According to Bloomberg ETF analysts James Seyffart and Eric Balchunas, the regulatory agency is expected to acknowledge the pending ETF filings as early as this week, marking a significant milestone for the two altcoins.

SEC’s Growing Engagement with Crypto ETFs

The SEC has been increasingly active in evaluating cryptocurrency ETF applications. On February 6, the regulator acknowledged an amended Solana ETF application from Grayscale, signaling a shift toward broader altcoin ETF consideration. Following this development, analysts believe the SEC’s next move will be recognizing Form 19b-4 filings for XRP and DOGE ETFs.

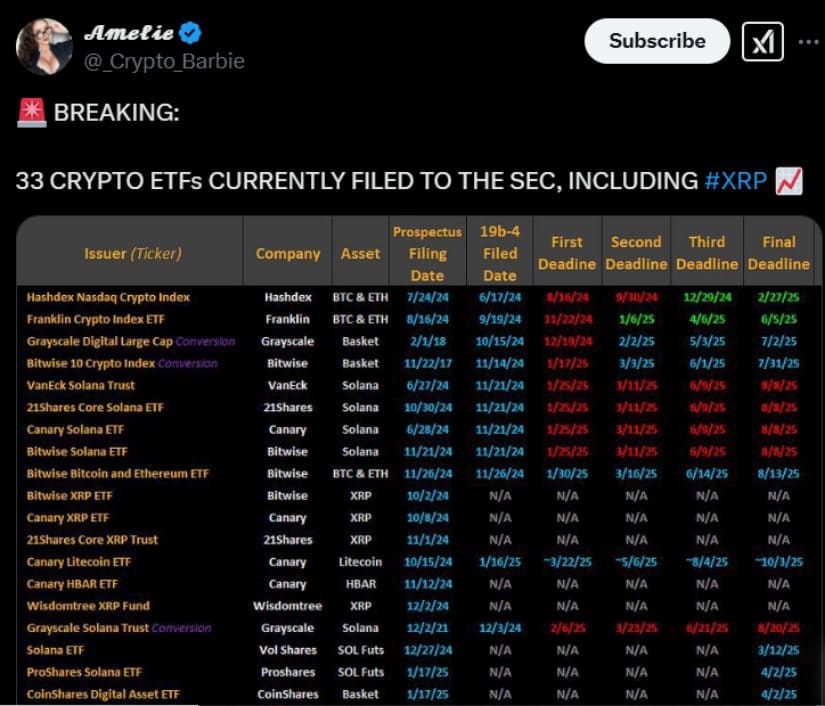

33 cryptocurrency ETFs, including one for XRP, have been filed with the SEC. Source: Amelia via X

“The SEC could acknowledge the spot ETF filings for XRP and DOGE within days,” Seyffart stated in a post on X.

Notably, Cboe BZX has submitted S-1 filings for XRP ETFs from Canary Capital, WisdomTree, 21Shares, and Bitwise, while Grayscale and Bitwise have filed for Dogecoin ETFs. Analysts expect the SEC to acknowledge Form 19b-4 filings on February 13 and 14, respectively.

Approval Odds and Market Sentiment

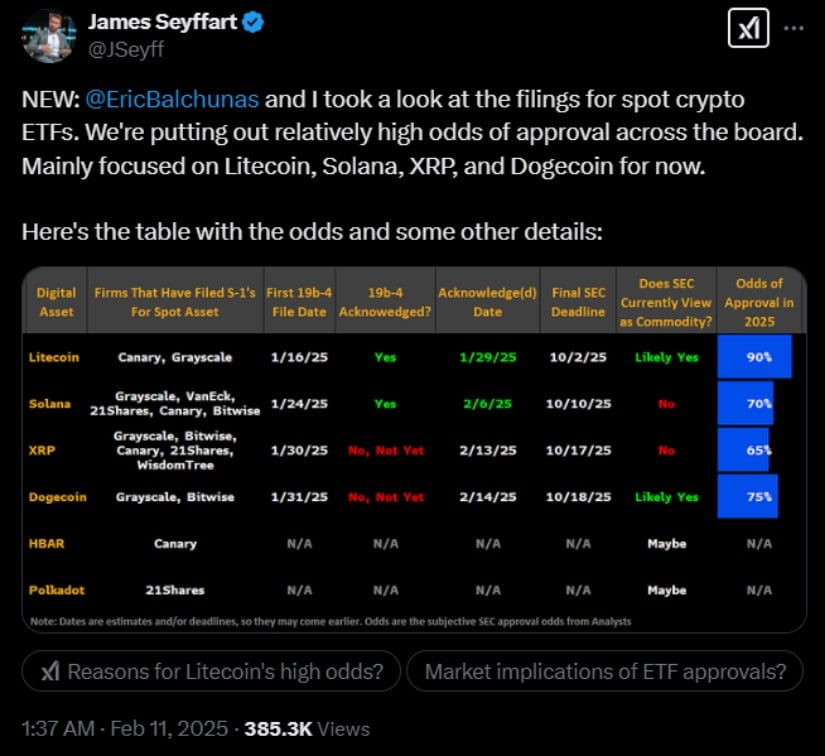

While acknowledgment does not guarantee approval, Seyffart and Balchunas have assigned varying odds to different altcoin ETF applications. Based on their assessment:

-

Litecoin ETF: 90% (approval probability)

-

Dogecoin ETF: 75%

-

Solana ETF: 70%

-

XRP ETF: 65%

XRP’s lower probability stems from its ongoing legal entanglement with the SEC, which previously categorized the asset as a security. However, a federal court ruling in 2023 overturned this classification, paving the way for increased institutional interest in XRP-related financial products.

Watch XRP Price Analysis

Regulatory Clarity and the Road to Final Approval

Industry participants said that, though some regulatory ambiguities remain, the crypto asset task force appointed by the Commission will bring clarity no later than the end of 2025. Among such pressing issues at this point will be whether assets like XRP should fall into the category of a security or commodity.

An analyst shares high approval odds for upcoming spot crypto ETFs, focusing on Litecoin, Solana, XRP, and Dogecoin. Source: James Seyffart via X

As Seyffart explains, “The SEC’s position on crypto regulation is constantly evolving, and by year-end we would expect to have a better sense of how altcoins fit into the ETF landscape.”.

The final approval of XRP and DOGE ETFs is due in October 2025; this gives a good time for the SEC to review the applications. If they are approved, this would go a long way in the huge win for these institutional cryptocurrencies.

Legal Factors and Institutional Interest

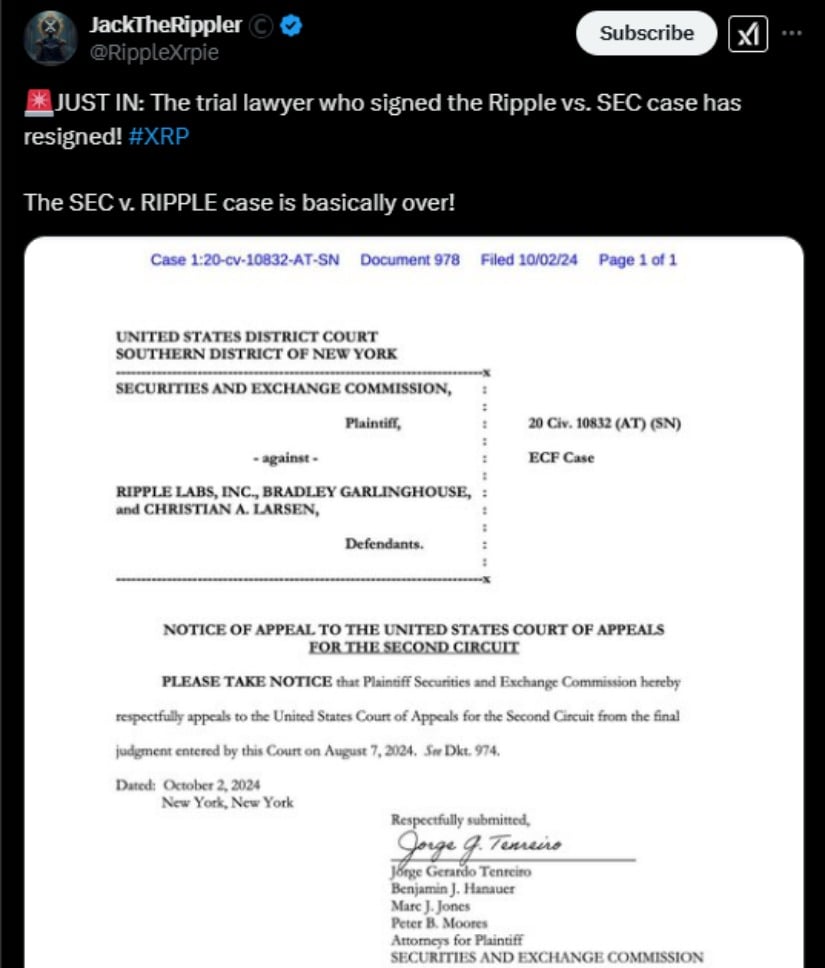

Some legal experts argue that the ongoing Ripple v. SEC lawsuit will not directly impact the ETF approval process. Pro-XRP attorney Jeremy Hogan recently noted that the ETF filings follow a separate regulatory framework.

The SEC lawyer behind the Ripple case has resigned. Source: JackTheRippler via X

“ETF approvals have different regulatory considerations than enforcement cases,” Hogan explained. “The SEC has already approved ETFs for assets facing legal scrutiny, so XRP’s situation should not be a barrier.”

Meanwhile, Nasdaq has moved forward with its own listing applications for XRP and Litecoin ETFs, further reflecting institutional interest in these assets. This follows a wave of bullish sentiment, with XRP’s price rising 3% to $2.50 in anticipation of regulatory progress.

Looking Ahead

As the SEC approaches a decision on these crypto ETFs, the broader market remains optimistic. With increasing institutional demand and legal clarity on the horizon, the likelihood of XRP and DOGE ETFs receiving the green light continues to grow.

If acknowledged this week as expected, the filings would mark another step toward mainstream financial adoption of cryptocurrencies, setting the stage for potential approvals later in the year.

Brave New Coin – Read More