Bitcoin traders faced turbulent conditions as BTC’s price dipped to $92,000 before staging a modest recovery, triggering mixed reactions across the crypto market.

Bitcoin (BTC) saw a sharp price drop on December 20, revisiting $92,000 lows as leveraged positions were liquidated, further pressuring bullish traders. After the Wall Street open, BTC/USD rebounded above $96,000, but the damage was already done.

Source: BNC Bitcoin Liquid Index

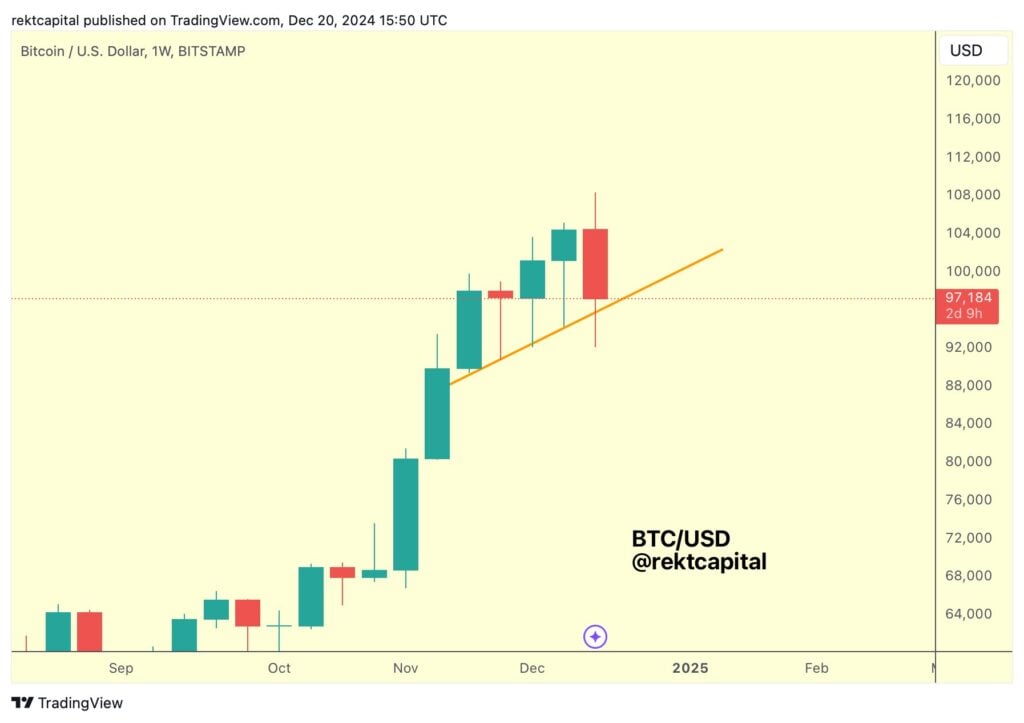

Market data from BNC showed Bitcoin down 1.5% on the day, continuing its descent from previous highs. According to popular trader and analyst Rekt Capital, this pullback mirrors historical bull market corrections.

“The cascade of support loss has indeed occurred,” Rekt Capital noted, emphasizing that Bitcoin’s 15% decline aligns with typical corrections seen six to eight weeks after breaking all-time highs.

Rekt Capital’s analysis suggests this is the first major “Price Discovery Correction” of the current cycle, offering a prime re-accumulation opportunity for long-term investors. He added that such corrections typically last a few weeks before reversing upward. But all is not lost, Rekt wrote that, “This is why I always talk about Weekly Closes to offer confirmation. Bitcoin has downside deviated both of the crucial Weekly supports while still maintaining these as support. BTC needs to lose these areas to transition into a deeper correction.”

Source: X

$1.4 Billion Liquidated as Coinbase Drives Sell-Side Pressure

The liquidation frenzy wasn’t confined to Bitcoin. Data from CoinGlass revealed that the broader crypto market suffered over $1.4 billion in liquidations in the past 24 hours. Analyst J. A. Maartun from CryptoQuant highlighted significant sell-side pressure originating from Coinbase, the largest U.S. crypto exchange.

The “Coinbase premium,” which measures the pricing difference between Bitcoin on Coinbase (BTC/USD) and Binance (BTC/USDT), showed a sharp negative trend. A negative Coinbase premium often signals strong selling pressure from U.S.-based traders.

“When Coinbase Premium is negative, it’s a signal to stay on the sidelines,” CryptoQuant contributor BQYoutube advised. “Wait for the market to show positive signals before jumping back in.”

What’s Next for Bitcoin?

While Bitcoin’s latest price drop rattled short-term traders, seasoned analysts see historical patterns playing out. The ongoing correction aligns with typical bull market pullbacks, potentially offering a buying opportunity for those confident in the long-term trajectory of the crypto market.

With macroeconomic data still driving sentiment, Bitcoin traders will be watching for signs of stabilization, particularly as inflation data and Federal Reserve policy continue to shape market expectations. For now, the $92,000 dip marks both a moment of pain for late bulls and a tempting entry point for dip buyers betting on Bitcoin’s resilience.

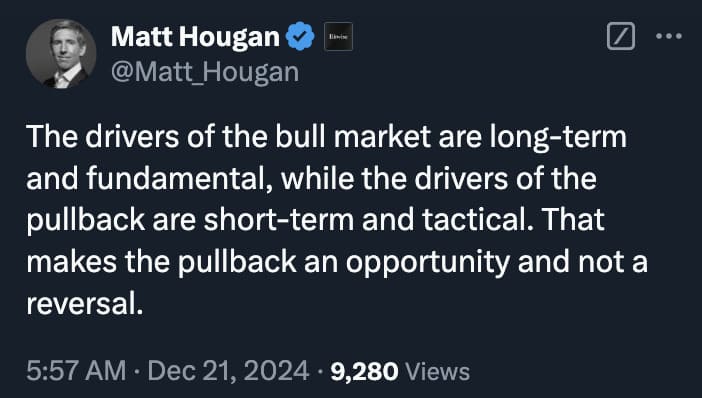

Remember folks, As Matt Houghan of Bitwise said on X, “The drivers of the bull market are long-term and fundamental, while the drivers of the pullback are short-term and tactical. That makes the pullback an opportunity and not a reversal.”

Source: X

Brave New Coin – Read More