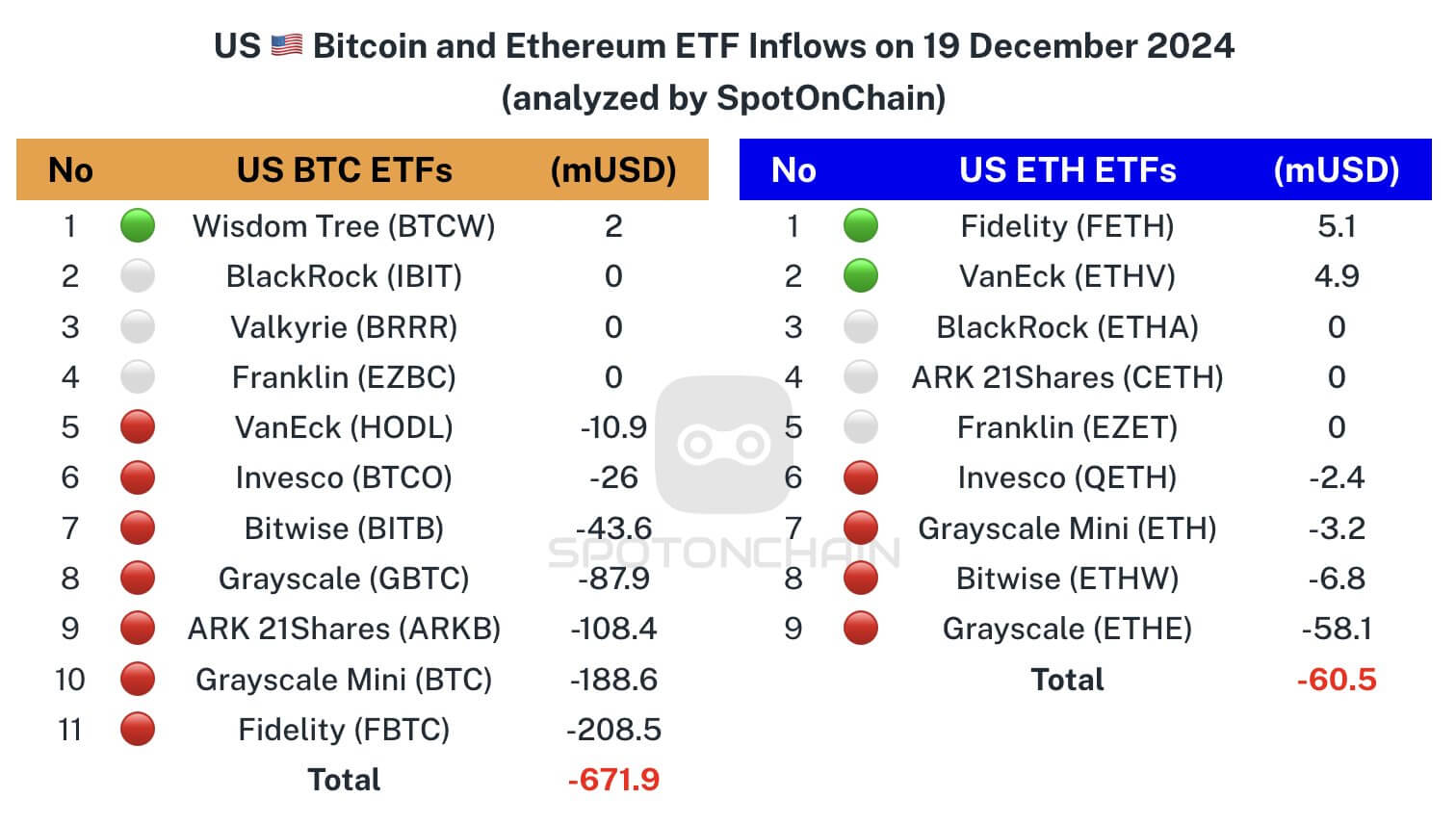

US spot Bitcoin and Ethereum exchange-traded funds (ETFs) witnessed a sharp decline on Dec. 19, with significant outflows disrupting long-standing streaks of investor inflows.

Data from SpotOnChain revealed that the Bitcoin ETFs recorded their most significant single-day outflows since their launch in January. The previous record was set in May with a $563 million outflow. Investors withdrew $671.9 million from the funds, breaking a 15-day streak of inflows.

Fidelity’s FBTC led the sell-off with $208 million in outflows, followed by Grayscale Bitcoin Mini Trust and ARK 21Shares’ ARKB, which saw outflows of $188 million and $108 million, respectively.

Despite the widespread withdrawals, WisdomTree’s BTCW bucked the trend, recording $2 million in modest inflows. BlackRock’s IBIT and other ETFs remained flat, with no notable changes.

Spot Ethereum ETFs were not spared, with outflows totaling $60.47 million and ending an 18-day streak of inflows.

Grayscale’s ETHE was hit hardest, losing $58.13 million, while Bitwise’s ETHW followed with $6.78 million in outflows. Grayscale’s Ethereum Mini Trust and Invesco’s QETH saw losses exceeding $5 million.

On the upside, Fidelity’s FETH and VanEck’s ETHV attracted inflows of $5.1 million and $4.9 million, respectively.

However, these gains did not offset the broader market decline, as other Ethereum ETF products recorded zero flows.

CryptoSlate – Read More