XRP, Ripple’s cryptocurrency, has been quite volatile in recent years, especially due to the ongoing legal drama with the U.S. Securities and Exchange Commission (SEC). With this dispute nearing a potential resolution, investors and analysts alike are speculating on where XRP might end up, with many asking if it can ever reach the $10 mark.

The Ripple vs. SEC Legal Battle: A Brief Overview

As a reminder, the SEC filed a lawsuit against Ripple Labs in December 2020 claiming that the sale of XRP by Ripple was an unauthorised offering of a security. This lawsuit caused major uncertainty in the market, triggering a plummet in the price of XRP and the delisting of the token on multiple exchanges.

In July 2023, however, U.S. District Judge Analisa Torres ruled in landmark fashion that XRP itself is not a security, at least not when sold in secondary markets. Ripple’s direct sales of XRP to institutional investors were indeed unregistered securities offerings, with a $125 million fine and a restriction on Ripple’s future sales to institutional entities.

Current Settlement Discussions and Potential Outcomes

As of March 2025, reports indicate that Ripple and the SEC are in advanced settlement negotiations. A central point of discussion is the potential reclassification of XRP as a commodity, akin to Ethereum, reflecting a shift in the SEC’s regulatory approach under its new leadership.

This potential reclassification could have profound implications for XRP’s market perception and regulatory treatment, potentially paving the way for broader institutional adoption and investment.

XRP’s Price Performance and Future Projections

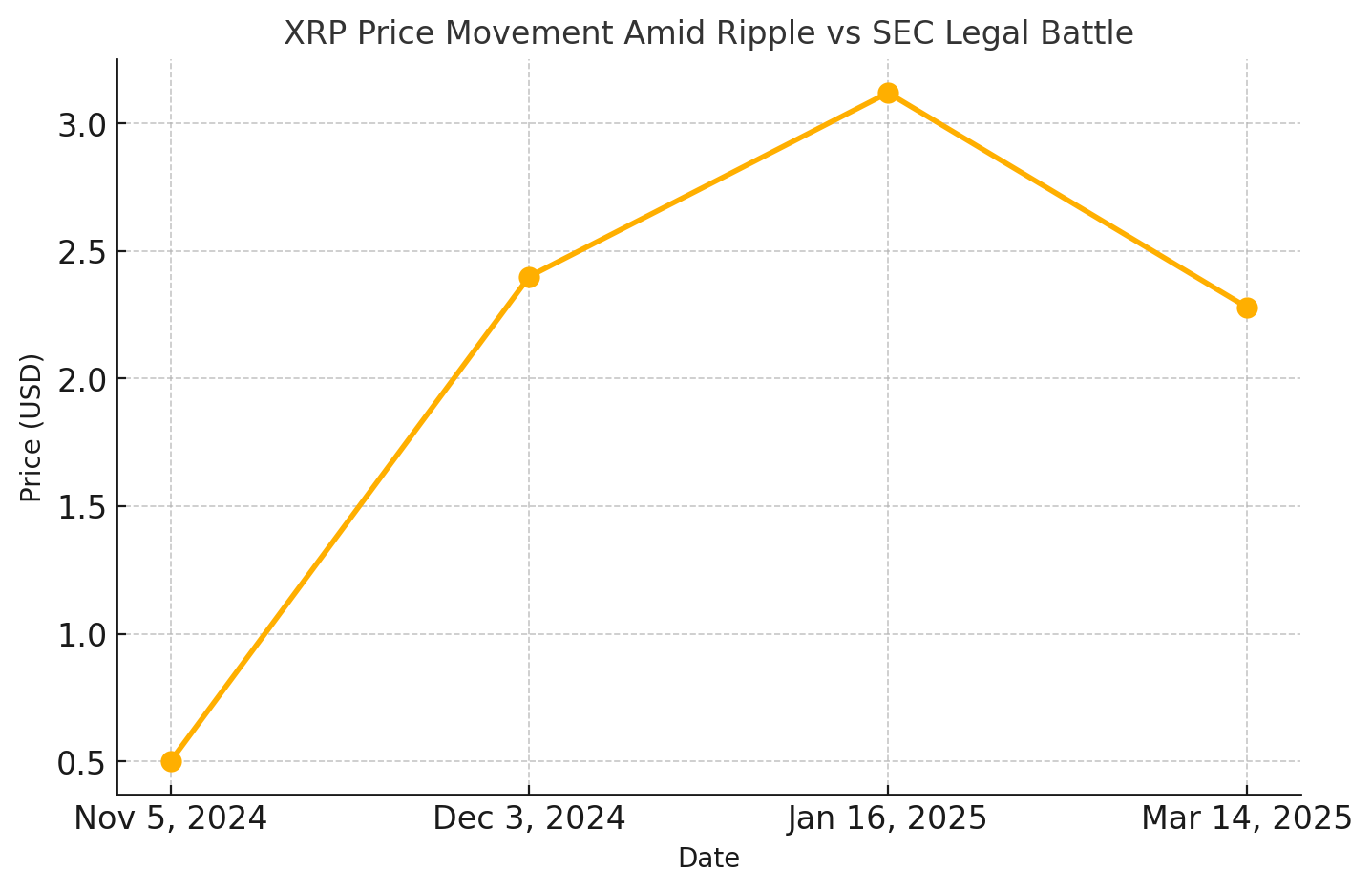

XRP has experienced a notable price rebound in recent months. Following a dip below $2 in late 2024, XRP surged to an all-time high above $3 in early 2025. As of March 14, 2025, XRP is trading at approximately $2.28.

Market analysts have varied predictions regarding XRP’s future price:

-

Conservative Estimates: Some analysts, such as Antonio Di Giacomo of XS.com, predict that XRP may face challenges reaching $3, citing market volatility and regulatory uncertainties.

-

Moderate Optimism: Arthur Azizov of B2BinPay anticipates that XRP could trade between $5 to $7 in the first half of 2025, driven by post-election momentum and Ripple’s advancements in cross-border payments.

-

Bullish Projections: Some experts believe that a definitive end to the SEC lawsuit could propel XRP to new heights. For instance, XRP Healthcare’s Head of Social Adoption, Edward Farina, suggests that XRP could reach $10, marking a new all-time high.

Factors Influencing XRP’s Potential to Reach $10

Several factors could influence XRP’s ability to surpass the $10 mark:

-

Regulatory Clarity: A favorable settlement with the SEC and the potential reclassification of XRP as a commodity could enhance investor confidence and attract institutional investments.

-

Market Adoption: Ripple’s ongoing efforts to expand its payment solutions and partnerships could drive increased demand for XRP. The approval of Ripple’s stablecoin, RLUSD, by the New York Department of Financial Services, is a notable development that could bolster XRP’s utility.

-

Macroeconomic Factors: Broader economic conditions, including monetary policies and global economic stability, can impact cryptocurrency markets. Additionally, political developments, such as the current administration’s crypto-friendly stance, could play a role.

Price Table: XRP’s Historical Price Points

| Date | Price (USD) | Notable Events |

|---|---|---|

| November 5, 2024 | 0.50 | Pre-election price |

| December 3, 2024 | 2.40 | Post-election surge |

| January 16, 2025 | 3.12 | All-time high |

| March 14, 2025 | 2.28 | Current price |

Conclusion

Frequently Asked Questions (FAQs)

Q1: What is the current status of the Ripple vs. SEC lawsuit?

As of March 2025, Ripple and the SEC are reportedly in advanced settlement negotiations, with discussions focusing on potentially reclassifying XRP as a commodity.

Q2: How has XRP’s price reacted to the legal developments?

XRP’s price has experienced significant volatility in response to legal developments. Notably, it surged to over $3 following positive news regarding the lawsuit but has since stabilized around $2.28.

Q3: What factors could drive XRP’s price to $10?

Factors include favorable regulatory outcomes, increased institutional adoption, expansion of Ripple’s payment solutions, and broader cryptocurrency market trends.

Glossary of Key Terms

-

XRP: A digital currency created by Ripple Labs, designed for fast and cost-effective cross-border payments.

-

Ripple Labs: The company behind the development of the Ripple payment protocol and the XRP cryptocurrency.

-

SEC (Securities and Exchange Commission): A U.S. federal agency responsible for enforcing federal securities laws and regulating the securities industry.

-

Commodity: A basic good used in commerce that is interchangeable with other goods of the same type; in this context, a classification that could apply to certain cryptocurrencies.

-

RLUSD: A stablecoin introduced by Ripple, pegged to the U.S. Dollar, aimed at enhancing the utility of the Ripple payment platform.

Sources

Read More: XRP’s $10 Dream: Can Ripple’s SEC Battle Finally End the Wait?“>XRP’s $10 Dream: Can Ripple’s SEC Battle Finally End the Wait?

The Bit Journal – Read More