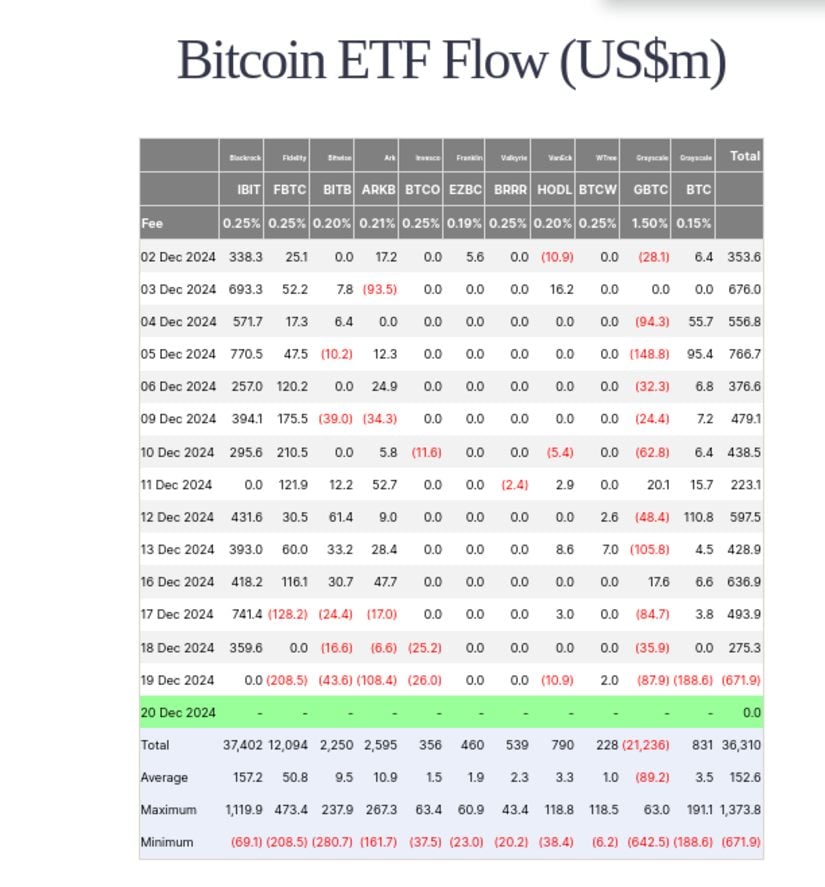

U.S.-listed Bitcoin exchange-traded funds recorded their largest-ever single-day net outflow on Thursday, as risk appetite diminished following signals of less accommodative monetary policy from the Federal Reserve.

According to data provided by Farside Investors, total net outflows from these funds reached approximately $671.9 million on December 19, marking a notable shift in sentiment after a period of steady inflows.

Source: Farside

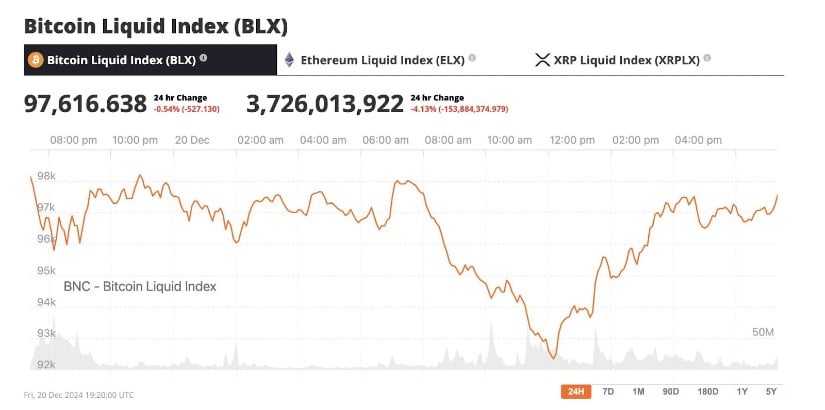

The wave of withdrawals came just days after Bitcoin touched an all-time high above $108,000 earlier in the week. The cryptocurrency has since retreated sharply, hovering just above $97,000 at the time of writing—a decline of roughly 10% from its peak. Market participants attributed the downturn to a combination of factors, including the Fed’s latest policy stance and investors’ inclination to lock in profits before year-end.

Source: BNC Bitcoin Liquid Index

Heavy Redemptions

The data shows that multiple funds experienced heavy redemptions. On December 19, the largest outflow in nominal terms was seen in funds offered by Fidelity, which lost about $208.5 million. ARK’s Bitcoin ETF also saw significant net selling, with around $108.4 million exiting the fund, while Bitwise shed approximately $43.6 million. Invesco and VanEck recorded outflows of about $26.0 million and $10.9 million respectively. Meanwhile, the Grayscale Bitcoin Trust (GBTC)—which carries a comparatively high annual management fee of 1.5%—experienced a net outflow of roughly $87.9 million. By contrast, some funds, such as WTree’s offering, posted small net inflows, but this did little to offset the overall negative trend.

The selling pressure came amid heightened uncertainty over the Federal Reserve’s policy trajectory. At the December Federal Open Market Committee meeting, policymakers indicated fewer interest rate cuts in 2025 than previously anticipated, reducing the likelihood of aggressive monetary easing that some market participants had hoped would bolster risk assets, including cryptocurrencies.

We’re Recalibrating Expectations

This recalibration of expectations placed pressure not only on Bitcoin but also on a broader range of digital assets. Analysts suggested that investors, after a year of robust gains in cryptocurrencies, are taking a more cautious stance. The prospect of fewer rate cuts and potentially tighter financial conditions in the future may have prompted some market participants to take profits, especially as liquidity traditionally thins out near the end of the year.

Market experts noted that management fees and the availability of lower-cost alternatives could also factor into outflows. Grayscale’s 1.5% annual fee, for instance, is higher than many competing Bitcoin ETFs that charge between 0.2% and 0.3%, potentially incentivizing investors to rotate into less expensive products. Recent filings and disclosures indicated that some funds had already been shedding their Bitcoin holdings over the course of the year, suggesting that the latest wave of redemptions may be part of a longer-term repositioning.

Still, some observers remain optimistic about Bitcoin’s longer-term prospects. Potential leadership changes at regulatory institutions in 2025, such as the upcoming scheduled departure of SEC Chair Gary Gensler, have been cited as potential catalysts for renewed bullish momentum. Analysts warn, however, that any regulatory uncertainty in the near term could stir further volatility, especially given that digital asset markets remain sensitive to changes in policy signals.

As Matt Houghan of Bitwise said on X, “The drivers of the bull market are long-term and fundamental, while the drivers of the pullback are short-term and tactical. That makes the pullback an opportunity and not a reversal.”

Source: X

Brave New Coin – Read More