Bitcoin and altcoins faced steep downsides, spurring heightened liquidation as the global market reacted to an intense macroeconomic headwind.

It is barely three days into February, and Bitcoin has corrected 9%. The largest cryptocurrency by market cap participated in the ongoing global market onslaught, as fears of a border trade war between the United States and major countries like Canada, Mexico, and China have escalated.

For context, Donald Trump imposed a 25% tariff on Canada and Mexico, with China receiving a milder 10%. The executive order, which will be fully implemented on February 4, saw the US dollar surge to a record peak against the Chinese yuan and a 22-year and 23-year high against the Canadian dollar and Mexican peso, respectively.

Risk assets like cryptocurrencies have immensely felt the heat, with Bitcoin dumping to an intraday low of $91,281 today. The 4% drop has ensured a more significant capitulation for altcoins, with the global crypto market downsizing 10.28% to $3.04 trillion.

Market Traders Become Casualties

Meanwhile, leveraged traders endured the heavy market correction as liquidation data spiked. As expected, bulls suffered the largest losses, with Coinglass showing that the downturn wiped out $2.22 billion the crypto market, with long positions accounting for $1.88 billion.

Ethereum’s over 20% correction ensured its traders endured the highest position liquidation. The drop has chalked off nearly $600 million worth of Ether trades from the market in the past 24 hours, with $474 million in long calls and $125.75 million in shorts.

Moreover, Bitcoin position liquidations also spiked in the past day, with $406 million erased from the market. Following the 4% correction, long positions worth $341 million were dissolved, while bears suffered a minute $65.5 million loss.

Other assets like XRP and Solana also saw increased liquidation heatmaps. The former recorded $155 million, while the latter witnessed $85 million. In total, the market crash liquidated 726,831 positions, with the largest single trade erased being a $25.64 million long position on the Binance ETH/BTC pair.

A Rebound on the Horizon?

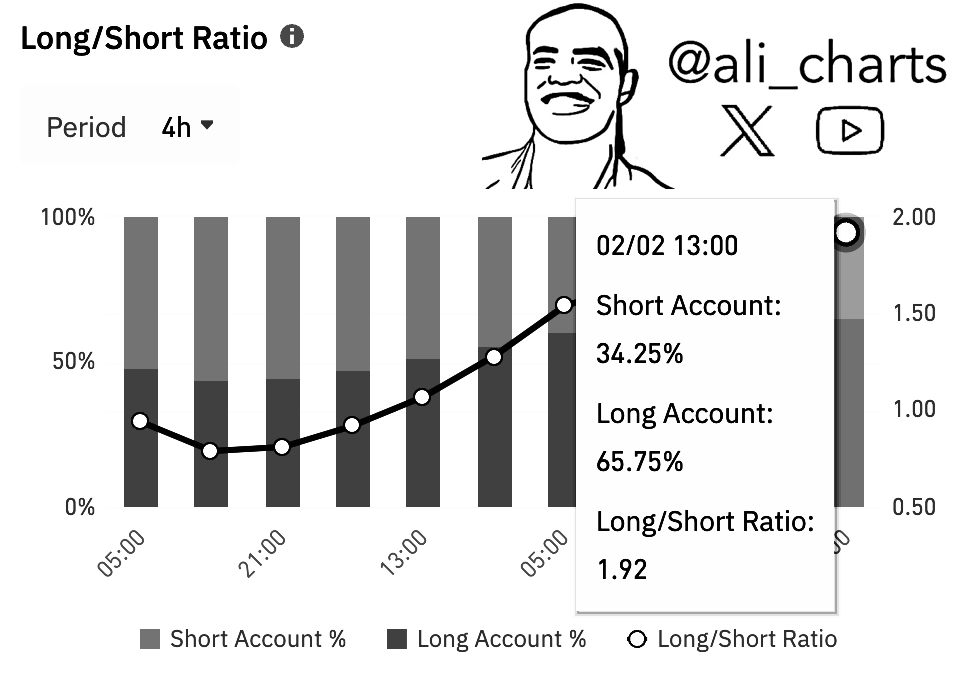

Interestingly, bulls are still betting on a price rebound amid global market skepticism. Prominent analyst Ali Martinez pointed to this surprising confidence, evident in the position bias on Binance, the leading crypto exchange by trading volume.

According to the disclosure, 65.75% of Binance traders are betting on a price rebound, with the long/short ratio at 1.92. Do these traders know what we don’t?

Meanwhile, Bitcoin and altcoins have rebounded from such a dip countless times, assuring market enthusiasts of their ability to dispel bearish pressure and target upsides. In the meantime, Bitcoin trades at $94,136, bouncing 3% from its intraday low of $91,281 already.

Latest Cryptocurrency News – The Crypto Basic – Read More