Recent developments, including the reassignment of key litigators and the restructuring of the SEC’s Crypto and Cyber Unit, suggest that the commission may reconsider its appeal against Ripple. This has sparked optimism among the crypto community, as an SEC retreat could mark a significant victory for Ripple and keep XRP’s $4 upside target alive.

Internal Changes at the SEC Signal a Shift

The SEC’s Crypto and Cyber Unit, once a powerful division dedicated to enforcing regulations against digital asset firms, is now undergoing significant downsizing. Acting Chair Mark Uyeda is reportedly leading an internal review, and as part of this, the agency has reassigned Jorge Tenreiro, a key litigator in the Ripple case, to the IT department. Tenreiro was instrumental in several high-profile cases against crypto firms, and his reassignment raises questions about the SEC’s willingness to continue its aggressive legal approach.

The trial lawyer who led the Ripple vs. SEC case resigns. Source: Amelia via X

In addition, another lawyer involved in drafting controversial accounting guidelines that restricted banks from providing digital asset custody services has also been moved. These shifts have fueled speculation that the SEC may no longer prioritize its appeal against Ripple, which was initially filed under former Chair Gary Gensler’s administration.

Commissioner Peirce’s Stance on Crypto Regulation

Commissioner Hester Peirce has been loudly criticized over the approach the agency took in crypto regulation through enforcement. The commissioner is in favor of clear guidelines over it. Peirce now stated that this new Crypto Task Force will revise its approach toward classifying digital assets, and it could have some repercussions on the case of Ripple. Their decision may take the XRP off the list of security and will drop the main argument over an appeal from the SEC.

SEC is expected to be more crypto-friendly under Commissioner Hester Peirce. Source: Coinage via X

Judge Analisa Torres had ruled that sales of XRP to retail investors do not constitute securities trades, a decision in resistance by the SEC. But with a changed regulatory environment and a leadership vacuum at the commission, it cannot be ruled out that the agency might weaken its stance on the case and let the appeal be dropped.

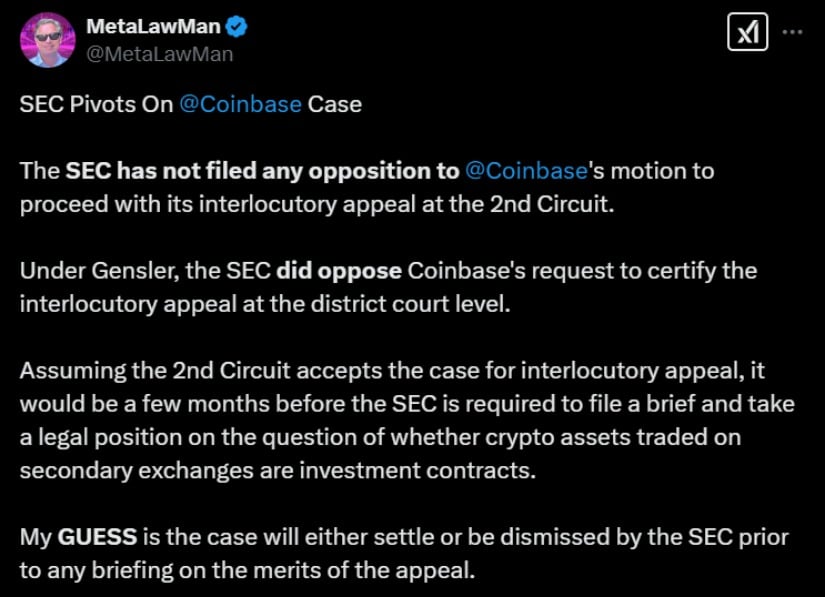

Legal Experts Predict a Favorable Outcome for Ripple

Prominent legal experts and pro-XRP attorneys believe the SEC’s appeal may not stand in the wake of these developments. Attorney James Murphy, known as MetaLawMan, has pointed to the SEC’s recent decision in the Coinbase case as a possible indicator of its shifting stance. The commission opted not to oppose Coinbase’s motion for an interlocutory appeal, signaling a departure from its previous aggressive litigation tactics.

The SEC hasn’t opposed Coinbase’s motion for an interlocutory appeal at the 2nd Circuit. Source: MetaLawMan via X

With the anticipated appointment of a new SEC Chair by April, the likelihood of the commission dropping or settling its case against Ripple is increasing. Legal analysts argue that without a strong leadership directive, the SEC’s ability to push forward with its appeal could be significantly diminished.

Possible Impact on XRP Price: Aiming the $4 Target

The ongoing legal battle has had a considerable impact on XRP’s market performance. With uncertainty surrounding the SEC appeal, XRP has experienced fluctuations in price, often reacting to updates in the case. If the SEC drops its appeal, investor confidence in XRP could skyrocket and force the asset to a new high.

Ripple’s XRP eyes $4 as a potential upside target. Source: Ewhite41 on TradingView

Technical analysts believe XRP might rally toward $4.00, provided the price stays above key support levels. The remittance-based token is trading inside a descending broadening wedge pattern, which many coin analysts consider a bullish setup. If buyers intervene and XRP breaks above resistance levels, then the token is poised for a strong upside movement.

Ripple’s XRP dropped below the $2.50 support, down 2.92% in the last 24 hours as of press time. Source: XRP Liquid Index (XRPLX) via Brave New Coin

On the other hand, if the appeal goes through and uncertainty remains, XRP will hardly gain momentum, probably testing lower supports. The next move from the SEC will be closely watched by the market, as that will define the fate of XRP in the short term.

Looking Forward

The SEC’s internal shake-up, coupled with shifting regulatory perspectives, raises doubts about the sustainability of its appeal against Ripple. With the reassignment of key litigators and Commissioner Peirce’s push for clearer crypto regulations, the likelihood of the case concluding in Ripple’s favor is growing. If the SEC withdraws its appeal, XRP could experience a substantial rally, reinforcing investor confidence and potentially setting new price milestones. The coming months will be critical in determining the outcome of this high-stakes legal battle.

Trump Media and Technology Group (TMTG), the parent company of Truth Social, has filed trademark applications for a series of financial products under the “Truth.Fi” brand.

These offerings include the Truth.Fi Made in America ETF & SMA, Truth.Fi U.S. Energy Independence ETF & SMA, and Truth.Fi Bitcoin Plus ETF & SMA.

The Made in America ETF could potentially include American-based digital assets such as Ripple’s XRP, Solana, and the stablecoin USDC. This move aligns with TMTG’s broader effort to provide investors with alternatives to what it describes as “woke funds” and financial institutions that engage in “debanking.”

Devin Nunes, TMTG’s chairman and former Republican congressman, emphasized that the initiative focuses on supporting American industry and offering competitive financial products. If XRP is included, it would be bullish for the Ripple XRP price

Watch: XRP Price Analysis

Brave New Coin – Read More