stole a total of $2.2 billion in crypto assets, representing a more than 21% year-over-year increase from 2023. These thefts occurred across 303 individual hacking incidents, up from 282 reported the previous year.

Analysts at blockchain research firm Chainalysis noted that 2024 marked the fifth year in the past decade to surpass the $1 billion theft threshold, joining 2018, 2021, 2022, and 2023. This continued prevalence of large-scale thefts has raised concerns within the cryptocurrency industry, especially as asset prices increase and adoption widens. The figures suggest that even as the market matures, the possibility of significant cyber intrusions persists.

Source: Chainalysis

Over the course of 2024, hackers displayed shifting priorities. Early in the year, decentralized finance (DeFi) platforms continued to appear vulnerable, building on patterns seen in previous years. However, the second and third quarters saw a notable turn as centralized services became the primary targets. Major breaches of centralized platforms, including a $305 million attack on Japan’s DMM Bitcoin exchange in May and a $234.9 million heist from India’s WazirX in July, underscored the evolving threat landscape. While DeFi platforms had previously been regarded as higher-risk targets due to rapid deployment and limited security vetting, the focus in mid-2024 moved toward established centralized exchanges that hold large pools of customer funds.

Chainalysis researchers stated that private key compromises accounted for the largest share of stolen crypto, at about 43.8%. Such incidents highlight how attackers exploit fundamental vulnerabilities in storage mechanisms. The targeting of private keys—digital credentials granting direct access to user assets—created new challenges for platform operators. According to data included in the Chainalysis reports, laundering strategies also shifted, with some attackers favoring mixing services and bridging platforms to disguise their tracks.

North Korea-linked hackers played an increasingly significant role, stealing $1.34 billion over 47 incidents in 2024, according to Chainalysis and other blockchain analysis firms. This figure amounted to more than half of the total stolen worldwide.

Chainalysis noted that while it had initially attributed $1 billion in theft to North Korea-linked groups in 2023, subsequent investigations narrowed that figure to $660.5 million, a revision prompted by new information. The marked increase in 2024, up from the revised 2023 total, suggests that these state-sponsored actors became more adept at orchestrating large-scale heists and also showed a willingness to conduct smaller operations, with some attacks netting only $10,000.

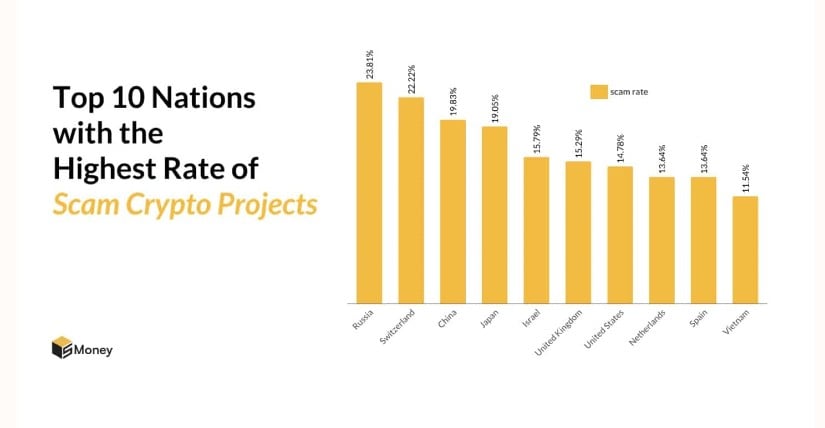

Source: 5Money

The activity of North Korean groups slowed in the latter half of 2024, a period coinciding with a high-level meeting between leaders from North Korea and Russia. Chainalysis data indicated that amounts stolen by North Korea-linked hackers dropped by about 53.7% after July 1, while non-DPRK-linked thefts rose by around 5%. Analysts did not conclusively link the slowdown to the summit but noted the timing as a notable shift in patterns. There is also a high likelihood that we will see similar trends to what we experienced this year in 2025.

Brave New Coin – Read More