Bitcoin miners are poised to end the year on a high note as profitability trends extend into December, according to a recent analysis by investment bank Jefferies. November marked a robust month for miners, with a surge in Bitcoin prices significantly outpacing the rise in the network’s hashrate, a key indicator of mining competition.

Bitcoin’s rally in November drove its price up by 31%, while the network’s hashrate—a measure of the total computing power dedicated to mining—rose by just 4%. This favorable ratio between Bitcoin’s price and mining difficulty led to improved economics for the sector.

The hashrate serves as a proxy for industry competition and mining difficulty. When Bitcoin prices rise faster than the hashrate, miners typically enjoy higher margins. In November, U.S.-listed miners accounted for 24.7% of the total network, mining fewer bitcoins overall compared to October but securing a larger share of the network’s output. Improved operational uptime, attributed in part to cooler temperatures as winter set in, further boosted efficiency.

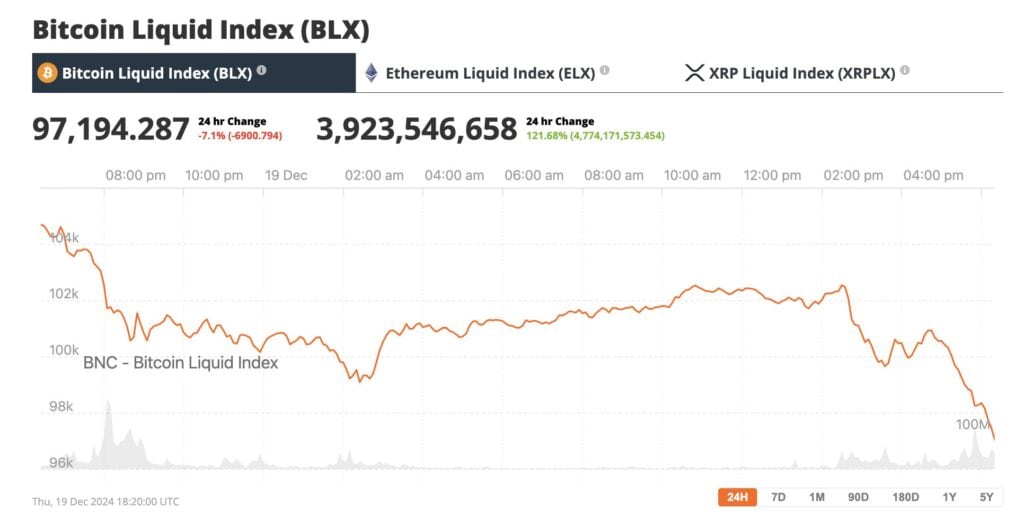

Source: Brave New Coin Bitcoin Liquid Index

MARA Holdings Leads the Pack

MARA Holdings (NASDAQ: MARA) emerged as the top-performing miner, producing 907 bitcoins in November, followed by CleanSpark (NASDAQ: CLSK) with 622 bitcoins. MARA maintained its position as the sector leader with an installed hashrate of 46.1 exahashes per second (EH/s), significantly ahead of CleanSpark’s 33.7 EH/s.

The report underscores MARA’s dominance in the sector, pointing to its expansive hashrate as a key advantage in capturing network rewards. CleanSpark’s continued growth also signals healthy competition among top-tier mining operations.

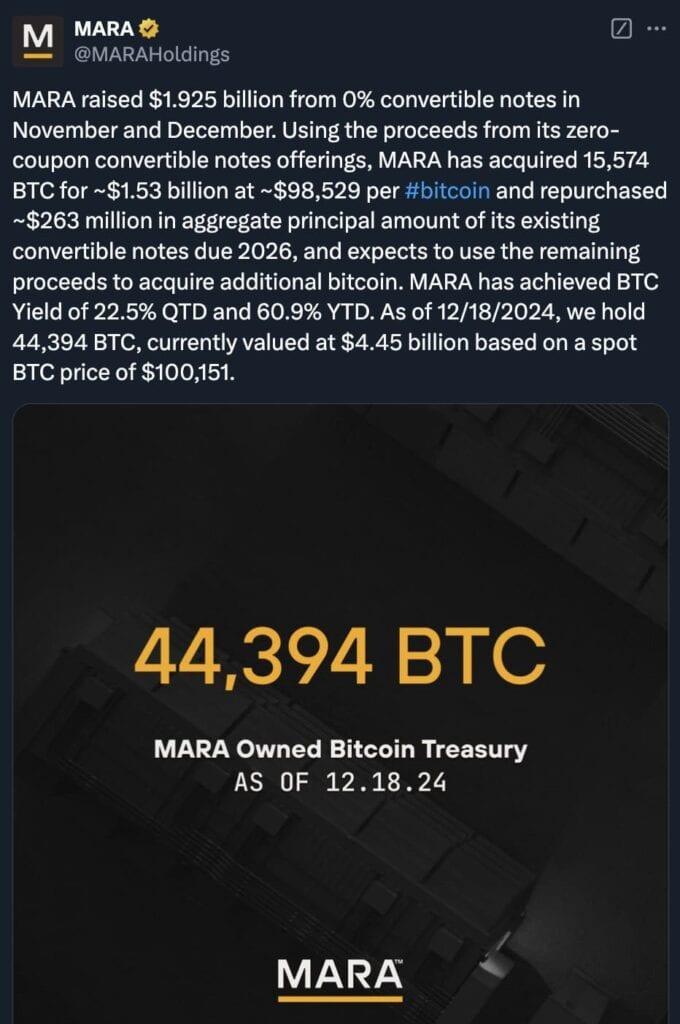

MARA also continued its strategy of following the MicroStrategy playbook. MARA raised $1.925 billion from 0% convertible notes in November and December. Using the proceeds from its zero-coupon convertible notes offerings, MARA purchased 15,574 BTC for ~$1.53 billion at ~$98,529 per BTC and repurchased ~$263 million in aggregate principal amount of its existing convertible notes due 2026, and expects to use the remaining proceeds to acquire additional bitcoin.

Source: X

December Outlook: Profitability to Persist

Bitcoin’s recent surge to new record highs is expected to sustain miners’ profitability into December. The combination of rising Bitcoin prices and manageable increases in mining difficulty paints a favorable picture for the industry as the year draws to a close.

Broader Implications for the Mining Sector

The profitability streak highlights the resilience and adaptability of the Bitcoin mining industry. With the halving event anticipated in 2024—an occurrence that will cut mining rewards in half—miners are likely to use this period of profitability to bolster their operations and prepare for potential challenges ahead.

For U.S.-based miners, who already represent nearly a quarter of the global network, this period of growth reinforces their critical role in Bitcoin’s decentralized ecosystem. The focus now shifts to operational efficiency, energy management, and scaling hashrates to maintain competitiveness in an evolving market.

As the year closes, miners’ performance in December will provide insights into how the sector is positioned for 2024, a year expected to bring both opportunities and heightened challenges with Bitcoin’s next halving cycle.

Brave New Coin – Read More