Bitcoin volatility has dropped to record lows, a development that could attract more institutional interest.

Bitcoin’s price swings have long been a defining feature of the market. However, new data suggests that its volatility is now at record lows. This comes as institutional investors increasingly enter the space, leading to a more mature and resilient market.

Bitcoin’s Declining Volatility Shows Market Maturity

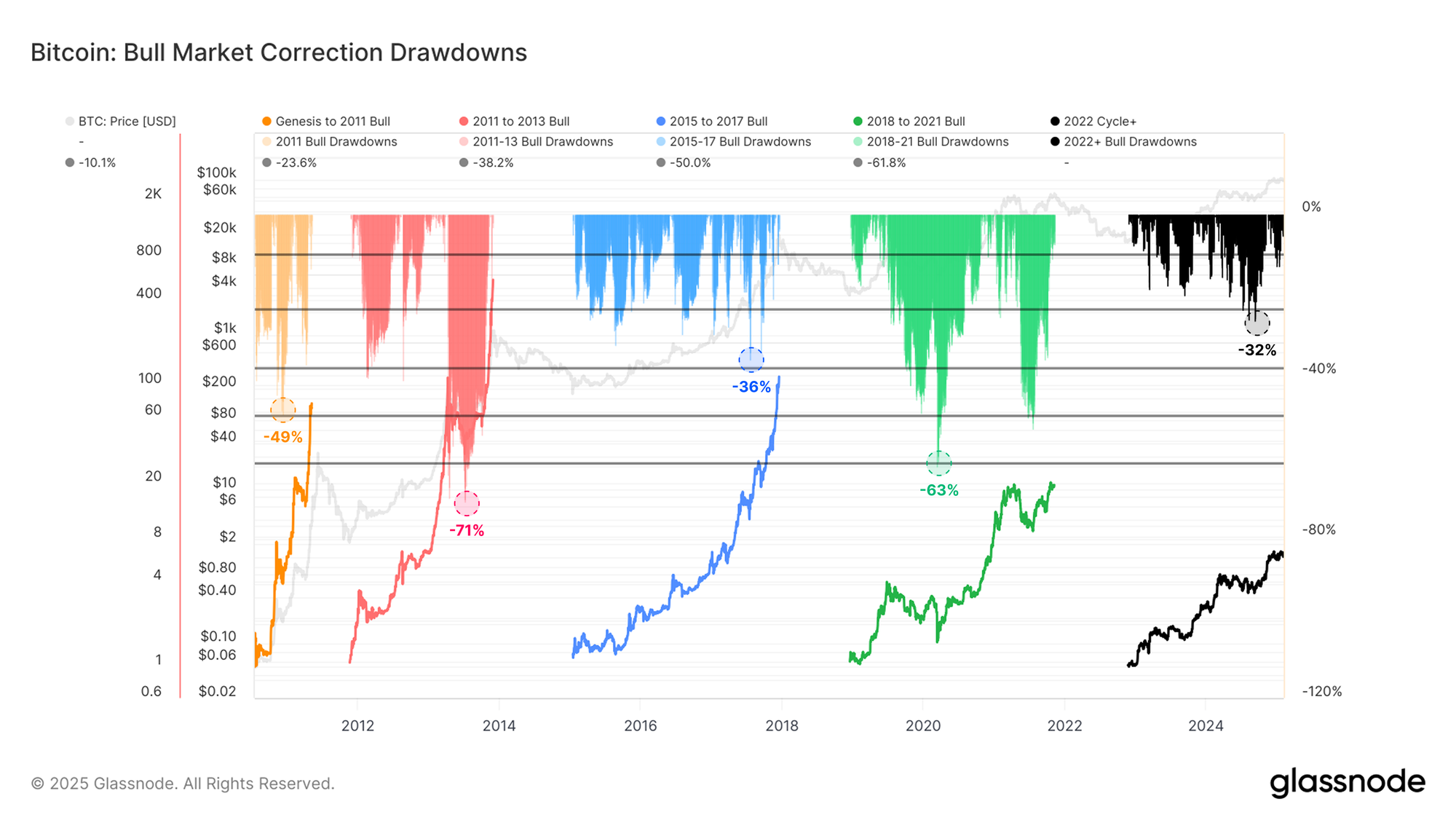

According to a report from Glassnode, Bitcoin’s three-month realized volatility has fallen to historically low levels. Unlike previous bull runs, where price swings regularly exceeded 80% to 100%, the current cycle has seen volatility stay below 50%.

This suggests that Bitcoin is stabilizing as an asset, making it more attractive to institutional investors who previously viewed its extreme price fluctuations as a risk.

This drop in volatility syncs with another major trend suggesting that more sophisticated investors are dominating Bitcoin’s market. Glassnode noted that large entities are absorbing more BTC, leading to a more controlled market structure.

Unlike previous cycles, where panic selling caused sharp drawdowns, this cycle has seen a more measured price correction process.

Bitcoin’s reduced volatility has also contributed to a new price pattern. Instead of extreme highs followed by deep crashes, the market is experiencing “stair-stepping” growth.

Notably, this means price rallies are now preceding periods of consolidation rather than sudden collapses. This stability could help Bitcoin gain further recognition as a legitimate store of value.

Institutional Investors Driving the New Bitcoin Trend

The entrance of institutional investors has played a role in Bitcoin’s changing volatility profile. Glassnode highlighted that the launch of U.S. spot Bitcoin ETFs has provided regulated exposure to Bitcoin, allowing institutions to invest in a more structured way.

These ETFs have already attracted over $40 billion in net inflows, contributing to a more stable market. Notably, BlackRock’s iShares Bitcoin Trust (IBIT) has led this charge.

Additionally, Bitcoin’s role as a macroeconomic asset is expanding. Countries like El Salvador and Bhutan are investing heavily in Bitcoin, while the U.S. government is exploring its potential as a strategic reserve asset.

Further, Bitcoin’s demand dynamics are different from past cycles. While the asset reached the $100,000 milestone, the inflow of new retail investors has been slower than in previous bull markets. Instead, large-scale investors have taken the lead, accumulating Bitcoin at a steady pace.

Analysts Confirm Whale Accumulation Trend

Also, other market analysts have noted Bitcoin’s evolving investor base. Crypto behavior analytics firm Santiment observed that whales have been accumulating more coins amid the latest price dip.

🐳 In a tale as old as time, Bitcoin whales are stacking up more coins during crypto's mid-sized drop and major volatile conditions.

🐟 For small retail traders, especially the ones who first entered the markets in the past 6 months, the volatility is causing them to liquidate.… pic.twitter.com/IT1ONrF6Ia

— Santiment (@santimentfeed) February 6, 2025

Their data showed that over 135 wallets holding at least 100 BTC were added in February, while the number of smaller wallets decreased by over 138,000.

This indicates that experienced investors see Bitcoin’s dip as a buying opportunity, while newer traders—many of whom entered in the past six months—are selling due to short-term volatility. Historically, when whales accumulate BTC during a market decline, it often shows an upcoming price rebound.

Meanwhile, crypto analytics firm Unfolded reported that Bitcoin’s annual volatility has dropped to its lowest level ever. Despite this, its risk-adjusted returns remain higher than most major asset classes. This strengthens the case for Bitcoin as a viable long-term investment. Currently, BTC trades for $97,407, down 0.92% in the past 24 hours.

Latest Cryptocurrency News – The Crypto Basic – Read More