In a shocking turn of events, ByBit, one of the leading cryptocurrency exchanges, fell victim to a massive security breach on Friday, the biggest crypto heist of 2025, international media reported.

Another day, another crypto hack—but this one’s on a whole different level. According to details, ByBit got hit by the biggest crypto heist of 2025, losing a whopping $1.5 billion in Ethereum (ETH) from its cold wallet.

Yep, you read that right.

Hackers pulled off an insanely sophisticated attack that tricked ByBit’s multisignature wallet signers into approving a fraudulent transaction, effectively handing over access to an entire cold wallet. The funds? Gone in minutes.

This breach questions ByBit’s security measures and sends ripples across the entire cryptocurrency ecosystem, forcing exchanges to reevaluate their security infrastructures. But how did this even happen? And more importantly, can ByBit bounce back? Let’s break it all down in the backdrop of the biggest crypto heist of 2025.

The Anatomy of the Heist

How Did It Happen?

On February 21, 2025, ByBit’s CEO Ben Zhou took to social media to disclose the breach. He revealed that the exchange’s Ethereum multisignature (multisig) cold wallet had been compromised due to a highly sophisticated attack. The hackers managed to execute an exploit that appeared legitimate to the wallet’s signers, tricking them into approving a transaction that led to the unauthorized transfer of funds to an unknown address, thereby successfully carrying out the biggest crypto heist of 2025.

Technical Breakdown: The Hack Explained

- The biggest crypto heist of 2025 involved an advanced phishing technique, where attackers masked the user interface (UI) to make it appear as though they were interacting with a trusted Safe (formerly Gnosis Safe) multisig wallet.

- This masked UI displayed the correct destination address, fooling ByBit’s security team into authorizing the malicious transaction.

- Once approved, the hackers altered the smart contract logic of the Ethereum cold wallet, gaining control and siphoning off funds into multiple wallets.

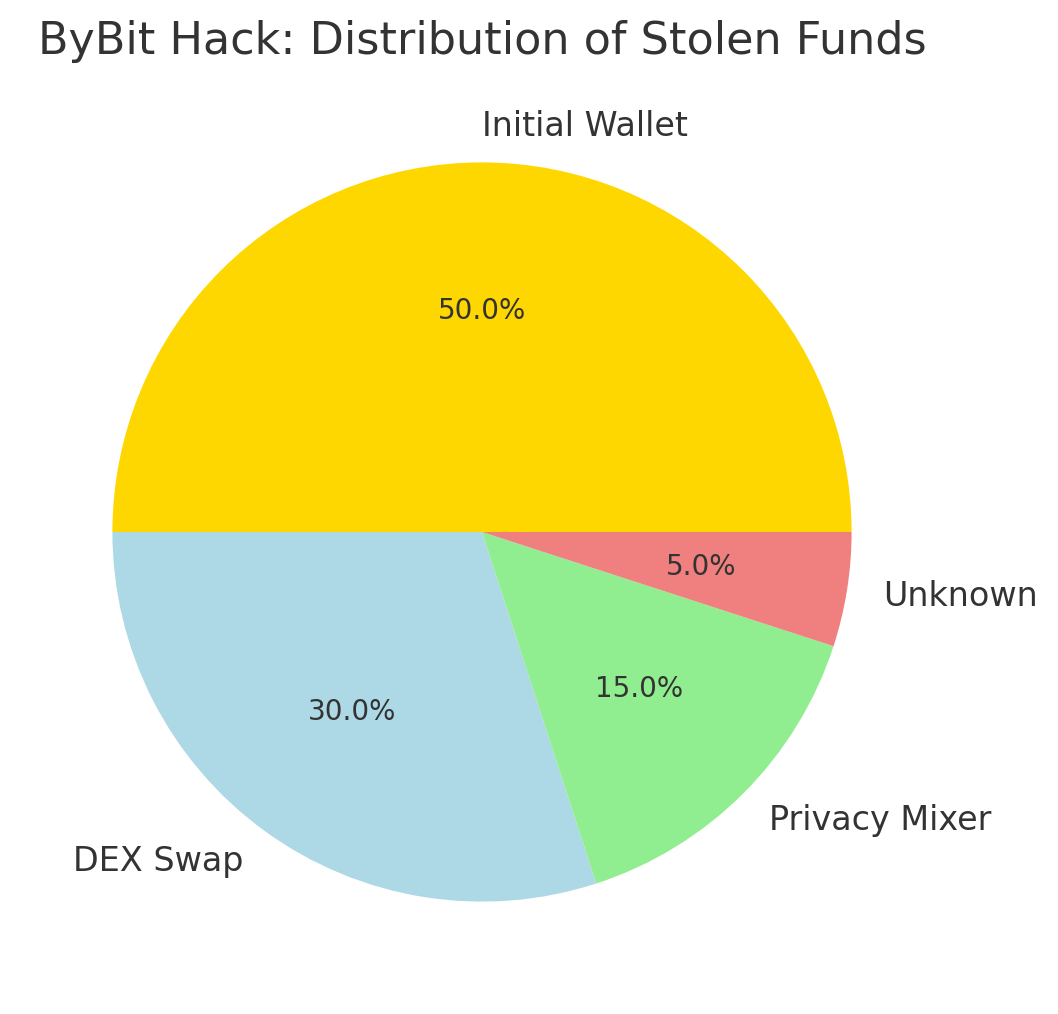

- The stolen ETH was quickly broken into smaller transactions and funneled through decentralized exchanges (DEXs) like Uniswap, ParaSwap, and KyberSwap to obscure the money trail in the biggest crypto heist of 2025.

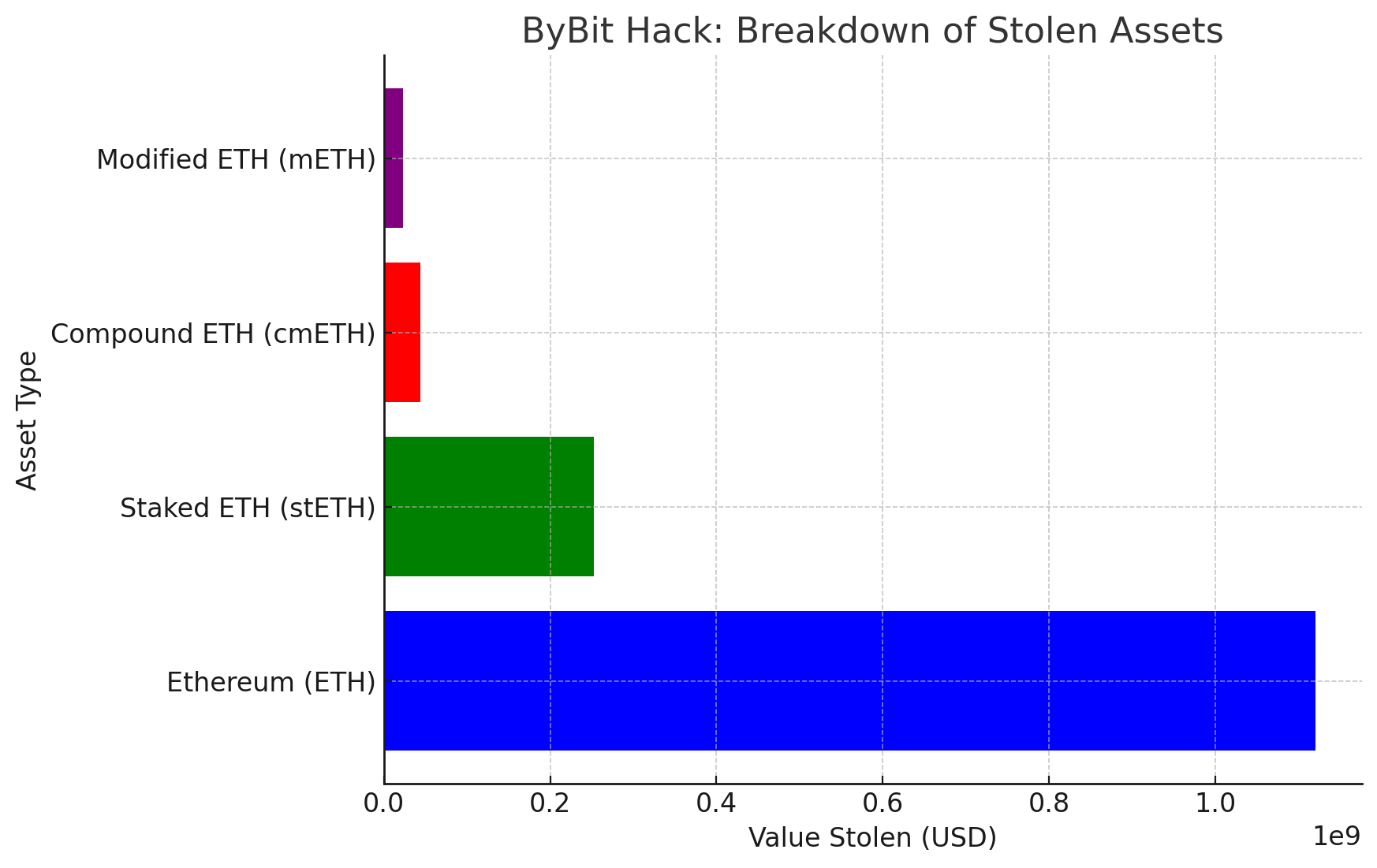

How Much Was Stolen? Breaking Down the Loot

Here’s a quick breakdown of the assets that vanished:

| Stolen Asset | Amount | Estimated Value |

| Ethereum (ETH) | 401,347 | $1.12 Billion |

| Staked Ethereum (stETH) | 90,376 | $253 Million |

| Compound Ethereum (cmETH) | 15,000 | $44 Million |

| Modified Ethereum (mETH) | 8,000 | $23 Million |

| Total Estimated Loss | – | $1.5 Billion |

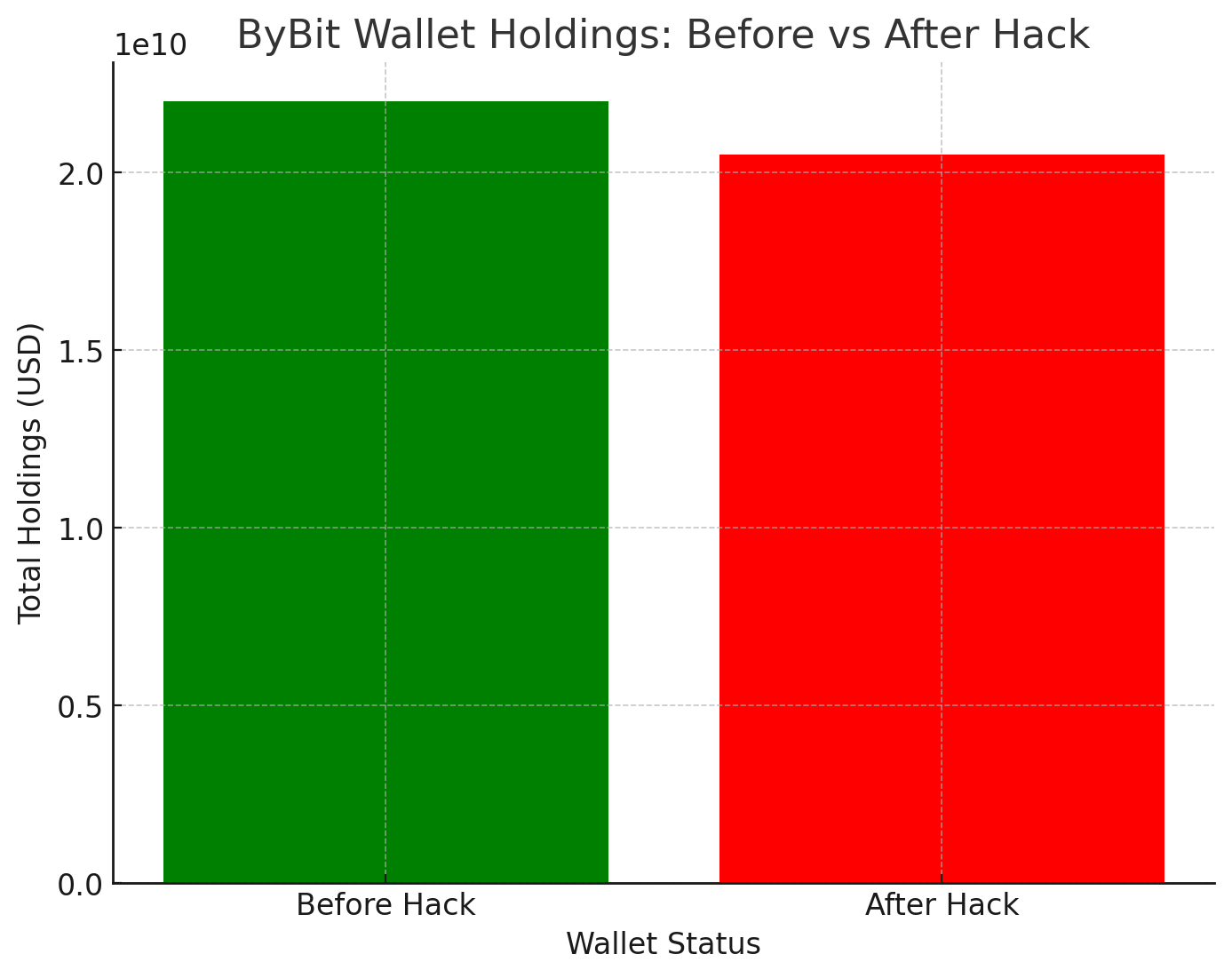

ByBit’s Ethereum multisig cold wallet was the only one affected. The hacker’s first move? Splitting the stolen ETH across multiple wallets, making it harder to trace and recover.

Immediate Market Reaction: A Bloodbath?

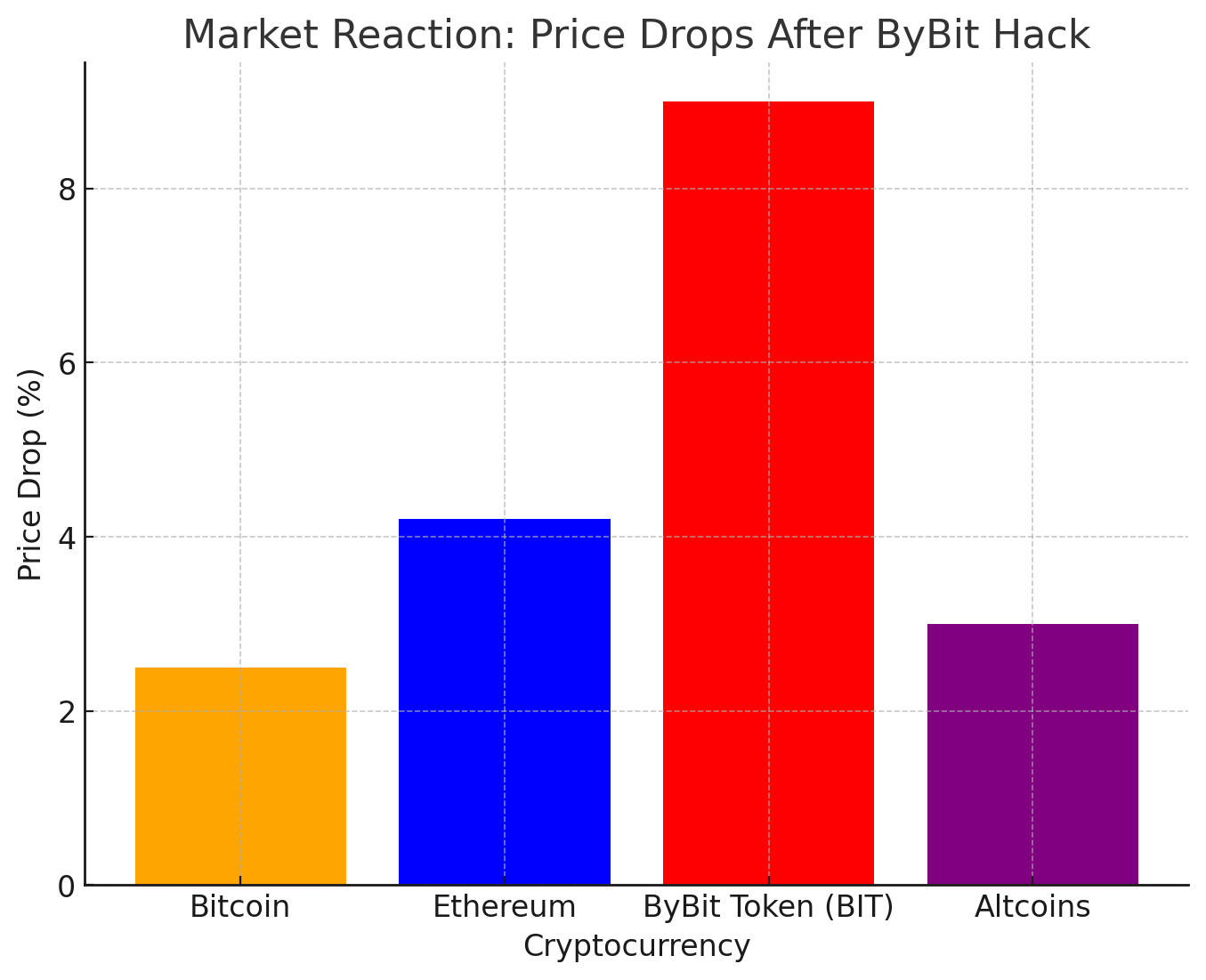

The sheer scale of the biggest crypto heist of 2025 shook the cryptocurrency market.

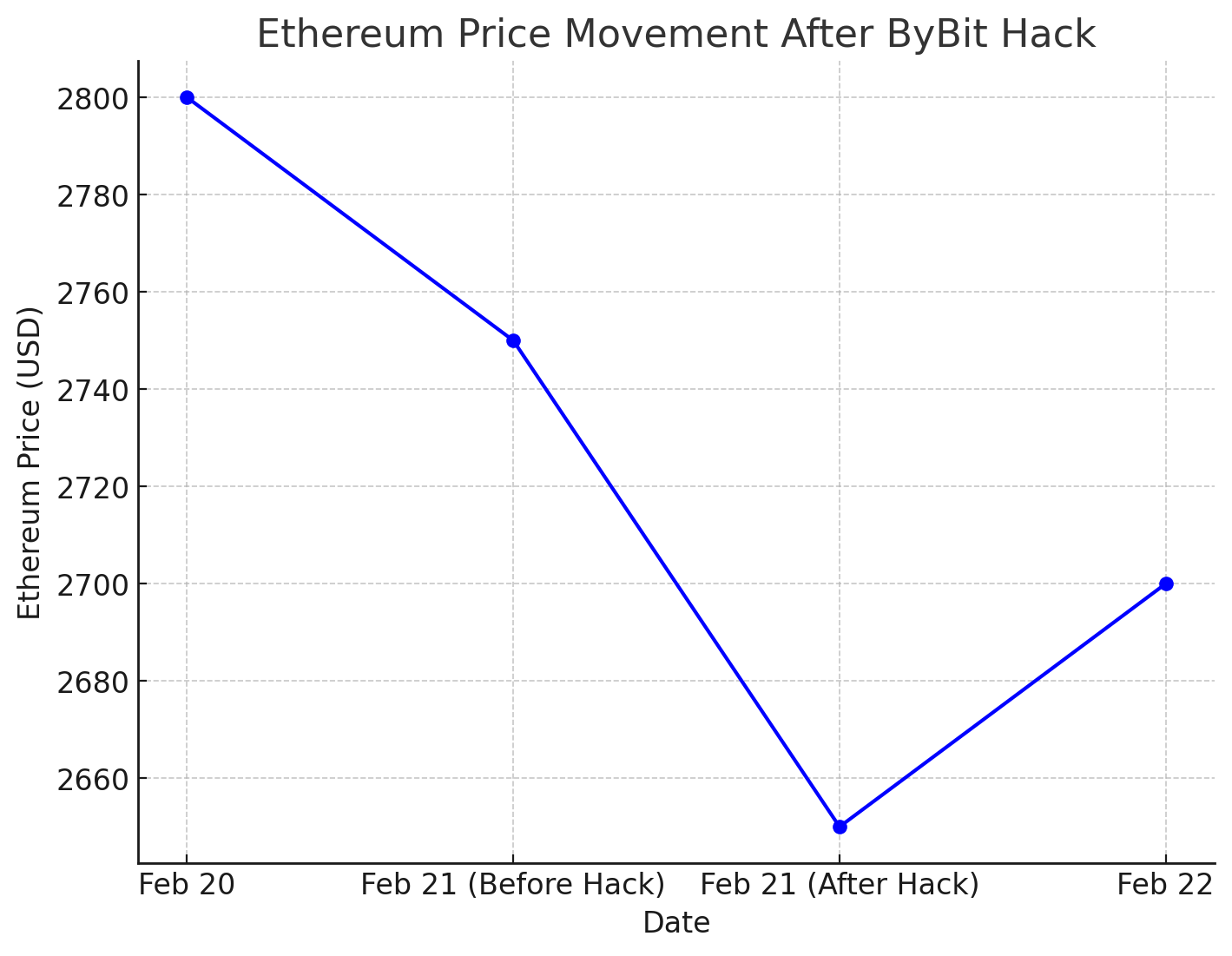

- Ethereum (ETH) Price Drop: ETH lost over 4% in value within hours of the breach being reported, dropping below $2,700.

- Bitcoin (BTC) Impact: Bitcoin also felt the heat, dipping to $97,000 after investor panic spread.

- Altcoin Market Volatility: Several altcoins linked to ByBit also witnessed double-digit losses due to uncertainty over the platform’s solvency.

ByBit’s Response: Damage Control Mode

What ByBit’s CEO Had to Say

ByBit CEO Ben Zhou quickly addressed the concerns, reassuring users that:

- “All other wallets are secure.”

- “ByBit remains solvent.”

- “Withdrawals are operating normally.”

- “We are working with blockchain forensic firms to trace the stolen assets.”

However, crypto analysts have raised concerns over whether ByBit can truly recover from the biggest crypto heist of 2025.

Security Measures Implemented Post-Hack

- Full-scale security audit with cybersecurity experts.

- Enhanced multisignature security measures to prevent UI masking attacks.

- Collaboration with blockchain forensics firms like Chainalysis to track stolen funds.

- Offering bounties for information leading to the hacker’s capture in the biggest crypto heist of 2025.

What This Means for the Future of Crypto Exchange Security

Regulatory Ramifications: Governments Watching Closely

- This attack is expected to intensify regulatory scrutiny on cryptocurrency exchanges.

- More stringent compliance requirements might be enforced, especially regarding cold wallet storage and multisig approvals.

Lessons for Crypto Traders & Investors

- Never store all your crypto on exchanges—use hardware wallets.

- Enable two-factor authentication (2FA) for added security.

- Stay informed about exchange security policies and breach response strategies.

The Biggest Crypto Heist of 2025: What Experts Are Saying

A Wake-Up Call for Exchanges

Industry professionals view the biggest crypto heist of 2025 as a stark reminder of the vulnerabilities inherent in centralized cryptocurrency exchanges. The breach underscores the necessity for continuous security enhancements and the implementation of robust, multi-layered defense mechanisms to safeguard user assets.

The Role of Multisignature Wallets

While multisignature wallets are designed to enhance security by requiring multiple approvals for transactions, this incident highlights that they are not foolproof. Experts suggest that exchanges should regularly audit their security protocols and provide comprehensive training to staff to recognize and prevent sophisticated phishing and social engineering attacks.

The Bigger Picture: Implications for the Crypto Ecosystem

Trust and Credibility at Risk

Such high-profile breaches can erode trust in cryptocurrency platforms, potentially deterring new users and investors from entering the space. Maintaining robust security measures is paramount for the credibility and sustained growth of the crypto industry.

Regulatory Ramifications

Incidents of this magnitude are likely to attract increased scrutiny from regulatory bodies worldwide. Exchanges may face more stringent regulations and oversight to ensure the protection of user assets and the integrity of the broader financial system.

Moving Forward: Strengthening Security Measures

Best Practices for Exchanges

- Regular Security Audits: Conduct frequent and comprehensive security assessments to identify and address potential vulnerabilities.

- Advanced Authentication Protocols: Implement multi-factor authentication and other advanced security measures to protect access to sensitive systems.

- Employee Training: Educate staff about the latest phishing techniques and social engineering tactics to prevent unauthorized access.

Advice for Users

- Personal Vigilance: Regularly monitor account activity and enable all available security features offered by the exchange.

- Diversify Holdings: To keep away from incidents like the biggest crypto heist of 2025, consider spreading assets across multiple platforms or wallets to mitigate potential losses from a single point of failure.

- Stay Informed: Keep abreast of the latest security developments and best practices within the cryptocurrency space.

Conclusion: The Biggest Crypto Heist of 2025

The ByBit Ethereum heist serves as a sobering reminder of the ever-present risks in the cryptocurrency landscape. As the industry continues to evolve, both platforms and users must remain vigilant and proactive in implementing and adhering to stringent security measures. Only through collective effort can the integrity and trustworthiness of the digital asset ecosystem be preserved.

Frequently Asked Questions (FAQs)

- What exactly happened in the ByBit Ethereum heist?

- The biggest crypto heist of 2025 happened when ByBit experienced a security breach where hackers manipulated a transaction within the exchange’s Ethereum multisignature (multisig) cold wallet, leading to the unauthorized transfer of approximately 401,347 ETH and other assets, totaling $1.5 billion in losses. The attackers used a masked user interface to trick wallet signers into approving the malicious transaction.

- Are users’ funds on ByBit still safe after the hack?

- According to ByBit CEO Ben Zhou, all user funds remain secure, and the exchange is solvent despite the breach. Withdrawals and trading operations continue to function normally. However, users are advised to enable two-factor authentication (2FA) and monitor their accounts for any suspicious activity.

- How did the hackers bypass ByBit’s security measures?

- The attackers exploited the multisig signing process, tricking ByBit’s security team into approving a fraudulent transaction that modified the smart contract logic of the Ethereum cold wallet. This method allowed the hackers to gain control and transfer funds without raising immediate suspicion.

- Has ByBit recovered any of the stolen funds?

- As of now, no funds have been recovered after the biggest crypto heist of 2025. Blockchain forensic firms and security researchers are working with ByBit to track the stolen ETH and related assets. The hacker’s funds have already been split into multiple wallets and are being moved through decentralized exchanges (DEXs) to obfuscate the trail.

- What steps is ByBit taking to prevent future hacks?

- ByBit has announced a full-scale security audit and is partnering with blockchain forensic experts to investigate the biggest crypto heist of 2025. The exchange is also reviewing its multisignature process to prevent future attacks that exploit UI masking and unauthorized smart contract modifications.

- How does this hack compare to other major crypto breaches?

- The ByBit hack is among the largest crypto exchange hacks in history. The biggest crypto heist of 2025 surpasses the $534 million Coincheck hack (2018) and the $470 million Mt. Gox hack (2014) but is smaller than the FTX collapse and associated thefts during bankruptcy proceedings.

- What should crypto investors do to protect their funds?

- Investors should store assets in cold wallets, enable multi-factor authentication (MFA), use hardware wallets for long-term storage, and avoid keeping large amounts of crypto on exchanges. Keeping up with the latest security updates and scams in the crypto space is also crucial.

Glossary of Key Terms

- Cold Wallet: A cryptocurrency storage method that keeps assets offline to protect them from hackers.

- Multisignature (Multisig) Wallet: A type of crypto wallet that requires multiple approvals before executing transactions.

- Smart Contract Logic: The set of rules and conditions programmed into a blockchain-based contract that executes transactions.

- DEX (Decentralized Exchange): A peer-to-peer crypto trading platform that doesn’t rely on a central authority.

- Staked ETH (stETH): Ethereum that has been locked in the network’s staking mechanism to earn rewards.

- UI Masking Attack: A cybersecurity exploit that tricks users into seeing false information while executing a transaction.

- Blockchain Forensics: The process of tracking and analyzing blockchain transactions to detect fraud, theft, and security breaches.

- 2FA (Two-Factor Authentication): A security measure that requires two forms of identity verification for account access.

- Sweeping Function: A feature in smart contracts that moves all assets from one address to another in a single transaction.

- Crypto Solvency: The ability of a cryptocurrency exchange to cover user deposits with existing funds, ensuring financial stability.

References

The Block – theblock.co

Binance – binance.com

Finance Magnets – financemagnets.com

FX Street – fxstreet.com

CoinDesk – tradingview.com

The Bit Journal – Read More