Bitcoin (BTC) price fell to a low of $91,657 on February 3. Cryptocurrency price analysis brought by Coinidol.com.

BTC price long-term forecast: bearish

BTC price long-term forecast: bearish

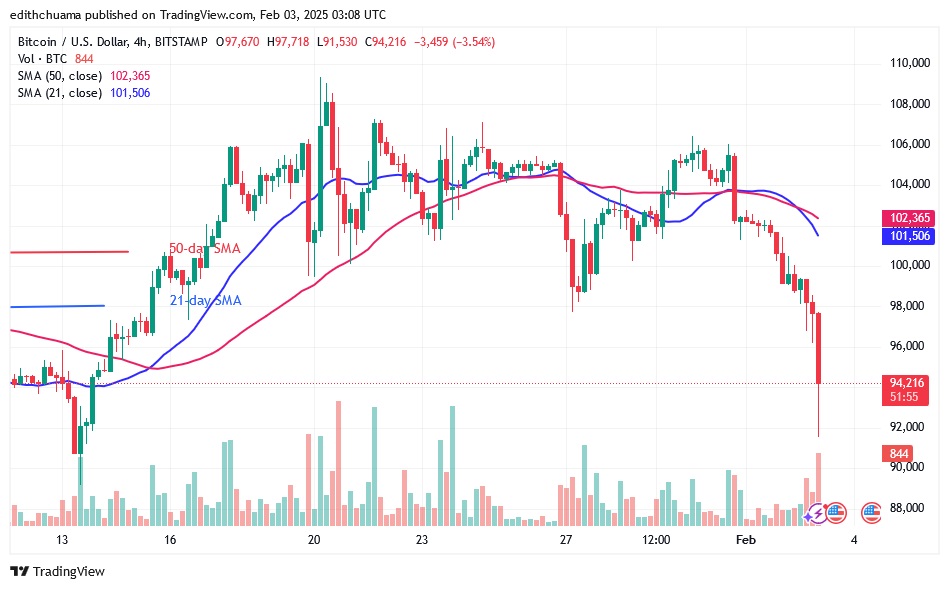

The bears managed to break below the 21-day SMA support or the low of $102,133. Selling pressure has eased above $92,000, while the Bitcoin price is correcting higher.

On the downside, bearish momentum will resume once the bears break the $92,000 support. This will force Bitcoin to fall to lows of $90,000 and $85,000.

However, it is predicted that the bulls will defend the areas where the price could fall. Bitcoin will rise if the price holds and stabilizes above the $92,000 support level. The largest cryptocurrency is trading above the $92,000 support level but below the moving average lines. Bitcoin is currently worth $100,275.

Analysis of the BTC price indicators

Analysis of the BTC price indicators

The BTC price has declined as the price bars have retraced below the moving average lines, although the selling pressure has stalled above the $92,000 support level. The moving average lines are horizontal and indicate that the Bitcoin price is moving in a range. Bitcoin has returned to a range of $90,000 to $107,500.

Today, a long candlestick tail indicates existing support. This means an excellent buying opportunity.

Technical indicators

Key supply zones: $108,000, $109,000, $110,000

Key demand zones: $90,000, $80,000, $70,000

What is the next move for Bitcoin?

What is the next move for Bitcoin?

The 4-hour chart shows that Bitcoin is trading above the $92,000 support but below the moving average lines. The cryptocurrency price will initiate a new trend once the current levels are broken. As traders prepare their next move, the cryptocurrency is trading above the $92,000 support.

Disclaimer. This analysis and forecast are the personal opinions of the author. They are not a recommendation to buy or sell cryptocurrency and should not be viewed as an endorsement by CoinIdol.com. Readers should do their research before investing in funds.

CoinIdol.com News – Read More