- Altcoin season might be returning to the market, according to Ki Young Ju.

- Regulatory shifts and hopes of ETF approval are likely to drive this altcoin adoption.

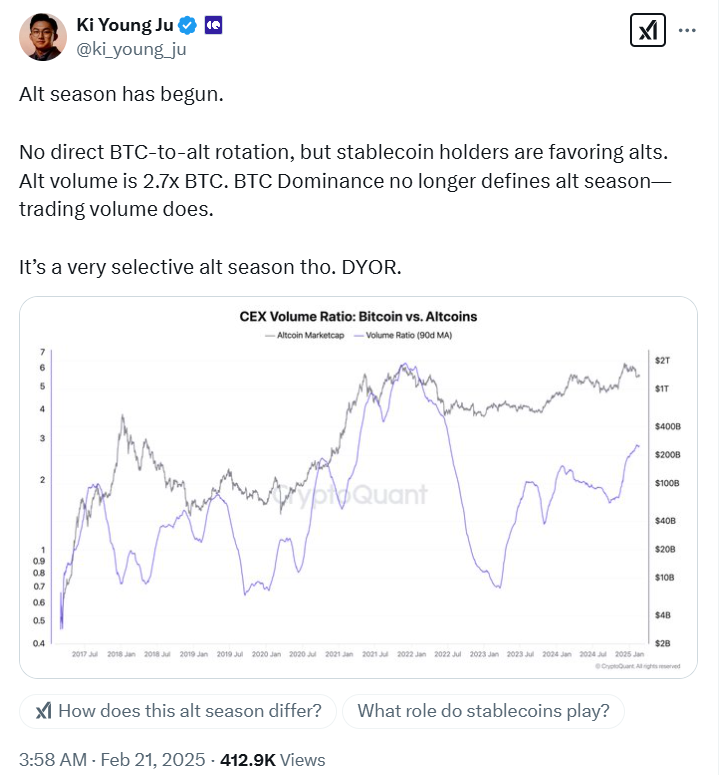

The broader digital currency ecosystem shows an impressive push toward altcoins, a trend suggesting the alt season might have commenced. CryptoQuant Founder and CEO Ki Young Ju triggered this sentiment in a post on X where he pointed out a key metric soaring within the altcoin ecosystem.

The Big Take on Altcoins Reboot

Known for his insightful takes on market trends, Ki Young Ju said there is no direct Bitcoin to altcoin rotation. He pointed out that stablecoin holders are favoring altcoins the most. In a follow-up post, the CryptoQuant Founder emphasized the no BTC-alt rotation take, saying Bitcoin is not a quote currency anymore.

Beyond this, he pointed out that the Altcoin volume is 2.7x that of Bitcoin. In his opinion, dominance no longer defines the alt season, and trading volume is what matters now. Based on market data, Bitcoin currently commands a 60% dominance of the broader market atop its $1.95 trillion market cap.

Ethereum, the biggest altcoin, only commands a 10% dominance, making this metric a faulty yardstick to measure the altcoin season. Despite the growing claims of altcoin season setting in, some market data conflict with this reality. As we discussed earlier, the altcoin index came in at 43 as of February 10; however, this data has dropped since then.

According to CoinMarketCap, the altcoin index is now pegged at 29, a sign of a sustained bearish growth outlook. To address some community members’ concerns, the CryptoQuant founder acknowledged that the alt season, as he perceives it, is a selective one.

This explains why coins like XRP have grown by over 72% in the past 90 days when Cardano (ADA) is down 25%. This conforms with an earlier take from Young Ju, who said only a select few will win in today’s current alt season.

The Ultimate Trigger for Alt Season

In today’s digital currency ecosystem, a major regulatory shift may favor altcoins the most. This is related to the pro-crypto administration led by United States President Donald Trump. Since his inauguration over a month ago, President Trump has initiated policies favorable to altcoin.

In a major twist, the President changed the expectations for a sole Bitcoin Reserve and hinted at a national digital assets stockpile. As detailed in our earlier news piece, this stockpile will feature the emergence of stablecoins and altcoins like ADA, XRP, and ETH.

Meanwhile, the quest for altcoin-based exchange-traded funds is growing very fast. Thus far, top asset managers like Grayscale Investments, Bitwise, Canary Capital, and CoinShares have filed applications with the Securities and Exchange Commission (SEC) for Solana, Litecoin, and XRP ETF products.

As featured in our recent post, Bloomberg Senior Analysts have issued high approval odds for these products, with 70% for XRP ETF. This aligns with the advancing proactive regulations in the market in general. Institutional capital may flow into these coins if approved, pushing forward their valuation.

Crypto News Flash – Read More