- ETH/BTC ratio nears 0.05 BTC support; failure risks slide to 0.045 as sellers dominate 77% of trading days.

- Bitcoin ETFs divert institutional capital from Ethereum, leaving ETH without catalysts to reverse underperformance.

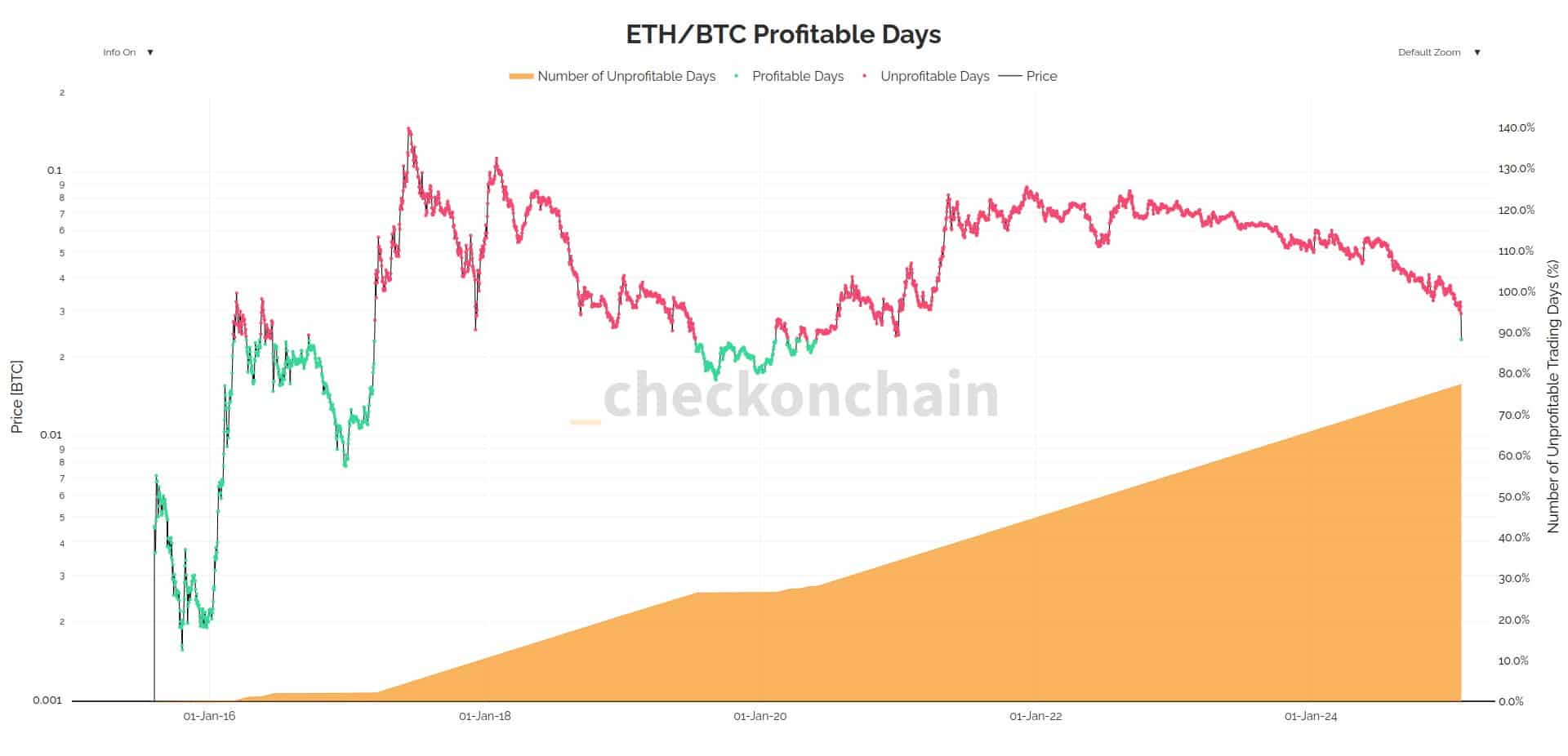

The ETH/BTC ratio hovers near 0.05 BTC, a threshold that could dictate its short-term direction. Data shows Ethereum has underperformed Bitcoin in 77% of trading days since 2022, a pattern amplified by recent volatility. This trend raises questions about Ethereum’s capacity to reverse its position against Bitcoin in current market conditions.

A chart tracking ETH/BTC profitability uses green and red bars to mark days when Ethereum gained or lost ground against Bitcoin. Red dominates the visual, reflecting prolonged underperformance. An orange section at the base grows steadily, indicating the proportion of unprofitable days now exceeds 77%.

Brief green intervals since early 2022 show temporary recoveries, but each has been followed by renewed declines. The ratio’s drop in early 2025 extended this pattern, pushing the metric to its lowest point in years.

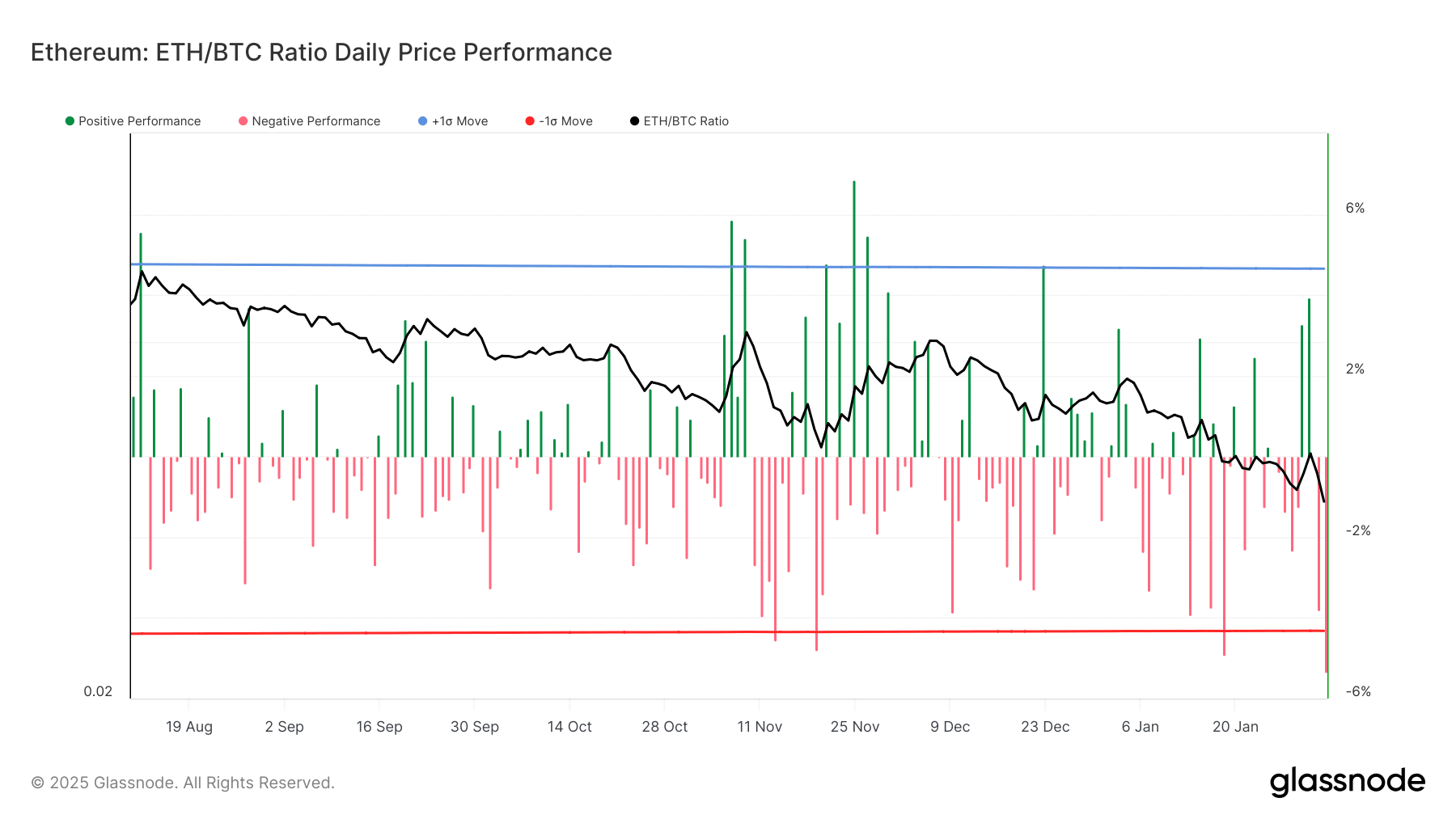

Price charts reveal sharp downward movements, including a steep decline in early 2025 that erased short-term gains. Daily closes below prior levels outnumber positive ones, confirming persistent selling activity.

Since mid-2024, Ethereum has failed to sustain rallies against Bitcoin, with each upward attempt met by swift reversals. The ratio’s descent to 0.05 BTC places it at a junction watched by traders, as this level previously acted as a floor during past cycles.

Bitcoin’s dominance in institutional portfolios explains part of Ethereum’s struggle. After U.S. regulators approved spot Bitcoin ETFs in 2024, capital flowed disproportionately into Bitcoin, sidelining other assets.

Ethereum, though widely used for decentralized applications, lacks comparable triggers to attract large-scale investment. Its own ETF approval failed to generate similar inflows, reflecting muted demand relative to Bitcoin.

ETHNews analysts identify the 0.05 BTC level as a make-or-break zone. A sustained breach could see the ratio slide toward 0.045 BTC, a scenario traders are preparing for. Monitoring order books and volume patterns near this level may offer clues about its durability.

Until Ethereum finds drivers to shift investor sentiment, its underperformance against Bitcoin is likely to persist. Market participants now weigh whether external factors, such as regulatory shifts or protocol upgrades, could alter this trajectory in the coming months.

The post 77% Loss Days: The Hidden Crisis Behind Ethereum’s Freefall Against Bitcoin appeared first on ETHNews.

ETHNews – Read More