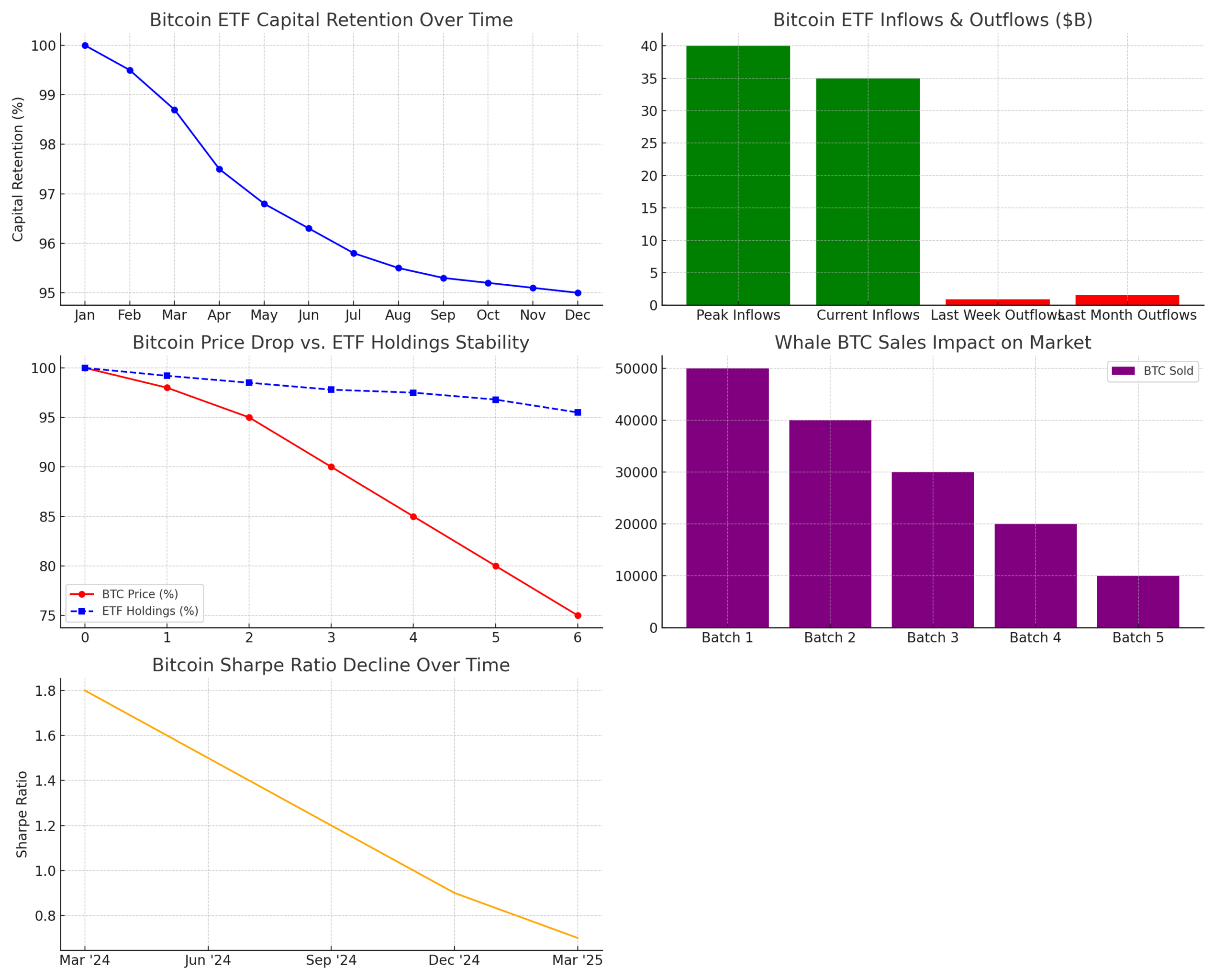

Bitcoin exchange-traded funds (ETFs) have demonstrated remarkable resilience, holding onto 95% of their invested capital despite slowing inflows and a downturn in Bitcoin’s price, according to Bloomberg ETF analyst James Seyffart. This suggests that long-term investors are maintaining confidence in Bitcoin ETFs, even as market volatility intensifies.

In a March 14 post on X, Seyffart revealed that Bitcoin ETF inflows have dropped from a peak of $40 billion to $35 billion. Despite this, total assets under management (AUM) remain at $115 billion, indicating that most investors are not withdrawing their funds. Bitcoin itself has seen a 25% price decline, yet ETF capital retention remains high.

Seyffart likened this trend to traditional U.S. stock ETFs, where seasoned investors typically avoid panic selling during downturns. Instead, many view these price dips as opportunities to accumulate more assets, signaling a broader shift from speculative trading to long-term investment strategies.

Spot Bitcoin ETFs Experience Outflows Amid Market Shifts

Meanwhile, data from SoSoValue reports that U.S. spot Bitcoin ETFs have faced $870 million in outflows over the past week and $1.6 billion over the past month. Analysts attribute this to a classic “buy the rumor, sell the news” cycle.

Market sentiment initially surged after U.S. President Donald Trump mentioned the Strategic Bitcoin Reserve initiative. This speculation led to a wave of Bitcoin purchases, pushing prices higher. However, by the time the official announcement was made at the Crypto Summit, the market had already priced in the news, prompting a sell-off.

Analysts Warn of Weakening Bitcoin Demand

Other market indicators suggest that Bitcoin’s demand has been declining. Darkfost, a CryptoQuant contributor, noted that Bitcoin’s 30-day simple moving average of apparent demand has dropped sharply since December 2024. This metric compares new BTC supply to long-inactive coins, and its decline signals fewer active buyers and a more hesitant market.

Adding to concerns, Alphractal, a data analytics platform, pointed out in a March 12 X post that the Bitcoin Sharpe Ratio has been in decline since March 2024. This ratio, which assesses risk-adjusted returns, shows increasing risk per unit of return, raising red flags for investors.

Even when Bitcoin hit an all-time high above $100,000, its risk-adjusted performance weakened, suggesting a more volatile market ahead.

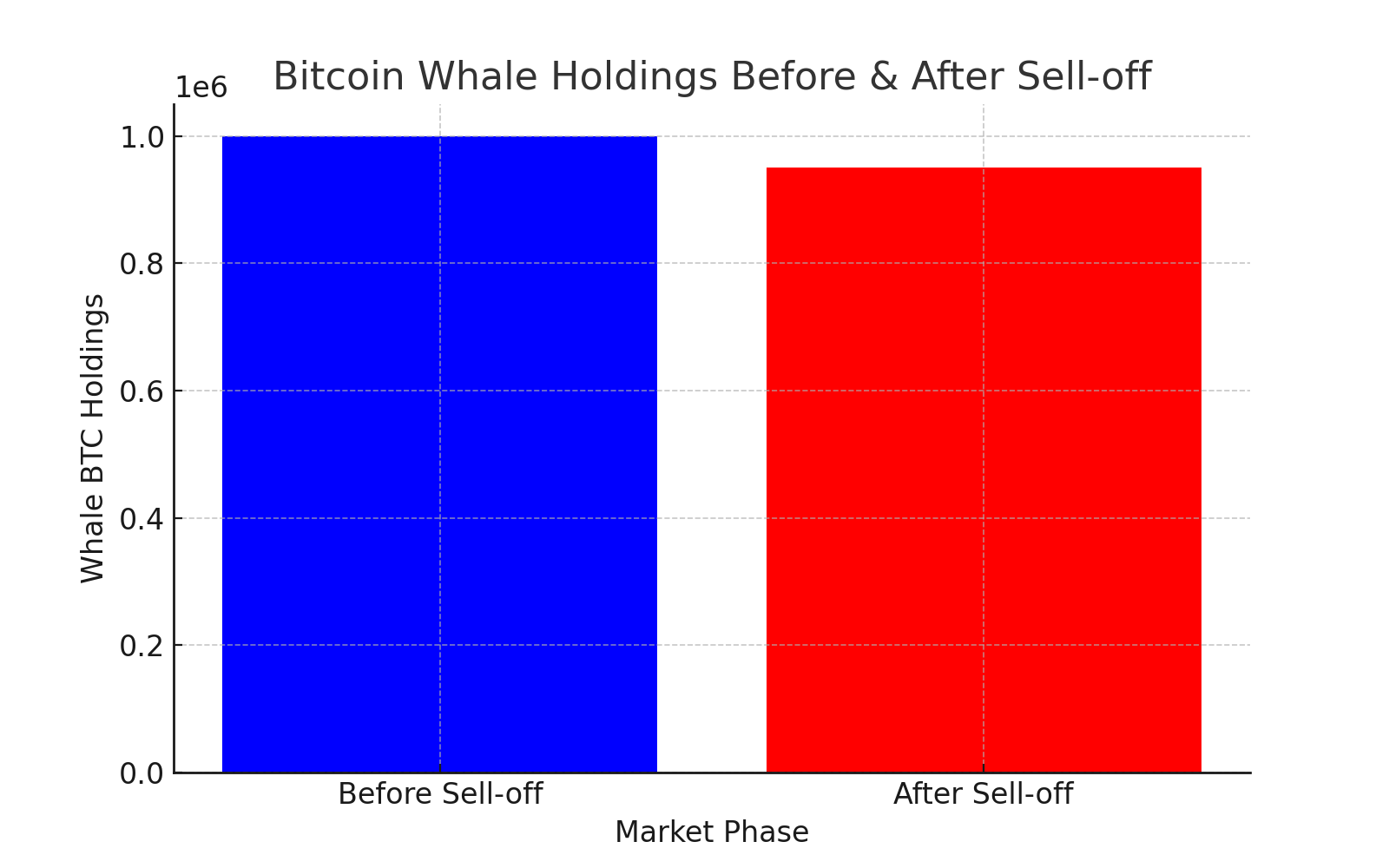

Whale Activity Signals Caution Among Institutional Investors

Further evidence of market uncertainty comes from Santiment, a blockchain analytics firm, which reported a sell-off by large Bitcoin holders. Over the past week, whale wallets holding 100–1,000 BTC have sold more than 50,000 BTC, valued at approximately $4.07 billion.

Historically, shifts in whale and shark wallet behavior have influenced market trends. This recent sell-off raises questions about Bitcoin’s short-term stability and whether institutional investors are adjusting their strategies in response to increased volatility.

Conclusion

Bitcoin ETFs have proven to be remarkably resilient, retaining 95% of their capital despite declining inflows and a turbulent market. This suggests that many investors remain committed to Bitcoin’s long-term potential, even amid price corrections and increasing volatility. However, weakening demand, a falling Sharpe Ratio, and whale sell-offs indicate growing caution in the market.

As institutional investors navigate these dynamics, Bitcoin’s performance in the coming months will be crucial in determining whether ETFs can sustain this level of capital retention. With global economic uncertainties still looming, all eyes are on Bitcoin’s ability to stabilize and regain investor confidence.

The BIT Journal is available around the clock, providing you with updated information about the state of the crypto world. Follow us on Twitter and LinkedIn, and join our Telegram channel.

FAQs

1. Why are Bitcoin ETF inflows declining?

Bitcoin ETFs have seen reduced inflows due to market corrections, profit-taking, and investor caution amid economic uncertainty.

2. What does it mean that Bitcoin ETFs retain 95% of capital?

Despite slowing inflows, most investors are keeping their funds in Bitcoin ETFs, indicating long-term confidence in the asset.

3. How do whale wallets affect Bitcoin’s price?

Large holders selling Bitcoin can trigger price declines by increasing supply in the market, leading to lower investor sentiment.

4. What is the significance of Bitcoin’s declining Sharpe Ratio?

A falling Sharpe Ratio suggests increasing volatility and reduced risk-adjusted returns, making Bitcoin a riskier investment.

Glossary

Bitcoin ETF: A financial product that allows investors to gain exposure to Bitcoin without directly holding the asset.

AUM (Assets Under Management): The total market value of assets managed by an investment fund.

Sharpe Ratio: A metric used to evaluate the risk-adjusted return of an investment.

Whale Wallets: Crypto wallets holding significant amounts of Bitcoin, usually between 100-1,000 BTC.

Spot Bitcoin ETF: A Bitcoin ETF that directly holds Bitcoin rather than derivatives or futures contracts.

References

Read More: Bitcoin ETFs Hold Strong at 95% of Capital Despite Slowing Inflows, Analyst Reveals“>Bitcoin ETFs Hold Strong at 95% of Capital Despite Slowing Inflows, Analyst Reveals

The Bit Journal – Read More