Binance has clarified that it has not been selling assets in response to the recent rumors of a decrease in its non-customer asset holdings.

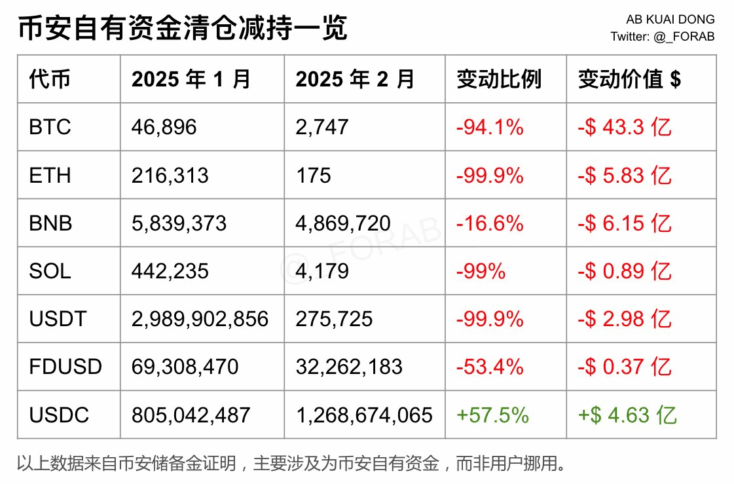

As per data, Binance’s reserves included approximately 2,746 Bitcoin (BTC), 275 million Tether (USDT), 174 Ethereum (ETH), and 4,179 Solana (SOL) at the end of January 2025.

In December 2024, when Binance reportedly held 46,896 BTC, 2.99 billion USDT, 216,312 ETH, and 442,234 SOL. This marks a sharp decline fueling speculation about an $8 billion reduction in reserves.

However, Binance has stressed that the changes are the result of internal treasury accounting adjustments rather than asset sales. The exchange stressed that user assets are still completely guaranteed and safeguarded by its Secure Asset Fund for Users (SAFU).

Binance also pointed to its Proof of Reserves system, which ensures all customer assets are covered on a 1:1 basis. While Binance maintains that these movements do not impact user funds, crypto analysts and traders continue to monitor the situation for further developments.

Also Read: Binance versus SEC Lawsuit to be on hold for 60 days

The Crypto Times – Read More