The cryptocurrency exchange Gemini and the on-chain research company Glassnode have just released their 2025 report “Charting The Tides”.

The two major entities in the Web3 sector have come together to delve into the current state of the crypto market, highlighting the shift in capital flows and the new trends underway.

Where is the future of digital assets headed? We discover it together in this article.

Gemini and Glassnode report: digital assets attract new capital flows in 2024

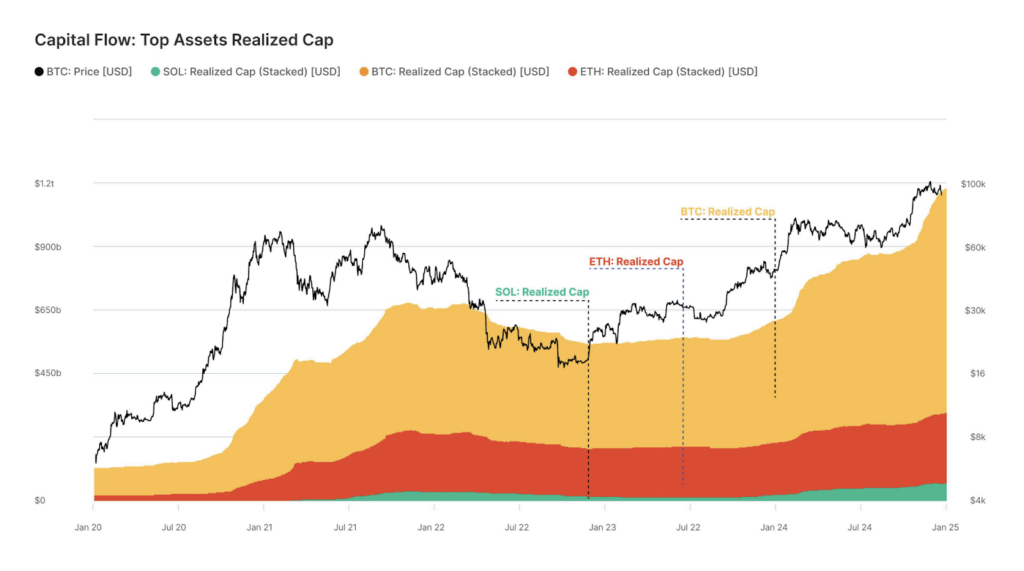

According to the report conducted by Gemini and Glassnode, digital assets have recorded large capital inflows in the last two years.

High-cap cryptocurrencies like BTC, ETH, and SOL have seen their prices rebound well during the 2023/2024 biennium, driven by an increase in demand both at the institutional and retail levels.

Bitcoin is by far the currency that has received the most inflows at this stage, as highlighted by the “Realized Cap” metric.

This Indicator, which tracks net money flows, is useful for evaluating investor behavior and better understanding market sentiment.

It is calculated by summing the value of each coin based on the price at which it was last purchased.

Since January 2023, the Realized Cap on Bitcoin has grown from 381 billion dollars to 843 billion dollars, for an increase of 121%.

At the same time, Solana achieved a more modest increase in capitalization, rising from 21 to 83 billion dollars, despite having a higher percentage increase of 295%.

Ethereum, on the other hand, is the one that performed worse, increasing from 176 to 256 billion in capitalization, for a growth of 45%.

From this perspective, Solana emerges as one of the fastest-growing digital asset ecosystems, having outperformed the top 2 digital assets in the market on 344 out of 727 open market days.

In any case, Bitcoin still boasts the largest overall share of realized capital, amounting to 70.6%, followed by Ethereum at 22.4% and finally Solana at 6.9%.

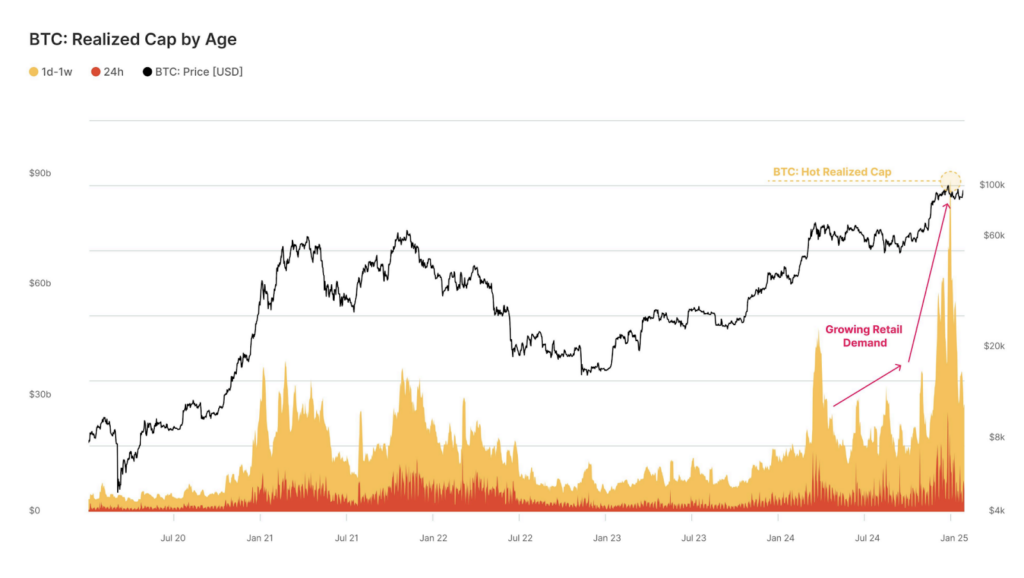

Retail investors drive the bull market of Bitcoin at the end of 2024

Gemini and Glassnode have observed how in the last 2 years the focus of various market players has consistently shifted during the last bull cycle.

If indeed between the end of 2023 and the beginning of 2024 the growth of the crypto sector was driven by institutionals, we cannot say the same for the subsequent period.

Retail investors, often more oriented towards short-term speculation, have come back into the spotlight from Q2 2024 onwards, with a strong expansion at the end of the year.

To evaluate how this handover occurred, Gemini and Glassnode isolated the Realized Cap values for BTC, ETH, and SOL, with the capital held by wallets active from 1 to 7 days.

By doing so, the indicator “Realized Cap by Age” is produced, which measures the longevity of new capital flows in the market.

This metric is particularly useful for understanding the distribution of network wealth among different age brackets, from the hot supply (coins that have moved recently) to the cold supply (older and dormant coins).

According to what emerged about Bitcoin, addresses from 1 to 7 days skyrocketed at the end of the year, coinciding with the break of 100,000 dollars.

In this context, retail investors contributed with 99.6 billion dollars, equivalent to 13.7% of the total wealth of the network.

In the last bull market cycle, retail investors had contributed only 45.3 billion dollars to Bitcoin, with a share of 22.5%.

This suggests that there is still room for a bull ride for investors more inclined towards speculation.

Gemini and Glassnode show contrasting retail forces on Ethereum and Solana

On Ethereum and Solana the issue appears different: Gemini and Glassnode show how

The retail arrived at different moments of the market and with different strength.

In 2024 for Ethereum we witnessed a less pronounced increase in retail strength, given the underperforming performance of the asset.

The local top of the Hot Realized Cap indicator for ETH, that is, the capital held by accounts that have been active in the last seven days, did not coincide with new price highs of the coin, unlike BTC and SOL.

The peak of the cycle brought inflows of only 11.6 billion dollars, equal to 4.7% of the total wealth of the network.

The currency of Vitalik Buterin has remained below the May 2021 low, suggesting a lack of appeal among retail users.

Solana, on the other hand, appeared much more interesting in the eyes of retail, who rushed to the SOL markets throughout almost all of 2024.

Also in this case, the Hot Realize Cap for the cryptocurrency did not coincide with the historical price high, although it came very close to the target.

Short-term investors have transferred wealth amounting to 15.8 billion dollars, equivalent to 21% of the total capital.

These data suggest that SOL has been the preferred asset in the bull market of this cycle, acquiring significant capital inflows.

The memecoin mania drives strong network activity on Solana

As Gemini and Glassnode highlight, one of the factors that has most contributed to bringing greater retail activity to Solana has been the memecoin mania.

For the first time in history, Solana has surpassed Ethereum in terms of capital held by retail investors, precisely due to the strong interest in this type of high-risk asset.

This trend began in October 2023, marking a strong pivot point of reversal for the SOL/ETH ratio. From that moment on, SOL has brutally outperformed ETH, leaving little room for speculative attention for the EVM network.

In a scenario like this, even on-chain activities have shifted in favor of the Solana ecosystem.

At the end of 2023, in fact, the number of active addresses of the SOL network skyrocketed, surpassing both the numbers of Ethereum and Bitcoin.

Consider that as of today the network founded by Anatoly Yakovenko boasts 12.3 million daily active addresses, 16.2 times more than Bitcoin and a full 24.6 times more than Ethereum.

As mentioned, the true proxy of this explosion in retail activity arrived in tandem with the success of the memecoin sector on Solana.

Throughout 2024, memecoins have played a prominent role as a feature of the cycle, attracting the largest share of capital through altcoins.

What has brought this trend out of control is likely the ability of meme assets to bring stellar gains to its early investors, despite the obvious enormous risks in trading these resources.

Gemini and Glassnode note in this regard how the WIF and BONK coins have led the bull of the SOL price throughout Q1 2024.

The exponential increase of their Realized Cap has indeed come hand in hand with the leg up of the currency above the key level of 120 dollars.

Furthermore, by monitoring the realized cap of BONK and WIF throughout 2024, we notice an incredible inflow of 4 billion dollars (+1330%).

The capital inflows into these two memecoins on Solana are 100 times higher compared to their Ethereum counterparts, highlighting the retail preference for the first chain.

New trends and stimuli of the futures market: the general orientation is bullish!

In their report, Gemini and Glassnode also focused on the upcoming trends and the new stimuli that the cryptocurrency market is facing.

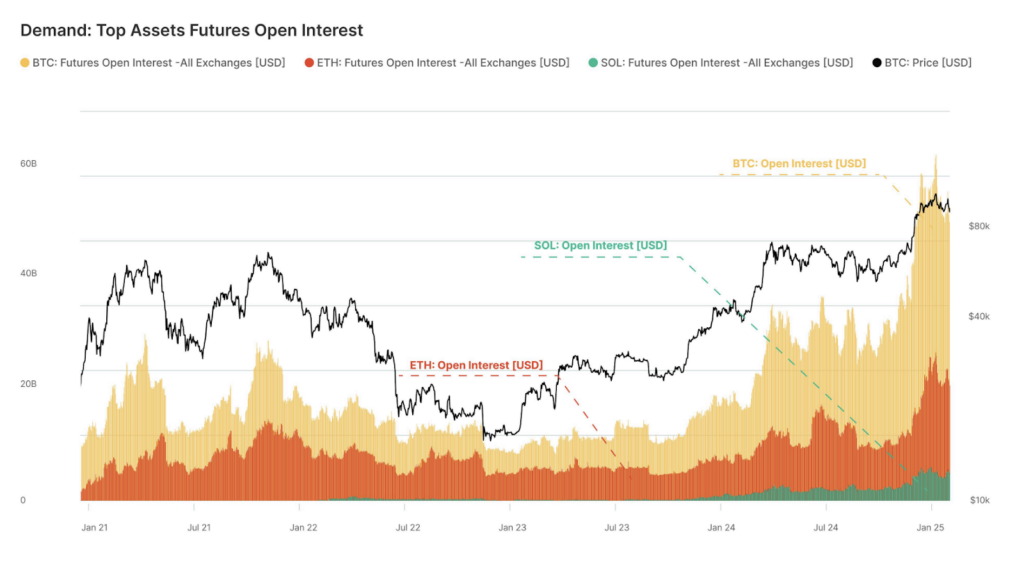

Very interesting to report in this regard the analysis on the crypto exchanges futures, which reveals a great increase in interest throughout 2024.

In particular, the open interest metric, which is the sum of all contracts still open, seems to have recorded a significant growth phase, surpassing the historical highs of 2021.

More specifically, since January 2024 the open interest of Bitcoin has increased by 216%, going from 16.1 to 50.9 billion dollars.

For Ethereum, there was more or less the same trend with an increase of 196%, bringing the open positions from 6.7 to 19.8 billion dollars.

For Solana, the true queen of this cycle, the open interest has exploded by 292%, with the futures value increasing from 1.3 to 5.1 billion dollars.

These data suggest a growing demand for exposure to digital assets for the institutional audience.

Unlike retail, institutional investors have contributed less with memecoins but have supported the growth of the derivatives markets.

Another aspect not to underestimate is that of the funding rates of the futures markets.

This metric indicates the cost of maintaining an open position in a derivative contract, and it can be of great help in assessing the trend of a trend and the behavior of investors.

According to the analysis by Gemini and Glassnode, since January 2024 the funding rates have been almost positive, indicating a general bullish orientation.

In the most euphoric phases of the 2023-24 season, the rates on solana tended to be traded.

slightly higher than that of bitcoin and ethereum, synonymous with greater speculative activity.

In the last phase of the year, rates fell into negative territory, highlighting less support from demand and a greater tendency towards seeking short positions.

If such a scenario were to reverse and return to an outlook similar to that of early 2024, we could return to a full bull expansion phase.

News and Analysis on Cryptocurrencies, Blockchain and Decentralized Finance – Cryptonomist – Read More