- BlackRock’s expansion into Europe with a Swiss-based Bitcoin ETP marks a major step in global crypto adoption, building on its U.S. success.

- While the U.S. embraces crypto under Trump, European markets face tighter regulations, making BlackRock’s move into Switzerland a strategic play.

Previously, Europe proposed a strategic Bitcoin reserve following Donald Trump’s U.S. election win and renewed optimism in the crypto sector, as highlighted in a CNF update. In a significant move, BlackRock, the world’s largest asset manager with over $10 trillion in assets under management, is preparing to launch a Bitcoin exchange-traded product (ETP) in Europe.

This initiative marks BlackRock’s first crypto-linked ETP outside the United States and underscores the increasing demand for digital asset investment opportunities among European investors. However, as reported by Reuters:

While the U.S. crypto industry has celebrated Trump’s election and his pledge to support the sector, crypto businesses in Europe are facing new, tougher regulations.

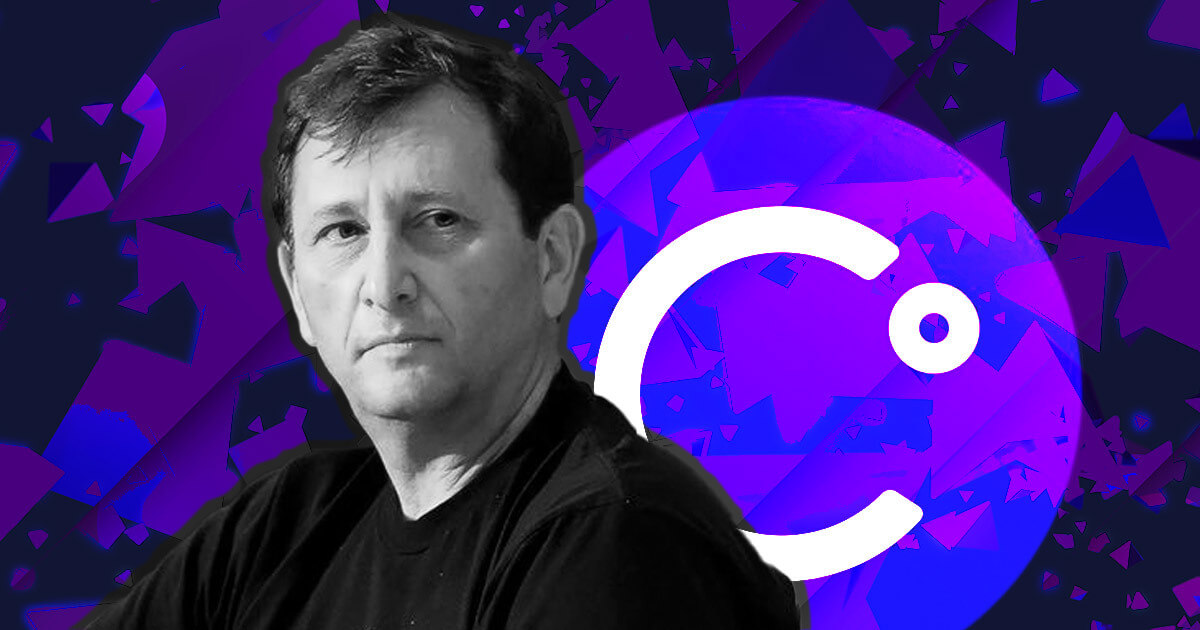

BlackRock’s European Bitcoin ETP: A Strategic Expansion

According to sources familiar with the matter, BlackRock plans to domicile the new Bitcoin ETP in Switzerland, with marketing efforts potentially commencing as early as this month. This strategic choice aligns with Switzerland’s progressive regulatory environment and its reputation as a hub for financial innovation.

James Seyffart, a Bloomberg ETF analyst, noted in a tweet, that it looks like BlackRock is going to launch a Bitcoin ETF in Europe according to my colleagues in Bloomberg News.

Looks like BlackRock is going to launch a Bitcoin ETF in Europe according to my colleagues in Bloomberg news ( @emilyjnicolle)

Can’t tell from article but guessing they will follow same playbook they used in Canada? Where the ETF is just a wrapper that holds IBIT (the US ETF) pic.twitter.com/Cqp9tlWsky

— James Seyffart (@JSeyff) February 5, 2025

Building on U.S. Success: The iShares Bitcoin ETF

This European venture follows the notable success of BlackRock’s U.S.-based iShares Bitcoin ETF (IBIT), which has amassed nearly $60 billion in assets since its launch in January 2024. The rapid growth of IBIT reflects a strong appetite for regulated Bitcoin investment vehicles among institutional and retail investors alike.

According to a Reuters update, while Europe has witnessed a surge in cryptocurrency adoption, the regulatory environment remains complex. The introduction of the Markets in Crypto-Assets Regulation (MiCA) presents both opportunities and challenges for firms like BlackRock.

Implications for Bitcoin Adoption in Europe & Market Update

BlackRock’s foray into the European crypto market is poised to significantly influence Bitcoin adoption across the continent. By offering a regulated investment vehicle, the firm provides investors with a familiar and secure avenue to gain exposure to Bitcoin.

Currently, Bitcoin is trading at approximately $98,525, reflecting a slight increase of 0.26% over the past 24 hours. BlackRock’s stock (BLK) is trading at $1,014.50, showing a marginal decrease of 0.16% from the previous close. These movements indicate a stable market response to BlackRock’s latest announcement.

Crypto News Flash – Read More