World Liberty Financial (WLFI), a crypto investment firm backed by Donald Trump, took major hits over the weekend.

From January 19 to January 31, the firm invested $242.77 million across numerous cryptocurrencies. But sadly, all that investment has depreciated by 21% owing to the market crash.

This means WLFI experienced an unrealized loss of around $51.77 million, with substantial drops in the main holdings like Ethereum (ETH) and Wrapped Bitcoin (WBTC).

ETH, which is the firm’s largest holding, experienced a drop of 24.45% slashing $36.67 million. WBTC also suffered a drop of 12.07% that led to loss of $8.07 million. Ethena (ENA) made the worst by experiencing a drop of 43.72% which resulted in loss of over 2 million dollars from WLFI’s investment.

Other holdings like TRON (TRX), AAVE, and Chainlink (LINK) also took big losses, deepening the crisis.

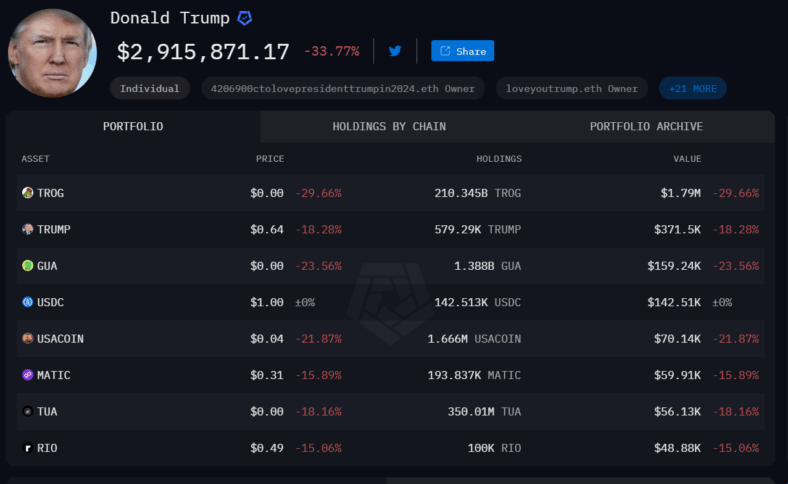

The president’s personal crypto portfolio also didn’t do well either. His official memecoin”, which once added $55 billion to his wealth, has fallen 64% in value since January 20, taking its value down to less than $20 billion in overall wealth in cryptocurrencies.

His donated crypto holdings have also dipped under $5 million, the majority of which is made of memecoins.

The fall is a result of the economic and political event that affected the whole crypto market. Analysts blame Trump’s newly imposed tariffs for the collapse, which has wiped out nearly $500 billion in market value.

Some say the fall was unavoidable owing to overheated market circumstances, but tariffs could have accelerated the sell-off. “Besides, the crypto market was already on the edge to busting after so many ‘top signals’ were hovering around,” according to one expert.

Also Read: Why Crypto Market Crashed? Trump’s Tariff or Top Signals?

The Crypto Times – Read More