- Analyst Jason Pizzino warns that Sui (SUI) may face a significant correction if it fails to hold the $2 support level, with potential drops to $1.60 or lower.

- SUI is currently trading at $3.60 with recent gains.

Cryptocurrency analyst and trader Jason Pizzino has raised concerns about Sui (SUI), suggesting that the Solana (SOL) competitor may be on the verge of a significant downturn. Pizzino analyzed SUI’s market structure, which shared the same indicators as previous price drops, leading to a sharp market fluctuation. He shared this finding with his 345,000 YouTube subscribers.

Pizzino highlighted that SUI’s price action has shown an “overbalance in time and price” following its drop to $2.38. This term refers to a market move where a correction extends further in both duration and depth than any previous pullbacks seen in the current bullish cycle. He noted that such a pattern often indicates a weakening trend, increasing the probability of a further decline.

Drawing a comparison to SUI’s price movement from April to August 2024, Pizzino observed a striking similarity. SUI initially fell from around $2 to below $1 during that period before experiencing another deep correction. The analyst warns that if this pattern repeats, SUI could be at risk of another substantial pullback.

Key Price Levels to Watch

At present, the token is attempting to maintain the 50% retracement level, a critical support zone. However, Pizzino warned that if SUI fails to hold above $2 on the daily chart, it may drop further to $1.60 or lower.

According to Pizzino, SUI must remain above the $2 mark to avoid a potential downward spiral. If it loses this support, the next key levels traders should watch include $1.60 and possibly $1.10–$1.20. He also noted that a more severe correction could push prices down to the $0.73 range, which served as a previous market low.

While these price targets represent possible scenarios, the analyst cautioned that further confirmation is needed before considering the lower ranges. He emphasized that market participants should closely monitor whether SUI can sustain its position above $2. It is worth noting that this comes at a time when Major altcoins like SUI, Aptos, and Arbitrum, among others, are set for token unlock, as discussed in our earlier reports.

Despite these warnings, SUI has shown strong short-term gains, rising 14% in the last 24 hours to trade at $3.56. This recent surge suggests that the asset still has buying interest, but the coming days will determine whether the upward momentum can be maintained.

Broader Market Implications

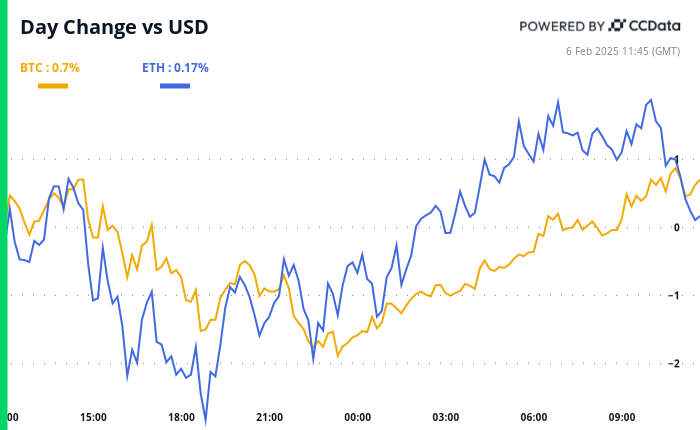

The future decline of SUI occurs during an uncertain period for the entire cryptocurrency industry. Market assets demonstrate mixed performance, with some continuing their rising trends while others showing signs of exhaustion. Market analysts treat these price drops as the normal course of market patterns, specifically when assets experience fast-rising trends.

Investors and traders will be watching closely to see if SUI follows the historical pattern outlined by Pizzino or manages to break out of it. If the token holds above key support levels, it could indicate renewed strength. However, failure to do so may confirm the bearish outlook and lead to a deeper decline.

Crypto News Flash – Read More