On Wednesday, Solana-based decentralized exchange aggregator Jupiter reportedly suffered a security breach where its official X account was compromised to promote fraudulent meme tokens. The incident had the crypto community up in arms, concerned over protocol security and social media vulnerabilities as many wondered how a platform managing billions in liquidity could fail to secure its digital presence.

It is reported that hacks and frauds have made the crypto industry lose approximately $1.49 billion in 2024, which was down 17% from 2023. According to a report by blockchain security platform Immunefi, hacks were by far the leading cause, at $1.47 billion or 98.1% of total losses across 192 incidents. Fraud, including rug pulls and scams, accounted for only 1.9% with losses amounting to $28 million, though this did increase by 72% compared to the year before. Overall, crypto losses went down because of better security, as the actual number of attacks went down by 27.5%, from 320 in 2023 to 232 in 2024.

Jupiter Confirms X Account Hack – Warns Users

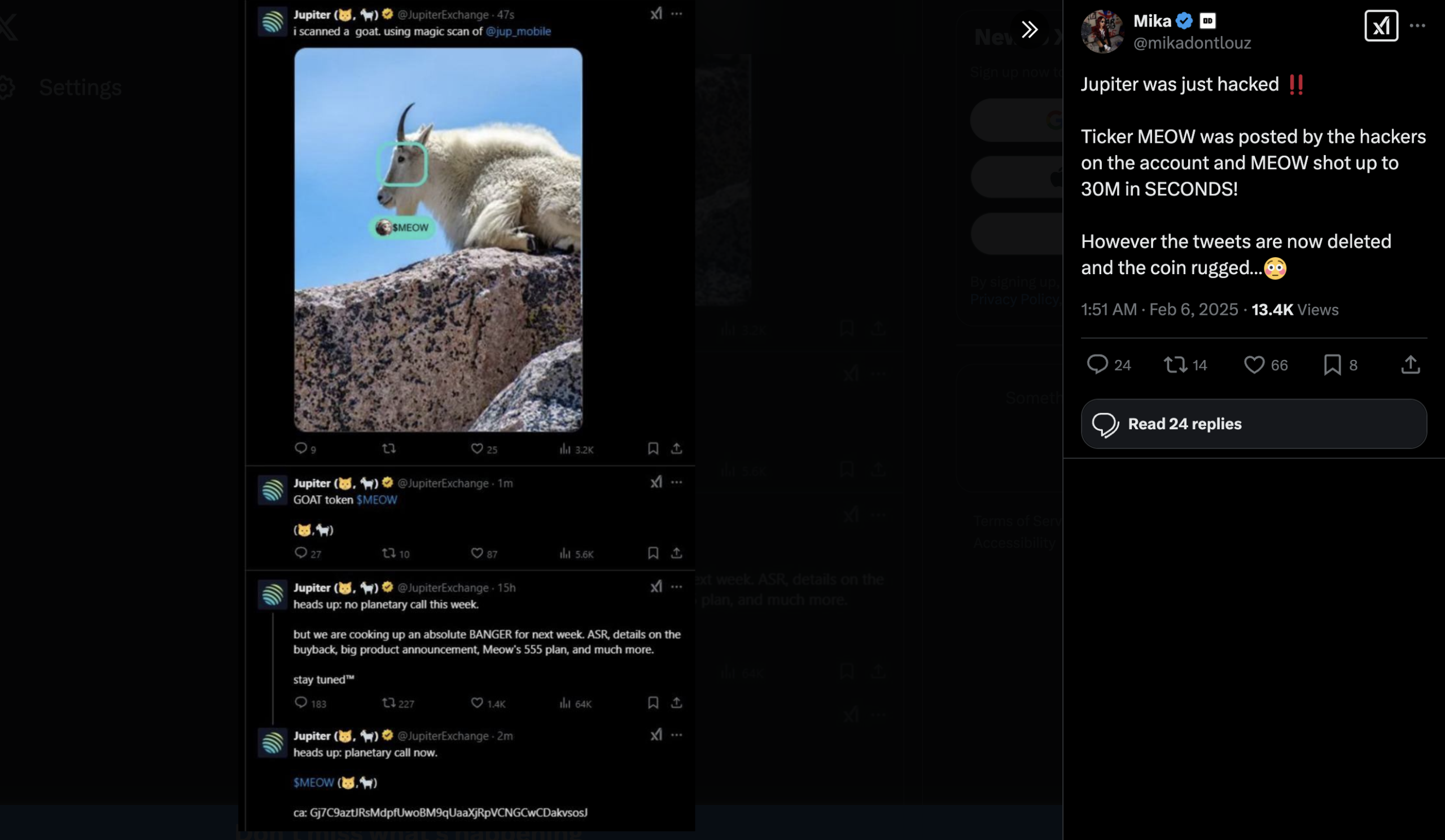

Jupiter’s official handle, Jupiter Mobile, confirmed that, indeed, the team was hard at work to regain control. Shortly after the attack, the compromised X account started shilling fake meme coins and asked users to visit malicious links.

“The main Jupiter Exchange account has been compromised,” Jupiter Mobile announced on X. “Team is working on restoring access. Do not engage with any links.”

Despite the immediate warning, several traders lost their money in minutes and raised the alarm over how crypto scams spread so fast via hacked accounts.

Hacker Pushes Fake $MEOW Token – Millions Lost

Based on available reports, it started with the attacker shilling some scam token, $MEOW, named after the pseudonymous Jupiter cofounder Meow. The scam token was heavily shilled through deceitful tweets, which called for participation in what looked like an official launch.

- Screenshots of the scam spread widely before the posts by the hacker were deleted.

- GM Capital founder Beanie had also said the traders lost millions within minutes over this fraudulent promotion.

- He went on to promote another fake token, $DCOIN, to further the damage.

Security Concerns Intensify

The incident has fanned the embers of security vulnerabilities in the crypto space. Critics wondered how a platform managing billions of DeFi liquidity still failed to secure its social media presence, an attack vector it should have known.

“It’s alarming that a leading DEX aggregator lacks proper account security. If attackers can breach its X account, what does this say about its internal security protocols?” – Crypto Security Analyst, Tom Reeves

Was Jupiter’s Team Physically Targeted? Founder Raises Concerns

According to Meow, the co-founder of the project, this might not be a regular hack. He even suspected that Mei, a core member who played an important role in the Jupuary airdrop, might have been physically attacked.

- She had been at MtnDAO – a blockchain developer event, before flying home in a family emergency.

- Shortly afterward, someone logged into the Jupiter X account using in-flight Wi-Fi on an Android device.

- Eventually, Mei became unreachable, and speculation arose of a real-world threat against Jupiter’s team.

“This is very, very serious—it looks like a case of physical targeting. I hope I’m wrong, but at first glance, this is much more serious than just a cyber hack.” – Meow

Still, with speculation rampant, the incident underlines the increasingly enhanced risks of both cyber and physical security threats within the cryptocurrency space.

Expert Analysis on Crypto Security Risks

As the Jupiter hack unfolds, security experts weigh in on the broader implications of cyber and physical threats in the crypto industry. From social media takeovers to potential real-world targeting, analysts provide insight into what this breach means for DeFi projects and how platforms can strengthen their defenses.

Dr. Emily Foster, Cybersecurity Expert at ChainSec Solutions:

“The Jupiter breach highlights a growing trend where hackers are not only leveraging social engineering tactics but are possibly resorting to physical intimidation. This could set a dangerous precedent for crypto developers and executives.”

James Rowe, Blockchain Security Specialist at Immunefi:

“Despite advancements in blockchain security, DeFi protocols continue to struggle with external threats. Social media accounts, often the first point of public engagement, need stronger security measures like hardware-based MFA and frequent access audits.”

Olivia Barnes, Crypto Market Analyst at Messari:

“The attack on Jupiter exposes a broader issue in the DeFi space: the lack of proactive security protocols for official communication channels. If traders rely on social media for updates, platforms must implement extreme security measures to prevent misinformation and fraud.”

Jupiter Assures Users – Funds Remain Secure

Jupiter immediately reassured their users that, as a matter of fact, the funds could not be compromised by them since, on the NFT marketplace and platform, there is no custodianship of user money. The globally distributed multisig system protects any treasury and upgradeable contract activities. This structure keeps core functions from being attacked by an exploitation in social media account access.

“We hold zero custody of user funds. All our key treasury and contract upgrades are controlled by a globally distributed multisig, so there’s no risk on that front at all.” – Jupiter Team

However, the incident raises larger questions about industry-wide security practices and how effective social media platforms are in preventing high-profile account takeovers.

Conclusion

The Jupiter hack is a wake-up call for crypto projects to reinforce their social media security. With so much at stake and billions in liquidity lying across DeFi, inability in the protection of key communication channels places users at high financial risk. Jupiter reassured users that they were safe, but this breach does surface how much more sophisticated crypto-related cyberattacks are getting. As threats evolve, both projects and investors will have to be keen on security measures to avoid further losses.

The BIT Journal is available around the clock, providing you with updated information about the state of the crypto world. Follow us on Twitter and LinkedIn, and join our Telegram channel.

Frequently Asked Questions (FAQ)

1. How did Jupiter’s X account get hacked?

The exact method is unknown, but attackers likely gained unauthorized access, allowing them to promote fraudulent tokens and phishing links.

2. Were user funds at risk due to this hack?

No, Jupiter does not hold custody of user assets. The platform’s treasury and contracts are protected by a multisig security system.

3. What fake tokens were promoted during the hack?

The hacker promoted fake tokens like $MEOW and $DCOIN, leading to losses for traders who engaged with the scam.

4. What security measures should crypto projects take to prevent such breaches?

Projects should enable multi-factor authentication (MFA), use dedicated security personnel, and implement real-time monitoring for unauthorized access.

Glossary of Key Terms

- Decentralized Exchange (DEX): A cryptocurrency exchange that operates without a central authority, allowing peer-to-peer transactions.

- Multisig (Multi-Signature): A security mechanism requiring multiple approvals before executing a transaction, reducing the risk of hacks.

- Phishing Attack: A form of cybercrime where attackers trick individuals into revealing sensitive information by impersonating a trusted entity.

- Social Engineering: A tactic used by cybercriminals to manipulate individuals into divulging confidential information.

- Two-Factor Authentication (2FA): An additional security layer that requires a second verification step to access an account.

References

The Bit Journal – Read More