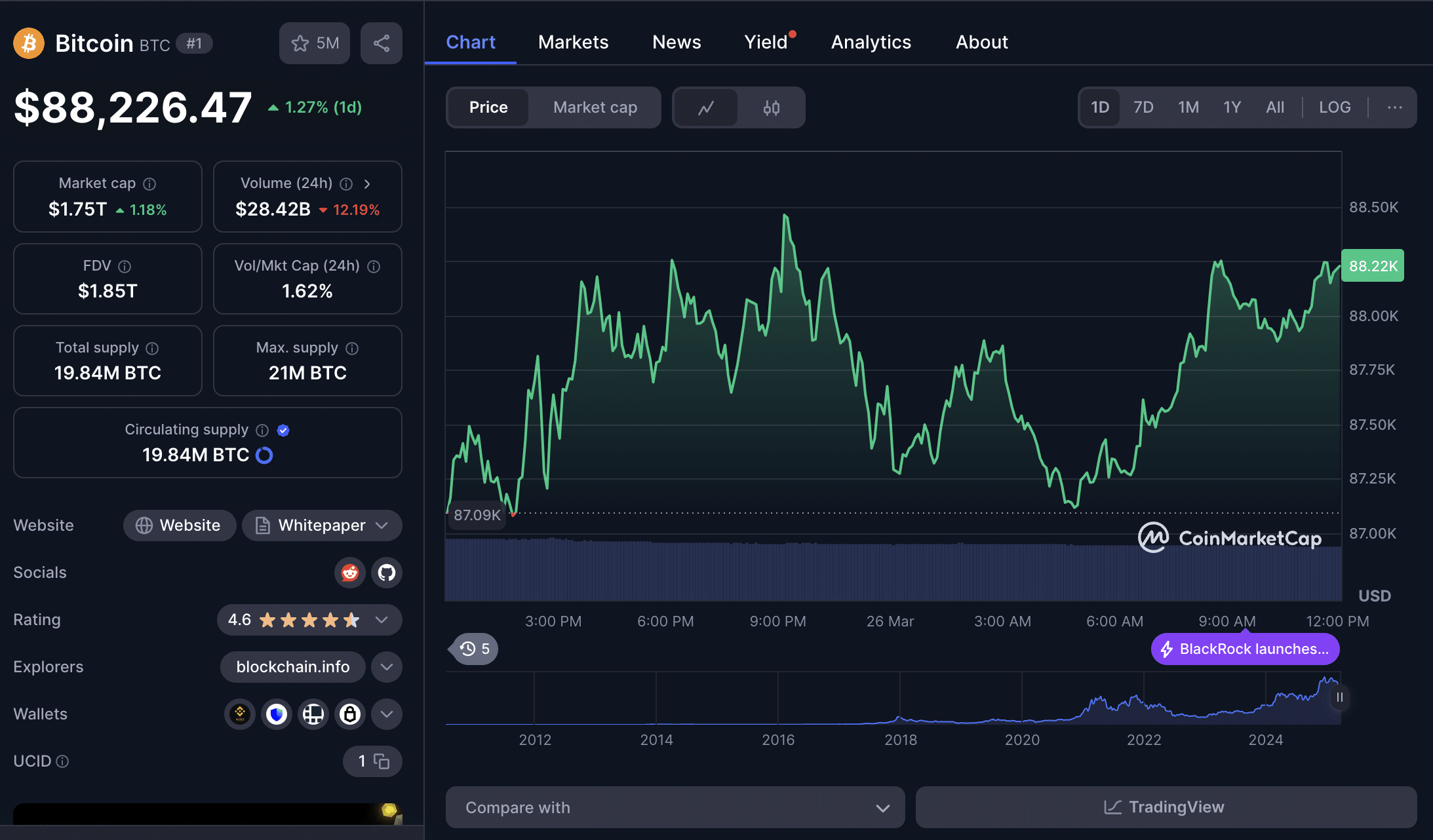

Bitcoin remained resilient above the $88,000 mark during Asian trading hours on Wednesday, showing strength despite rising macroeconomic uncertainties. Traders continue to weigh the impact of upcoming U.S. tariffs set to begin on April 2, maintaining a cautious stance as the market anticipates key data releases.

The crypto market at large saw muted performance among major altcoins, with Solana (SOL), XRP, BNB, and Ethereum (ETH) each gaining under 3%. However, the spotlight shifted toward meme coins, as Dogecoin (DOGE) and Shiba Inu (SHIB) outpaced the market with notable gains.

Meme Coins Lead the Charge: DOGE and SHIB Outperform Majors

Dogecoin jumped 5.5%, marking its second consecutive day of gains, supported by growing interest in meme coin trading. Meanwhile, Shiba Inu (SHIB) soared 11%, driven by a risk-on shift among retail traders and a 228% surge in activity on its native ShibaSwap exchange over the last 30 days.

Futures market data supports this sentiment, with SHIB open interest climbing over 20% since Sunday. Traders appear to be rotating toward high-beta tokens like DOGE and SHIB, which are increasingly being viewed as proxies for broader market sentiment and Ethereum’s strength. Tokens like PEPE and MOG also saw modest gains, signaling increased speculative appetite in the altcoin space.

“Crypto will remain a close proxy of equities in the foreseeable future… recent M&A activity involving Coinbase and Kraken reinforces long-term bullish trends,” — Augustine Fan, SignalPlus

Investor Focus Turns to U.S. Tariffs and Inflation Data

Market participants are turning their attention to two significant developments: the U.S. tariff announcement on April 2 and the release of the Personal Consumption Expenditure (PCE) data on March 28. These macroeconomic events could become major catalysts for risk asset performance, including cryptocurrencies.

The Federal Reserve closely watches the PCE index as a measure of inflation. Elevated PCE readings may push the Fed toward interest rate hikes, potentially reducing liquidity and weakening crypto market sentiment. Conversely, a subdued reading could bolster hopes for rate cuts or policy stability, thereby supporting Bitcoin and altcoins.

Analysts suggest that PCE’s outcome will directly impact Bitcoin volatility in the near term, especially as inflation trends shape Fed expectations heading into Q2.

Options Market Signals Caution Despite Q2 Optimism

Despite optimism about Q2 historically being one of the best-performing quarters for both equities and Bitcoin, options markets suggest that traders are hesitant to fully embrace a bullish stance.

Insights from QCP Capital highlight that while the S&P 500 averages a 19.6% annualized return in Q2, and Bitcoin has historically posted strong median gains, call skew in Bitcoin options hasn’t shifted decisively in favor of call options.

“Call skew hasn’t meaningfully shifted toward calls, with traders waiting to see how the tariff situation develops,” — QCP Capital broadcast

Traders are mostly holding back until tariff-related clarity emerges, suggesting a temporary pause before major directional bets resume. Volatility is expected to spike post-PCE and tariff announcements.

Conclusion

With Bitcoin holding firm above $87K and meme coins leading short-term momentum, traders remain glued to macroeconomic triggers like the PCE index and upcoming U.S. tariff announcements. While DOGE and SHIB rally on retail momentum, broader market sentiment hinges on inflation and policy signals from the Fed.

As historical Q2 trends suggest favorable returns, caution from the options market indicates that the next move will likely depend on how March 28 and April 2 unfold. Until then, the market may continue consolidating with eyes on the next catalyst. Follow us on Twitter and LinkedIn, and join our Telegram channel.

FAQs

1. Why is Bitcoin hovering around $87,000?

Bitcoin is maintaining support above $87K as traders remain cautious ahead of key U.S. economic updates, particularly tariffs and PCE inflation data.

2. Why are Dogecoin and SHIB rallying?

DOGE and SHIB have seen sharp gains due to increased retail trading, speculative momentum, and rising activity on platforms like ShibaSwap.

3. What is the significance of the PCE report?

The PCE index measures inflation and influences Fed interest rate policy. A high reading could reduce crypto appetite, while a low reading could support further rallies.

4. How do U.S. tariffs impact crypto?

Tariffs affect global markets by influencing investor sentiment and risk appetite. Uncertainty around their implementation could increase short-term volatility in crypto.

Glossary

PCE Index: Personal Consumption Expenditure index; a key inflation metric used by the Federal Reserve.

Call Skew: An options market condition indicating more demand for call options over puts.

Open Interest: The total number of outstanding futures or options contracts.

ShibaSwap: A decentralized exchange platform for SHIB and related tokens.

Beta Token: A cryptocurrency that shows exaggerated movements compared to a broader asset class, often used to gauge sentiment.

References

Read More: Bitcoin Holds $88K as Meme Coins Explode: DOGE and SHIB Steal the Spotlight“>Bitcoin Holds $88K as Meme Coins Explode: DOGE and SHIB Steal the Spotlight

The Bit Journal – Read More