Bitcoin’s circulating supply this month surpassed 19.8 million coins, bringing the world’s largest cryptocurrency by market value within 1.2 million of its maximum limit of 21 million.

This milestone underscores one of Bitcoin’s most distinctive features: a hard-coded supply cap that contrasts starkly with the fiat money printing capabilities of central banks.

Over 94% of Bitcoin’s total supply has now been mined, according to data from timechainindex.com. Industry observers note that the cryptocurrency’s final issuance is expected to conclude around 2140, a date determined by its algorithmic “halving” schedule. These halvings take place roughly every four years and reduce the block reward by half each time. Following a halving in April 2024 that cut miners’ rewards to 3.125 BTC per block, the next one is set for 2028, when rewards will shrink further to 1.5625 BTC.

Gold Vs Bitcoin

The concept of scarcity has fueled comparisons between Bitcoin and gold. Proponents argue that limited supply endows Bitcoin with “digital gold” qualities, while opponents cite its volatility as a barrier to broader acceptance. Despite this ongoing debate, the cryptocurrency has posted remarkable gains this year, surging to above $108,00 at its peak and currently up over 110% in 2024. The rally comes amid growing institutional interest, including approvals for exchange-traded funds (ETFs) and high-profile acquisitions by companies such as MicroStrategy.

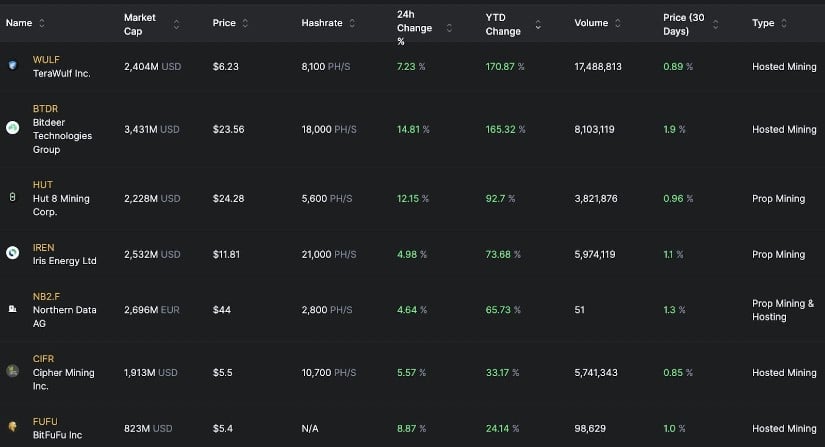

Yet the benefits of higher Bitcoin prices have not reached all corners of the industry. Publicly traded mining companies, which secure Bitcoin transactions and earn newly minted coins as a reward, have seen mixed results despite the cryptocurrency’s strong performance.

Data from the Hashrate Index shows that out of 25 listed miners, only seven have notched year-to-date gains. For example, Bitdeer (BTDR) has soared 166%, and TeraWulf (WULF) is up 170%. Meanwhile, some miners like Argo Blockchain (ARB) and Sphere 3D (ANY) suffered sharp drops, losing 84% and 69%, respectively.

Source: Hashrate Index

Rising Mining Difficulty

Analysts attribute these diverging fortunes to a combination of rising operational costs, higher mining difficulty, and the reduced block reward from Bitcoin’s most recent halving. The Bitcoin network’s mining difficulty has nearly doubled from a year ago, escalating the computational power required to successfully mine new coins. Electricity expenses and equipment upgrades have further strained profit margins for smaller or less efficient miners.

In an effort to reduce risks and diversify revenue streams, several mining firms have turned to strategies beyond Bitcoin extraction. Core Scientific, for instance, recently ventured into hosting services for artificial intelligence (AI) applications, a move the company projects could generate billions in additional revenue over the next decade.

Brave New Coin – Read More