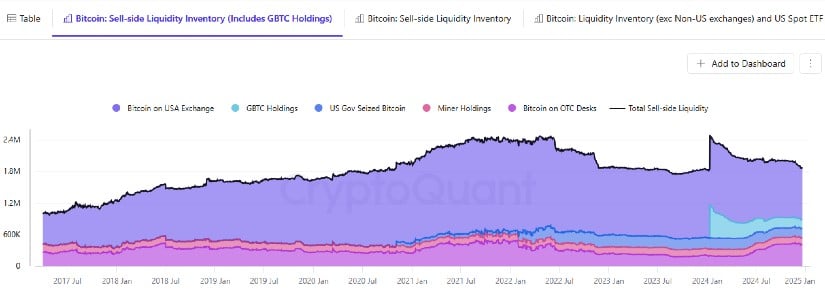

The Bitcoin market is grappling with a significant supply shock, as sell-side liquidity has plummeted to levels not seen since October 2020.

According to on-chain analytics firm CryptoQuant, only 3.397 million Bitcoin (BTC) are currently available for sale across exchanges, miners, over-the-counter (OTC) desks, and the Grayscale Bitcoin Trust (GBTC). This marks a sharp decline of 678,000 BTC in 2024 alone.

Shrinking Liquidity and Rising Demand

The drastic reduction in sell-side liquidity has tightened the market considerably. CryptoQuant’s chart illustrates Bitcoin demand has been in “expansion territory” since late September, growing 228,000 BTC a month. Such high demand, together with dwindling supply, has sent the price of the cryptocurrency soaring, setting an all-time high at $108,000 early this month.

Bitcoin sell-side liquidity chart. Source: CryptoQuant

Adding to the liquidity crunch are accumulator addresses—wallets that consistently buy Bitcoin without selling. These addresses currently amass Bitcoin at a record high of 495,000 BTC per month. Analysts say this growing influence of long-term holders is locking away large portions of Bitcoin, adding to the supply shortage.

Stablecoins Surge as Liquidity Proxy

While Bitcoin’s supply tightens, the larger cryptocurrency market has seen a significant increase in liquidity. The overall market capitalization of USD-based stablecoins, comprising Tether (USDT) and USD Coin (USDC), has reached $200 billion. This marks a 20% gain, or $35 billion, since late October.

Stablecoins serve an important role in the crypto ecosystem as a liquidity proxy. Their expansion indicates new capital inflows into the market, which might drive additional price hikes for Bitcoin and other cryptocurrencies. “The heightened liquidity aligns with Bitcoin’s recent rally, suggesting a direct relationship between stablecoin market trends and Bitcoin price movements,” according to experts at CryptoQuant.

Impact on Price and Market Dynamics

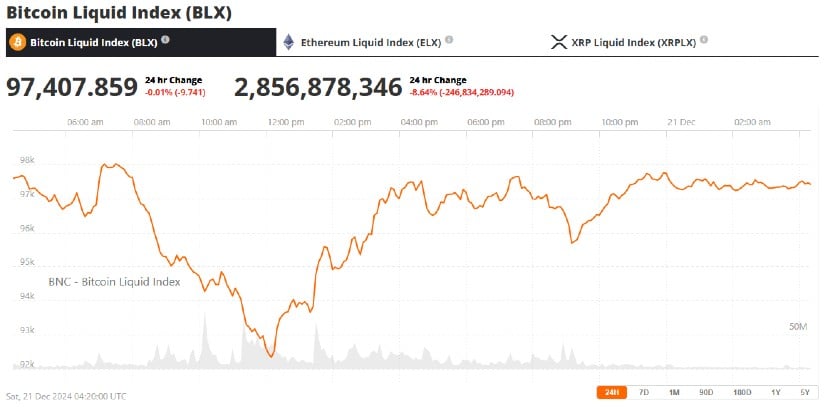

Despite the bullish momentum, the crypto market has not been immune to volatility. On Friday, more than $1 billion in leveraged positions were liquidated within 24 hours, causing Bitcoin to dip by over 8% and trade below $96,000. This marked a sharp reversal from its recent high and underscored the ongoing unpredictableness of the market.

Bitcoin (BTC) price chart. Source: Bitcoin Liquid Index (BLX) via Brave New Coin

CryptoQuant’s data also reveals that the liquidity inventory ratio—a measure of how many months of demand the current sell-side inventory can sustain—has dropped significantly. As of December, the ratio stands at 6.6 months, a steep decline from 41 months recorded at the beginning of October. This sharp reduction reflects the accelerating pace at which Bitcoin’s sell-side inventory is being depleted.

Bitcoin Supply Crunch: Implications for Market Players

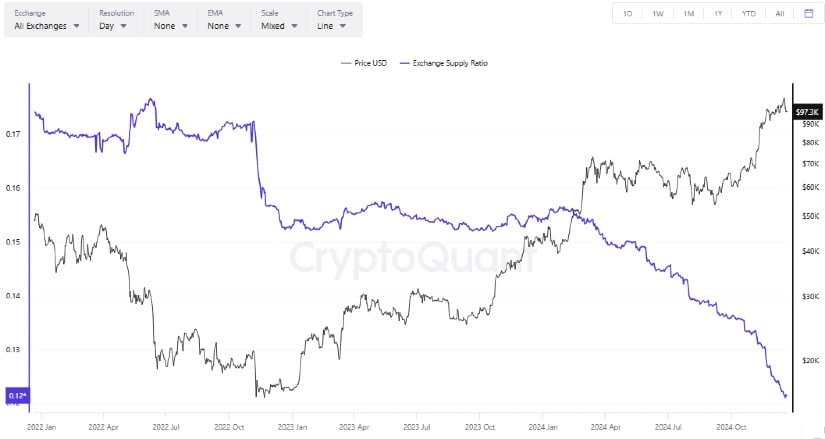

Bitcoin exchange supply ratio. Source: CryptoQuant

The tightening market dynamics have broader implications for both investors and the cryptocurrency industry. CryptoQuant researchers suggest that these shifts are partly driven by macroeconomic factors, including market anticipation of pro-cryptocurrency policies under the incoming U.S. administration. Discussions around a potential strategic Bitcoin reserve have further fueled optimism, adding to the bullish sentiment.

This evolving landscape underscores the importance of liquidity management and long-term investment strategies in the cryptocurrency market. As Bitcoin’s supply continues to shrink, the interplay between stablecoin growth, market demand, and regulatory developments will likely shape its future trajectory.

Brave New Coin – Read More