Coinbase has successfully defended itself in a legal battle with BiT Global Digital Limited (BiT) over the delisting of Wrapped Bitcoin (wBTC) from its platform.

The Hong Kong-based firm, which is reportedly linked to controversial crypto figure Justin Sun, had sought emergency legal relief to prevent the removal of wBTC, citing potential harm to its business and the wider crypto ecosystem. However, a U.S. District Court ruled in favor of Coinbase, allowing the delisting to proceed.

Legal Concerns and Risk Mitigation

The core of Coinbase’s defense rested on concerns regarding wBTC’s custodianship and its association with Sun’s BiT Global. According to Coinbase, the decision to delete the asset was made following a routine internal assessment, with the exchange underlining the significance of consumer protection and platform integrity. Sun’s involvement was a major concern, as it cast doubt on the token’s reliability given his history of legal difficulties and charges of fraud and market manipulation.

Source: X

Coinbase’s legal team argued that the presence of BiT and Sun, as well as their collaboration with BitGo, raised serious concerns about the token’s future viability. The firm also claimed a lack of openness about the joint venture’s ownership structure and Sun’s role in it. Given these concerns, Coinbase determined that delisting wBTC was necessary to reduce potential risks.

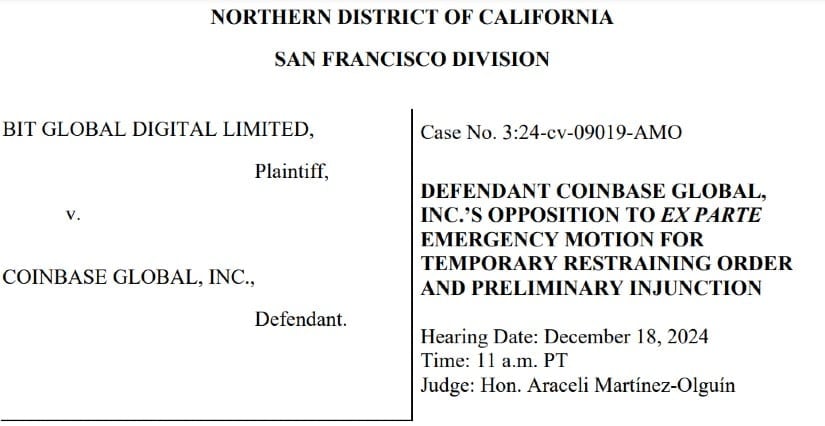

Court Rejects BiT Global’s Claims

BiT Global filed the lawsuit in mid-December 2024, requesting an urgent injunction to prevent the delisting, which was set to take effect on December 19. The court found that BiT’s claims of imminent harm lacked sufficient evidence, noting that the company failed to file the case in a timely manner. According to the judge, if the damage was truly as severe as BiT had claimed, the lawsuit would have been filed much earlier, thereby weakening the company’s argument.

Source: CTFAssets

The court also rejected BiT’s assertion that the delisting would cause irreparable harm, explaining that any financial losses could be compensated through damages. With these points in mind, the court ruled that Coinbase was within its rights to proceed with the delisting as planned.

Sun’s Reputation: a Key Factor

One of the pivotal factors in the case was Justin Sun’s controversial reputation within the cryptocurrency space. Coinbase highlighted his ongoing legal troubles, including investigations by U.S. authorities, which contributed to the exchange’s decision to delist wBTC. The firm argued that the association with Sun posed too great a risk to its platform and its users, prompting the delisting.

In a statement following the ruling, Coinbase’s legal team underscored the importance of maintaining a trustworthy platform for users, particularly when dealing with assets linked to figures like Sun, whose history of financial misconduct and market manipulation raised serious red flags.

A Strategic Move for Coinbase’s Competitor, cbBTC?

While the court sided with Coinbase, some critics have suggested that the decision may have been influenced by competitive interests. Coinbase’s own tokenized Bitcoin product, Coinbase Wrapped Bitcoin (cbBTC), launched in September 2024, directly competes with wBTC. BiT Global claimed that the delisting was part of a broader strategy to promote cbBTC at the expense of wBTC.

Despite these allegations, Coinbase maintained that the delisting was driven purely by risk management concerns and the need to protect its customers. The exchange emphasized that wBTC represented less than 1% of its trading volume, which minimized the impact of its removal.

Implications for the Crypto Ecosystem

The ruling highlights the ongoing tension in the cryptocurrency space over the control and custodianship of major tokens. As exchanges like Coinbase continue to navigate the complexities of regulatory compliance and asset management, the case underscores the importance of transparency and risk assessment when listing or delisting tokens.

With wBTC’s delisting now confirmed, the market will likely see continued competition between tokenized Bitcoin products, such as Coinbase’s cbBTC, and other assets in the decentralized finance (DeFi) ecosystem. As the crypto industry evolves, exchanges will need to balance innovation with solid risk management practices to ensure the integrity and security of the assets they offer to users.

Brave New Coin – Read More