Software company MicroStrategy is stopping its Bitcoin buying spree for now. The company, known for holding a massive Bitcoin stash, had been on a non-stop shopping spree for 12 weeks straight.

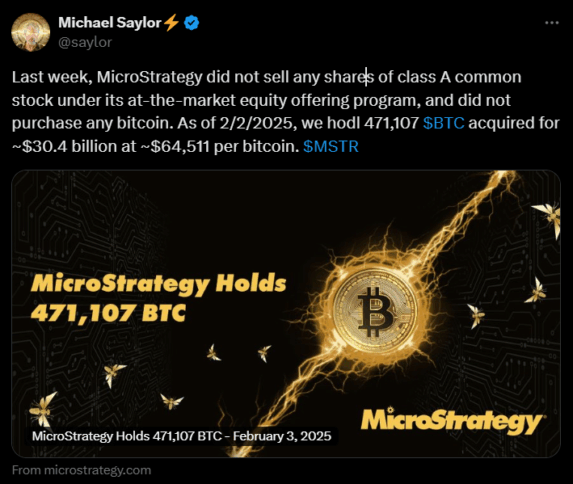

Chairman and co-founder Michael Saylor announced on X, formerly Twitter, that the firm paused its Bitcoin buys last week.

“Last week, MicroStrategy did not sell any shares of class A common stock under its at-the-market equity offering program, and did not purchase any Bitcoin,” Saylor wrote.

Even with the pause, MicroStrategy still holds 471,107 BTC, worth around $46.6 billion at today’s price.

Over the years, the company has spent $30.4 billion buying Bitcoin. Its largest purchase was just 12 weeks when its poured over $20 billion into the assets

The company has been following an aggressive strategy called the “21/21 Plan”, which aims to raise $42 billion to buy even more Bitcoin. The company plans to gather $21 billion from selling stock and another $21 billion from fixed-income securities.

Originally, MicroStrategy focused on selling data analytics software, but it has now become the biggest corporate holder of Bitcoin. Investors have been buying MicroStrategy’s stock as a way to gain exposure to Bitcoin without holding it themselves.

Saylor first turned to Bitcoin in 2020, when the COVID-19 pandemic hit, and the U.S. Federal Reserve slashed interest rates. He saw Bitcoin as the best way to protect the company’s money. Since then, MicroStrategy’s stock has skyrocketed. It went from $14.44 in August 2020 to $332 today, a 2,199% increase.

Also Read: Bitcoin Price Drops to $92K as Trump Imposes New Tariffs

The Crypto Times – Read More