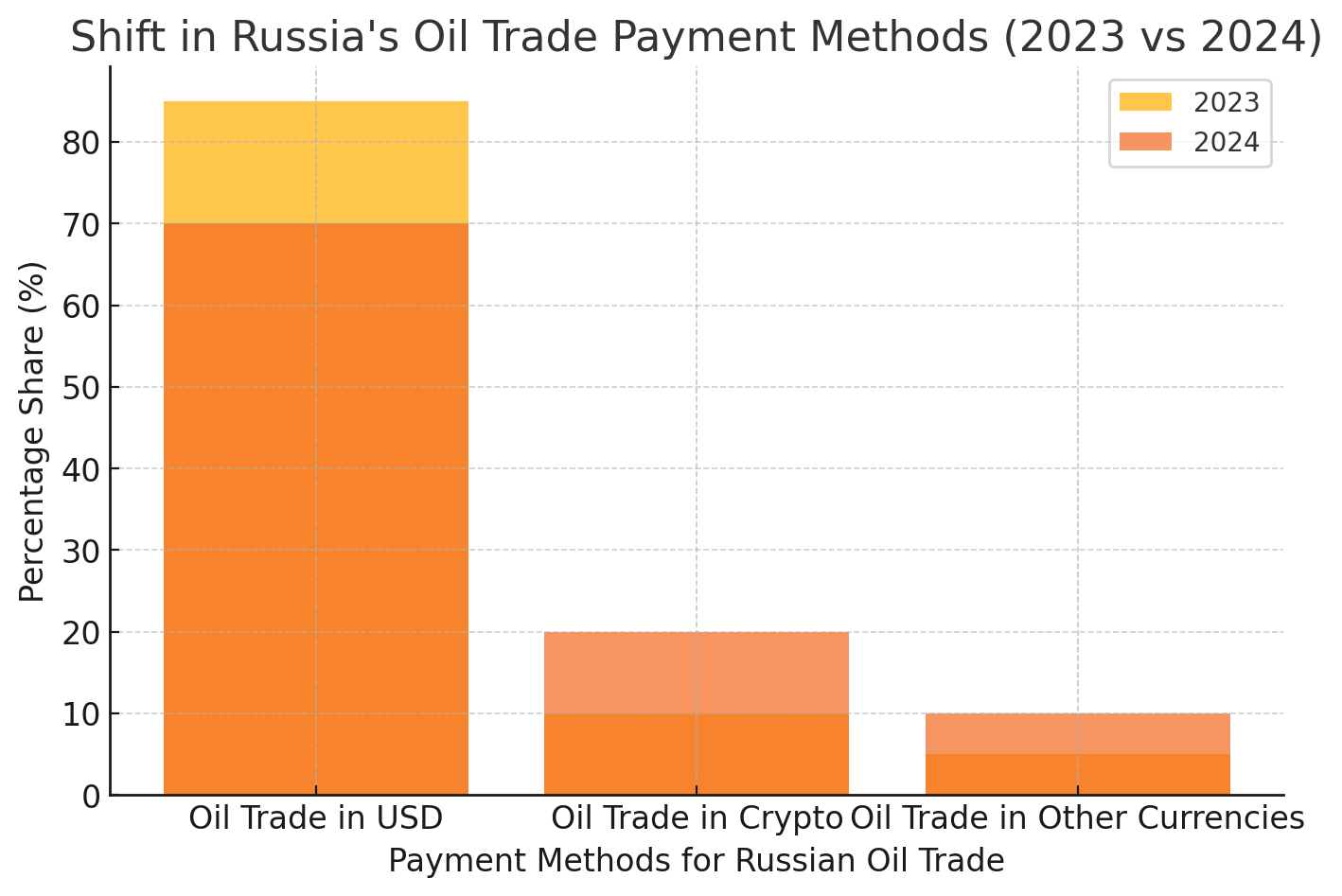

Russia is increasingly turning to cryptocurrencies to facilitate oil trade with China and India, effectively circumventing Western sanctions. This strategic pivot not only highlights the adaptability of global trade mechanisms but also underscores the evolving role of digital currencies in international commerce.

Russia’s Shift to Cryptocurrency in Oil Transactions

Historically, Russia’s oil trade has been predominantly conducted using traditional currencies like the U.S. dollar and the euro. However, in response to escalating sanctions, there has been a marked shift towards digital currencies such as Bitcoin, Ether, and stablecoins like Tether. These cryptocurrencies offer a decentralized and relatively unregulated medium, enabling Russia to maintain its oil exports despite financial restrictions.

The process typically involves Chinese or Indian buyers paying intermediaries in their local currencies. These intermediaries then convert the funds into cryptocurrencies, which are subsequently transferred to Russian entities and converted into rubles. This method mirrors tactics employed by countries like Iran and Venezuela to sustain their economies amidst sanctions.

The Role of Tether in Sanctions Evasion

Tether, a stablecoin pegged to the U.S. dollar, has emerged as a pivotal tool in Russia’s strategy to bypass sanctions. Its stability and widespread acceptance make it an attractive option for international transactions outside traditional banking systems. However, this has raised concerns about its potential misuse for illicit activities, including money laundering and sanctions evasion.

Despite these concerns, Tether’s CEO, Paolo Ardoino, maintains that the company operates transparently and cooperates with global authorities to prevent misuse. He emphasizes Tether’s role in providing financial stability, especially in regions with volatile economies.

Russia’s Regulatory Stance on Cryptocurrency

In a notable policy shift, the Russian Central Bank has proposed allowing “specially qualified” investors—those with substantial assets or income—to participate in cryptocurrency investments. This move signifies a departure from the bank’s previous stringent stance against cryptocurrencies and suggests a recognition of digital assets’ potential in mitigating the impact of sanctions.

Case Study: Garantex and Sanctions Evasion

Garantex, a Russian cryptocurrency exchange, has been implicated in facilitating transactions for sanctioned entities. Despite facing sanctions from the U.S. Department of the Treasury for its alleged involvement in illicit activities, Garantex continues to operate, highlighting the challenges regulators face in controlling decentralized financial platforms.

Global Implications

Russia’s adoption of cryptocurrencies to bypass sanctions underscores a broader trend of nations exploring digital assets to mitigate economic isolation. This development challenges the efficacy of traditional sanctions and prompts a reevaluation of regulatory approaches to digital currencies.

While cryptocurrencies offer alternative avenues for international trade, they also pose risks related to financial transparency and the potential for illicit activities. As more countries consider integrating digital currencies into their economies, the global financial system may need to adapt to ensure both innovation and security.

Conclusion

Russia’s strategic use of cryptocurrencies in its oil trade with China and India illustrates the dynamic nature of global finance and the increasing significance of digital currencies. This shift not only enables Russia to circumvent sanctions but also signals a transformative period in international trade practices. As digital assets become more entrenched in global commerce, policymakers and regulators worldwide face the challenge of balancing technological advancement with the need for financial oversight and security.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates.

FAQs

Q: How is Russia using cryptocurrencies to bypass sanctions in its oil trade?

A: Russia employs cryptocurrencies such as Bitcoin, Ether, and Tether to facilitate oil transactions with countries like China and India. This involves intermediaries converting local currencies into digital assets, which are then transferred to Russian entities and converted into rubles, effectively circumventing traditional banking restrictions imposed by sanctions.

Q: Why is Tether significant in Russia’s strategy to evade sanctions?

A: Tether, a stablecoin pegged to the U.S. dollar, offers stability and widespread acceptance, making it an attractive medium for international transactions outside conventional banking systems. Its use allows sanctioned countries like Russia to conduct trade without relying on traditional financial channels.

Q: What regulatory changes has Russia implemented regarding cryptocurrency investments?

A: The Russian Central Bank has proposed allowing “specially qualified” investors—individuals with substantial assets or income—to invest in cryptocurrencies. This marks a significant shift from the bank’s previous opposition to digital assets, indicating a potential integration of cryptocurrencies into Russia’s broader financial system.

Q: How does the operation of exchanges like Garantex impact sanctions enforcement?

A: Exchanges like Garantex facilitate cryptocurrency transactions for sanctioned entities, complicating enforcement efforts. Despite facing sanctions themselves, these platforms continue to operate, highlighting the challenges regulators face in controlling decentralized financial activities.

Q: What are the broader implications of using cryptocurrencies to evade sanctions?

A: The use of cryptocurrencies to bypass sanctions challenges the effectiveness of traditional financial restrictions and necessitates a reevaluation of regulatory frameworks. While digital assets offer alternative avenues for international trade, they also pose risks related to financial transparency and the potential for illicit activities.

Glossary of Key Terms

-

Cryptocurrency: A digital or virtual form of currency that uses cryptography for security and operates independently of a central authority.

-

Stablecoin: A type of cryptocurrency designed to maintain a stable value by pegging it to a reserve asset, such as a fiat currency like the U.S. dollar.

References

Read More: Russia Uses Crypto to Evade Sanctions in Oil Trade – Here’s How“>Russia Uses Crypto to Evade Sanctions in Oil Trade – Here’s How

The Bit Journal – Read More