A high projection that’s turning heads across Wall Street, JPMorgan’s head of digital currency analysis, Nikolaos Panigirtzoglou, has boldly forecast that Bitcoin could rocket to $500,000 within the next seven years. This daring outlook is based on a confluence of developing trends, including growing acceptance among large institutional investors, diminishing price volatility in the crypto market, and potential changes in regulations under the Biden administration that could supercharge mainstream adoption.

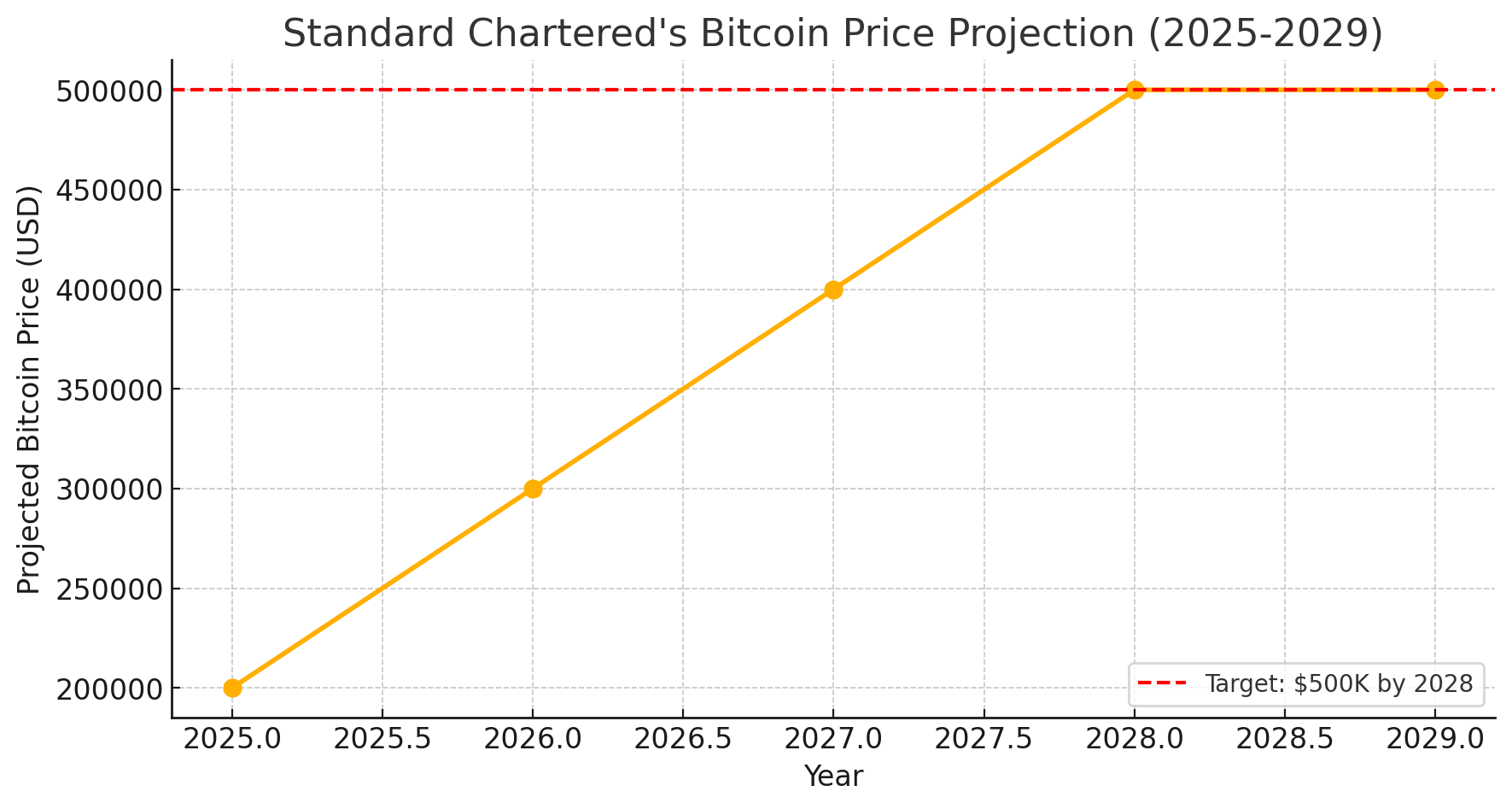

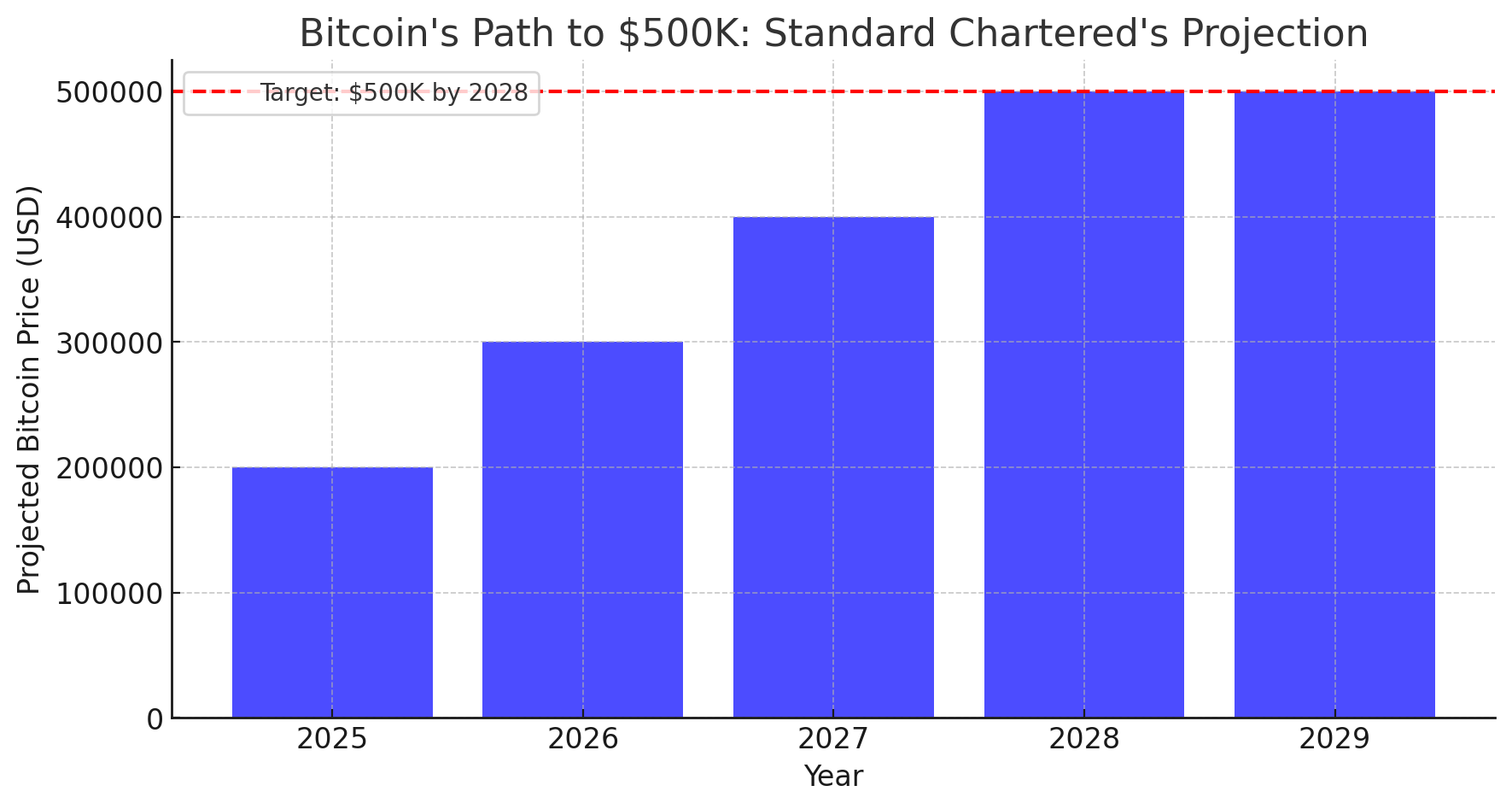

The Roadmap to Half a Million: Year-by-Year Projections

Panigirtzoglou’s projection isn’t merely an unfounded hypothesis; it’s a detailed multi-year model that charts Bitcoin’s potential trajectory. He anticipates Bitcoin reaching $200,000 by the close of 2025 as major investors gradually allocate more of their portfolios to the top cryptocurrency. Thereafter, the model predicts Bitcoin will climb to $300,000 in 2026 and $400,000 in 2027 as larger corporations enter the space.

Contingent on the ongoing development of digital currency infrastructure and stablecoin regulation, Panigirtzoglou’s model has Bitcoin achieving its long-held $500,000 price target by the end of 2028, where it could stabilize for several years.

“Our long-term BTC price target remains $500,000 by end-2028,” stated Panigirtzoglou, “though the pace of institutional adoption will be key to realizing that outlook.”

Institutional Inflows: The Driving Force Behind Bitcoin’s Surge

One of the main drivers of this forecast growth is the expected arrival of institutional investors. The U.S. spot Bitcoin ETF market, which launched in January 2024, has so far seen $39 billion in net inflows, indicating a strong demand from institutional players. Kendrick compares it with gold’s behavior after the ETP was launched in 2004, pointing out that gold gained 4.3-fold in the 7 years thereafter. He foresees a similar explosion for Bitcoin in a shorter period, he says,

“As volatility drops, the optimized two-asset portfolio with gold sees more and more share to Bitcoin.”

Regulatory Shifts Under the Trump Administration: A Potential Game Changer

The political landscape also figures prominently in Kendrick’s analysis. He points to potential regulatory changes under the Trump administration, including some that would further enhance Bitcoin’s attractiveness. One notable change is the repeal of SAB 121, which had placed accounting restrictions on companies holding digital assets.

Furthermore, Trump’s instructive to explore the technical practicality of creating a national digital asset reserve potentially approaches making Bitcoin a central bank investable asset. “Access is improving under Trump,” Kendrick said. Institutional inflows will continue to gather pace and volatility will gradually come lower as quality of flows improve and other infrastructure expands.

Declining Volatility: Paving the Way for Mainstream Adoption

Bitcoin has long been criticized for being notoriously volatile. Kendrick thinks this volatility will lighten as institutional participation grows and market infrastructure becomes more mature. He cites the evolving financial landscape, including options markets, as mechanisms to help support this stabilization.

“As volatility drops, the percentage of an optimal two-asset portfolio including Bitcoin and gold increases,”

he says, saying a calmer Bitcoin will become more and more appealing to a wider cross-section of investors.

A Word of Caution: Navigating the Unpredictable Waters of Cryptocurrency

Though Kendrick’s projections are rosy, they should be taken with a grain of salt. Cryptocurrency is volatile and moves of its own accord based on many factors, such as advances in technology, regulatory actions and macroeconomic trends. Investors need to do their due diligence and risk tolerance before robotics investing.

Conclusion: A Bold Vision for Bitcoin’s Future

To stretch it further, Geoffrey Kendrick believes that Bitcoin could reach $500,000 by 2028. Bolstered by growing institutional adoption, positive regulatory developments, and changing market infrastructure, this forecast highlights the unprecedented role that Bitcoin has the potential to play in reshaping the structure of the global financial system. Always remember, the future is uncertain but the continuously moving structure of the cryptographic scenario needs to be closely followed by the investors.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates. Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!

FAQs (Frequently Asked Questions)

1. Will Bitcoin really reach $500,000 by 2028?

Standard Chartered’s head of digital assets research, Geoffrey Kendrick, believes it’s possible based on rising institutional inflows, declining volatility, and regulatory changes under a potential Trump administration. However, cryptocurrency markets remain unpredictable, and external factors like global regulations and economic shifts could influence the price trajectory.

2. How will institutional investors drive Bitcoin’s price to $500K?

Institutional investors, such as hedge funds, pension funds, and corporations, are increasing their exposure to Bitcoin, particularly through spot ETFs. The more capital that flows into Bitcoin, the greater its price stability and upward trajectory, similar to what happened when gold ETFs were introduced in 2004.

3. What role does Trump’s potential presidency play in Bitcoin’s future?

If Trump returns to office, his administration may implement pro-crypto policies, such as repealing restrictive regulations like SAB 121, making it easier for banks and corporations to hold Bitcoin. This could accelerate adoption and drive prices higher.

4. Is Bitcoin’s volatility decreasing?

Yes, according to Standard Chartered, as institutional investors enter the market and ETFs provide a regulated investment vehicle, Bitcoin’s volatility is expected to decline. A more stable Bitcoin could attract even more investors, creating a positive feedback loop for long-term growth.

Glossary of Key Terms

Institutional Inflows – Large-scale investments from financial institutions, such as banks, hedge funds, and pension funds, which can significantly impact Bitcoin’s price and market stability.

Spot Bitcoin ETF – A financial product that allows investors to buy shares that directly track Bitcoin’s price without needing to hold the asset themselves. Launched in 2024, these ETFs have attracted billions in investments.

SAB 121 – A controversial U.S. Securities and Exchange Commission (SEC) regulation that imposed restrictive accounting rules on firms holding digital assets. Its repeal could encourage more corporate Bitcoin adoption.

Volatility – The rate at which the price of Bitcoin fluctuates. High volatility means large price swings, while declining volatility suggests a more stable and mature market.

Two-Asset Portfolio (Bitcoin & Gold) – A diversified investment strategy where investors hold both Bitcoin and gold to hedge against inflation and financial instability. As Bitcoin matures, its share in such portfolios is expected to increase.

Sources

The Bit Journal – Read More