This divergence reflects the complexities and uncertainties surrounding altcoins in the broader cryptocurrency ecosystem.

A Stagnant Market or a Slow Rebuild?

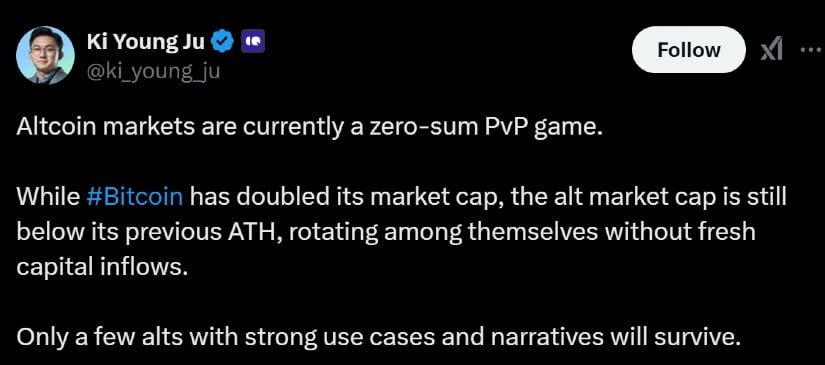

Ki Young Ju, CEO of the on-chain analytics firm CryptoQuant, paints a sobering picture of the altcoin market. In a recent analysis, he described it as a “zero-sum player versus player game,” where gains are primarily internal, with little to no new capital entering the sector. “Bitcoin’s market value has doubled since 2021, but altcoins’ total market cap remains below previous all-time highs,” Ju noted, emphasizing that only a handful of altcoin projects with strong use cases and compelling narratives are likely to endure.

Source: Ki Young Ju via X

The total market capitalization of all altcoins, excluding Bitcoin and Ethereum (tracked as Total3), currently hovers around $943 billion. This figure is significantly below the all-time high of $1.1 trillion achieved during a late-2024 rally. The stagnation reflects a lack of fresh inflows, with analysts noting that most trading activity within the altcoin space is circular, rather than indicative of broader market growth.

Stablecoins and ETFs Redefining Altseason Dynamics

Ju argues that traditional altcoin cycles, where capital rotates from Bitcoin profits into smaller coins, have shifted. Instead, he suggests that future altcoin growth may depend on stablecoin liquidity and an increase in stablecoin trading pairs, which signal genuine demand rather than capital recycling.

Source: Ki Young Ju via X

Additionally, he highlights a structural challenge: the rise of exchange-traded funds (ETFs) for Bitcoin and Ethereum has created a siloed investment environment. Funds allocated to these ETFs are less likely to flow into smaller altcoin projects, further constraining the sector.

Citi Analysts Offer Optimism

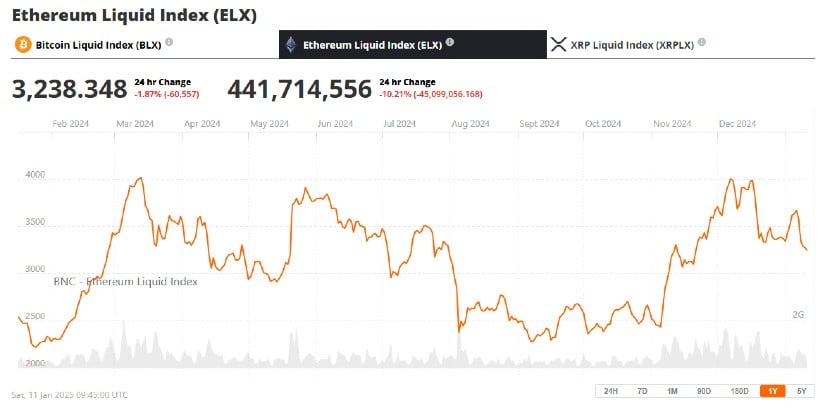

Contrary to CryptoQuant’s cautious outlook, analysts from Citi suggest a brighter future for altcoins in 2025. They point to Ethereum’s growing prominence, bolstered by its inclusion in spot ETFs, and anticipate that the success of major cryptocurrencies could eventually benefit smaller-cap assets like Ripple (XRP), Solana (SOL), and Tron (TRX). Ethereum’s price alone surged 59% in December 2024, showcasing its continued strength.

Similarly, Ripple’s XRP is emerging as a contender to be one of the best-performing assets of 2025. It has surged 300% over the last 90 days. With tacit support from President Trump, and an XRP ETF almost certain in 2025, XRP is one of the few alt coins that has the potential to outperform Bitcoin.

Ethereum (ETH) price chart. Source: Ethereum Liquid Index (ELX) via Brave New Coin

Citi analysts also attribute Bitcoin’s strong performance in 2024—a 116% annual gain—to major catalysts, including the approval of spot BTC ETFs, a mid-year halving event, and favorable political developments in the United States. They argue that such events create conditions for an eventual “altcoin season” as investors diversify.

Emerging Narratives and Investment Trends

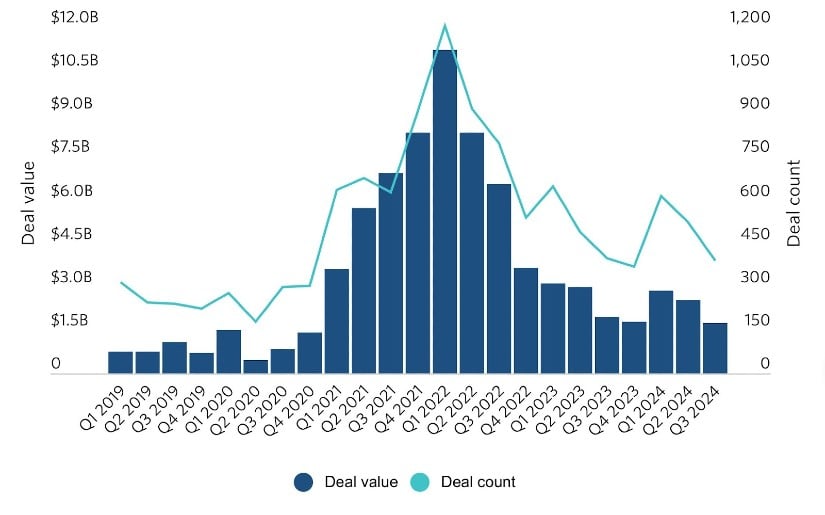

Despite current headwinds, new narratives and venture capital activity could reshape the altcoin landscape. According to Pitchbook, Q1 2024 saw crypto fundraising surge to $2.4 billion across 518 deals, reflecting a 40.3% increase in capital investment compared to the previous quarter. AI-related projects, in particular, attracted significant attention, receiving $106 million in funding during Q3 2024 at a $1.1 billion pre-money valuation.

Global crypto VC investment by deal value and count. Source: Saleh Almenawer via X

These developments highlight an increasing appetite for early-stage projects, reinforcing the importance of robust narratives and strong fundamentals—factors that both CryptoQuant’s Ju and Citi analysts agree are critical for long-term success.

A Complex Road Ahead

As the debate continues, it’s clear that the altcoin market faces both challenges and opportunities. While stagnation and limited inflows pose immediate concerns, emerging trends in stablecoin liquidity, ETFs, and venture capital activity could provide the foundation for a more vibrant altcoin ecosystem in the future. The question remains whether these factors will materialize quickly enough to drive a significant shift in 2025.

Regardless, recent news suggests that Bitcoin and XRP are in the driver’s seat for 2025, and ready to perform well.

Brave New Coin – Read More