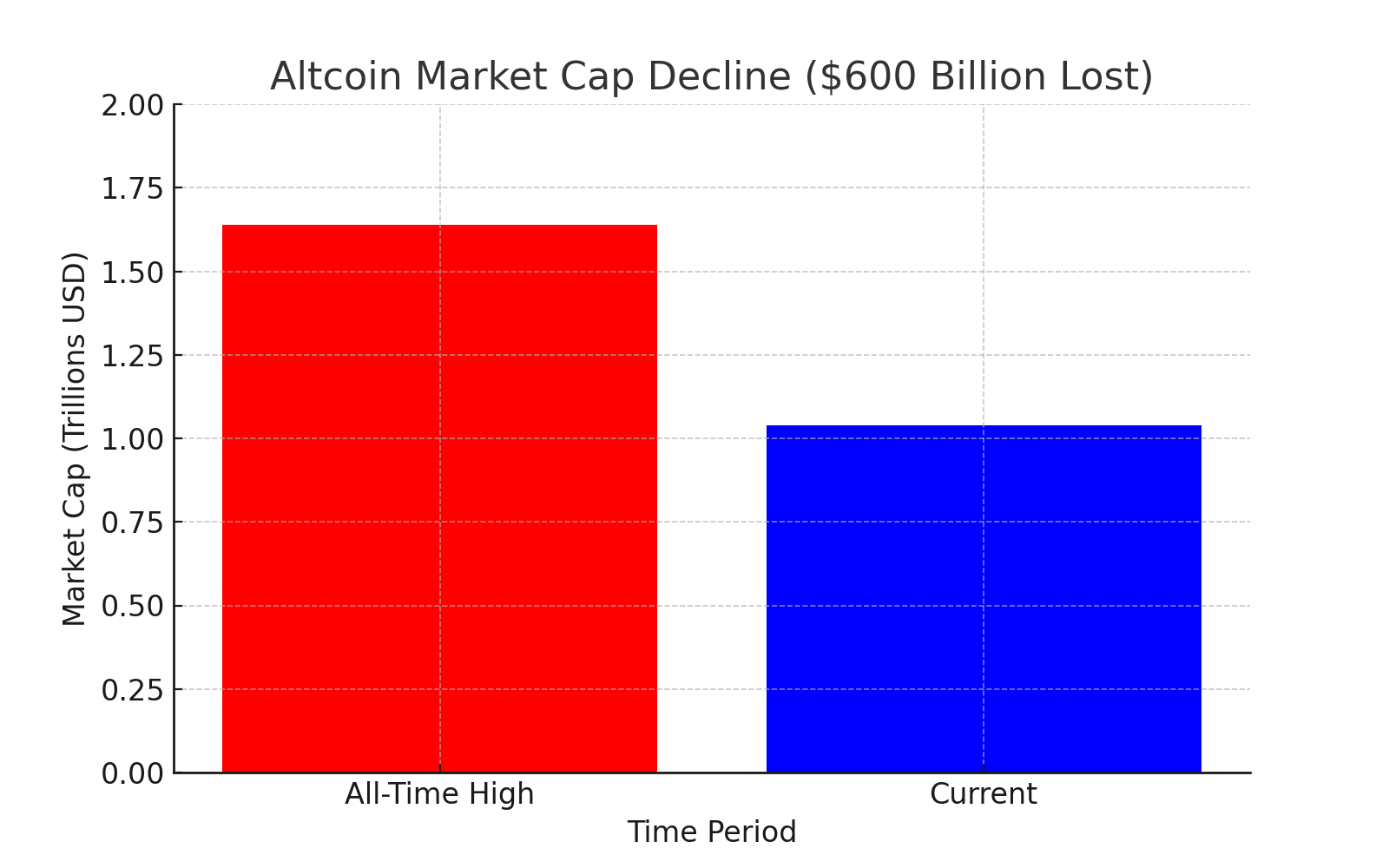

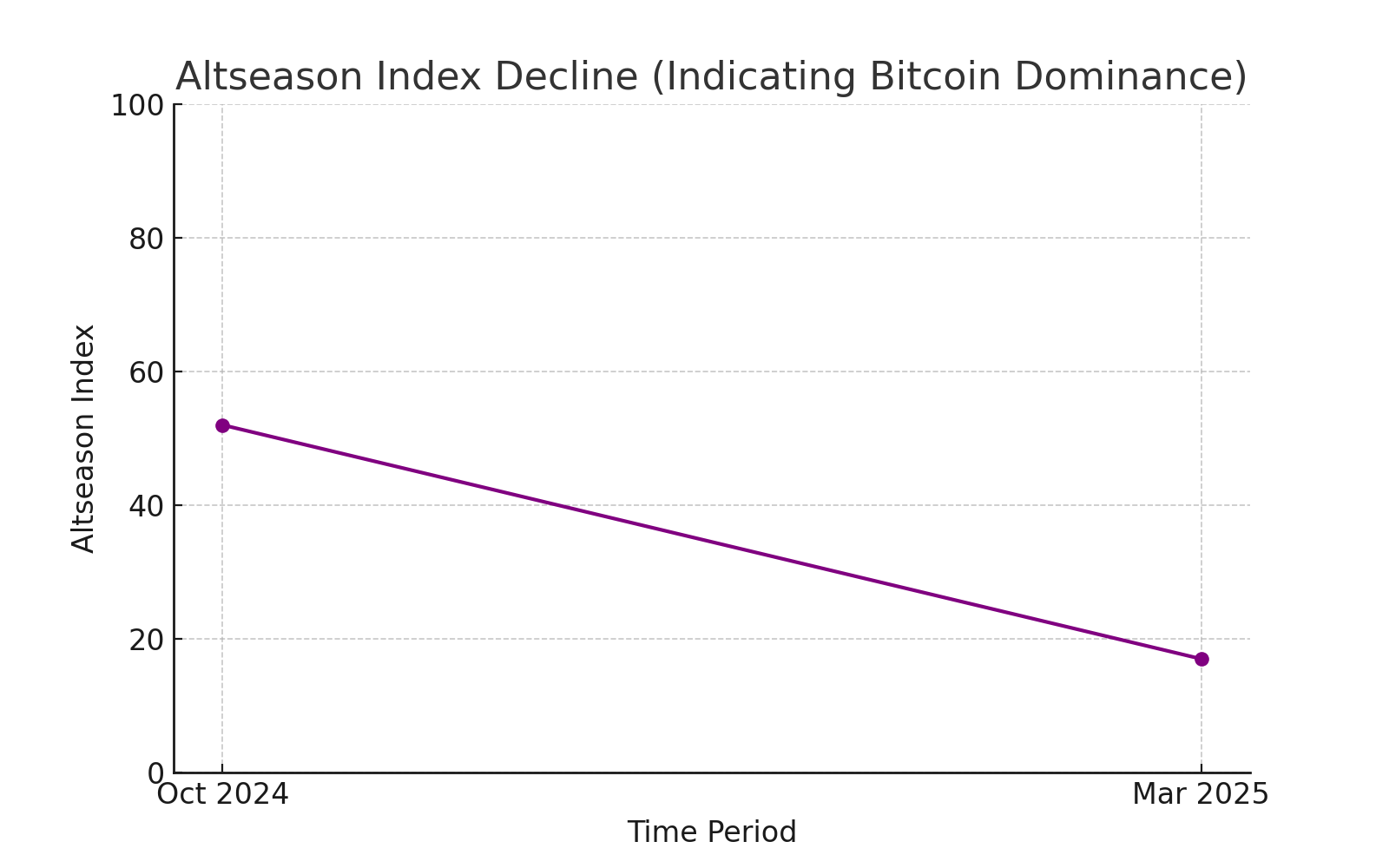

The cryptocurrency market is currently showing intense decline, with the loss of $600 billion in altcoin market value. The alt season index currently sits at 17, indicating intense Bitcoin market dominance.

Expert opinions about this market decline differ because some believe losses will continue while others detect possible indicators of recovery. Will future years mark the death of altcoins or will they experience a new bull market?

Altcoin Market Hits Multi-Month Low

The CoinMarketCap Altcoin Season Index stands at 17 which indicates Bitcoin dominates the overall market activity. Index scores under 25 indicate Bitcoin maintains adequate dominance over altcoins whereas scores above 75 usually predict a period favorable for altcoins.

Market Highlights:

- Market value from the altcoin capitalization peak has declined 38% to $1.04 trillion and removed $600 billion in value.

- Within the last 90 days just 17 out of the 100 highest ranked altcoins demonstrated superior performance than Bitcoin.

- According to BlockchainCenter the Altseason Index stands at its most minimal value since October 2024 ahead of an upcoming strong altcoin price increase.

The experts predict that when Bitcoin increases its market dominance it causes these altcoin cycles to extend further into bearish phases. Historical evidence reveals that when the altseason index reaches its lowest point this marks the beginning of an upcoming altcoin recovery phase.

What Experts Are Saying

Crypto industry professionals hold different opinions concerning future price recovery of alternative cryptocurrencies.

The founder of Binance Changpeng Zhao (CZ) expressed his difficulties in these times by admitting:

“A score of 50 looks like an excellent outcome in this situation according to him. The current market makes it challenging to achieve better performance than Bitcoin.”

According to Ki Young Ju who leads CryptoQuant as CEO

“there is no longer validity in the classic altseason framework because Bitcoin-driven crypto asset rotations have effectively ended with regulations and institutional adoption.”

Analysts maintain that counter-trend indicators may signal an incoming change in market direction.

Signs of a Potential Altcoin Comeback

Signs of a Potential Altcoin Comeback

Analysts detect initial warning signals that the market may be shifting toward recovery even though it currently faces severe losses. Alphractal reports that one of the 57 monitored cryptocurrencies proved stronger than Bitcoin for the previous 72 hours.

Why Some Experts Believe in an Altcoin Rebound:

- Recent evidence suggests that major altcoin investors are conducting less intensive selling of their assets.

- Small-cap altcoins indicate initial patterns of buying behavior yet to become widespread.

- The historical data indicates that whenever Bitcoin’s dominance reaches its highest point small alternative cryptocurrencies start to demonstrate strong performance.

The CEO of Alphractal Joao Wedson predicts that the altcoin market will recover according to him:

“Markets indicate that an upcoming altcoin season will start within the next few weeks. The equity market displays fatigue signals that suggests small-cap investments are ready to break through.”

The ongoing Bitcoin dominance threatens to extend the recovery period according to his assessment.

Will Institutional Investors Revive the Market?

A major transformation in the crypto market originates from institutional engagement. Altcoin recoveries depend heavily on their strong practical purposes and support from institutional investors according to expert opinions.

Key Institutional Trends:

| Trend | Impact on Altcoins |

| Stablecoin Dominance | The preference for stablecoins has grown stronger than speculative altcoins because institutional capital endorses them. |

| Regulatory Scrutiny | Government regulations reduce the ability to speculate in altcoin markets. |

| ETF Influence | The introduction of Bitcoin ETFs has led to decreased liquidity within the altcoin market. |

When institutions start investing into important altcoin assets, a new round of market expansion could initiate. The main challenge preventing advancement comes from regulatory uncertainty.

What’s Next for Altcoins?

Altcoin market conditions will determine the outcome of the subsequent weeks. An increasing Bitcoin dominance creates downward pressure on alternative coins because many investors favor the first crypto. The data shows that if historical trends apply this situation could prompt an upcoming change.

Key Takeaways:

- The altseason index currently shows its most minimal value since the previous months.

- The altcoin market lost approximately $600 billion throughout this period.

- Multiple analysts forecast an upcoming recovery for altcoins because of earlier market patterns.

The performance outlook of altcoins in forthcoming years may be determined by institutional level investment in the market.

At this point investors must stay mindful and look out for essential market indicators in addition to spreading their cryptocurrency assets between different digital currencies. Keep following The Bit Journal and keep an eye on crypto updates.

FAQs

-

Why did altcoins lose $600 billion?

Bitcoin’s growing rate of market control and institutional Bitcoin ETF interest together with market-wide risk avoidance explain the altcoin sector’s value decrease.

-

When can we expect another altcoin market expansion?

Market analysts differ on whether altcoins will regain value because regulations and institutions have transformed market fundamentals.

-

What indicators does a 17 value on the altseason index provide?

Based on this read Bitcoin maintains superior performance compared to most alternative coins which reveals an ongoing Bitcoin season without any signs of an altseason.

-

Are there any signs of a reversal?

The market seems to show any indication of a shift in direction. Experts who study market trends detect three possible elements that hint at an upcoming altcoin price uptick.

-

What should investors do now?

Before deciding to invest investors need to keep themselves updated about the market and analyze risks together with monitoring the trends.

Glossary of Key Terms

| Term | Definition |

| Altcoin | Any cryptocurrency other than Bitcoin. |

| Altseason Index | A metric showing whether altcoins are outperforming Bitcoin. |

| Bitcoin Dominance | The percentage of the total crypto market capitalization held by Bitcoin. |

| Institutional Investors | Large financial entities that invest in crypto, such as hedge funds and banks. |

References

- CoinMarketCap – Altcoin Season Index

- CryptoQuant – Market Trends

- BlockchainCenter – Altseason Analysis

- Alphractal – Crypto Performance Data

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!

The Bit Journal – Read More