Bitcoin’s price dipped to $85,000 even as BlackRock expanded its global Bitcoin footprint with the launch of its iShares Bitcoin ETP across Europe on March 25. Now trading on Xetra, Euronext Amsterdam, and Euronext Paris, the move reflects rising institutional interest beyond U.S. markets.

Although inflows are expected to trail U.S.-based ETFs, analysts say BlackRock’s $11.6 trillion asset footprint lends significant credibility to the European offering. Bitfinex analysts note that increasing regulatory clarity could unlock greater institutional allocation over time.

Key takeaways:

- BlackRock’s European Bitcoin ETP is now live on three major exchanges

- Analysts expect gradual adoption, citing regulatory uncertainty

- BlackRock’s global footprint could pave the way for broader ETF exposure

This launch reinforces Bitcoin’s long-term position as an institutional asset, even if short-term price impact remains muted.

GameStop’s Bitcoin Play Fuels Corporate Adoption Buzz

GameStop’s investment policy now permits Bitcoin holdings, and the firm is exploring a $1.3 billion convertible bond issuance—possibly to fund BTC purchases. MicroStrategy co-founder Michael Saylor stoked conversation by polling followers on how much BTC GameStop should acquire.

Of the 69,000 votes, 47% favored a $3 billion allocation.

Meanwhile, MicroStrategy continues adding to its holdings, acquiring 6,911 BTC on March 24 for $584 million, raising its total stash to 506,137 BTC.

- GameStop’s potential BTC buy adds to the institutional use case

- Saylor’s $3B suggestion received strong public support

- Bitcoin remains central to corporate treasury strategies

Despite GameStop shares dropping over 20% on the news, interest in BTC among corporates continues to expand.

Crypto.com Cleared as SEC Softens Industry Approac

In a notable shift, the U.S. Securities and Exchange Commission closed its investigation into Crypto.com without pursuing enforcement. CEO Kris Marszalek confirmed the case—originally flagged by a Wells notice in August 2023—had been dropped.

This follows similar moves regarding Coinbase, Uniswap, and Consensys. Under new leadership, the SEC appears to be recalibrating its crypto policy approach.

- Crypto.com clears SEC probe, joining other resolved cases

- SEC’s evolving stance may ease investor concerns

- Pro-crypto tone from regulators could bolster institutional flows

This regulatory thaw could prove pivotal for Bitcoin’s next growth cycle, as investors see reduced legal headwinds.

Bitcoin Price Outlook: Bearish Break Risks Deeper Losses

Technically, Bitcoin is trading at $85,040 after breaching key support at $86,500 and dipping below its 50-period EMA. The rejection of $88,800 as resistance confirms a shift in sentiment.

The RSI has fallen to 32, approaching oversold levels. However, without a strong reclaim of the $86,500 mark, downside targets at $84,800, $83,200, and $81,100 remain in play.

Short-term momentum favors sellers, but any macro catalyst—be it from the Fed, SEC, or institutional inflows—could flip the structure in bulls’ favor. For now, traders remain cautious.

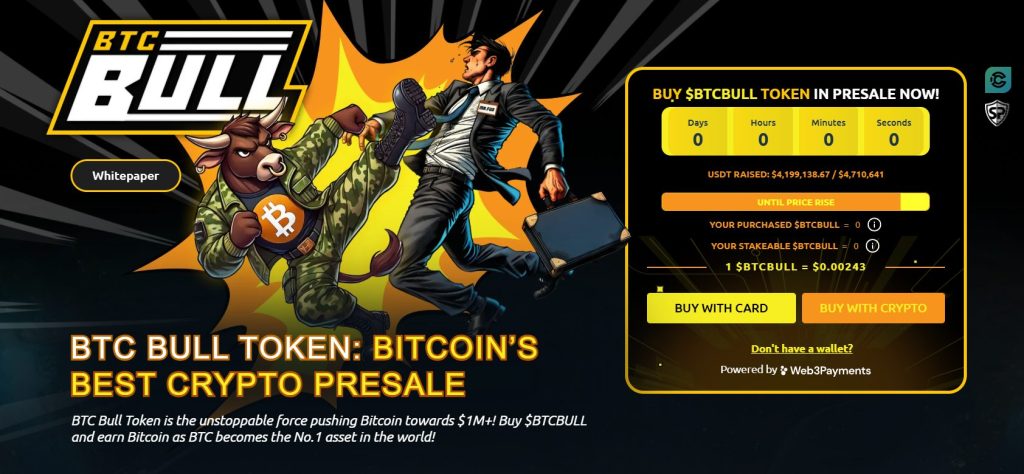

BTC Bull: Earn Bitcoin Rewards with the Hottest Crypto Presale

BTC Bull ($BTCBULL) is making waves as a community-driven token that automatically rewards holders with real Bitcoin when BTC hits key price milestones. Unlike traditional meme tokens, BTCBULL is built for long-term investors, offering real incentives through airdropped BTC rewards and staking opportunities.

Staking & Passive Income Opportunities

BTC Bull offers a high-yield staking program with an impressive 119% APY, allowing users to generate passive income. The staking pool has already attracted 882.5 million BTCBULL tokens, highlighting strong community participation.

Latest Presale Updates:

- Current Presale Price: $0.00243 per BTCBULL

- Total Raised: $4.1M/ $4.5M target

With demand surging, this presale provides an opportunity to acquire BTCBULL at early-stage pricing before the next price increase.

The post Bitcoin Slides to $85K Despite $3B GameStop Buzz & BlackRock’s ETF Launch appeared first on Cryptonews.

News – Read More

$11 TRILLION BlackRock’s Global Allocation Fund reports owning $47.4 million worth of

$11 TRILLION BlackRock’s Global Allocation Fund reports owning $47.4 million worth of

GameStop plans to raise $1.3 Billion to purchase Bitcoin!

GameStop plans to raise $1.3 Billion to purchase Bitcoin!

BREAKING: Crypto. com has announced that the SEC has agreed to close its investigation against the cryptocurrency exchange with no enforcement action taken.

BREAKING: Crypto. com has announced that the SEC has agreed to close its investigation against the cryptocurrency exchange with no enforcement action taken.  English

English Afrikaans

Afrikaans Albanian

Albanian Amharic

Amharic Arabic

Arabic Armenian

Armenian Azerbaijani

Azerbaijani Basque

Basque Belarusian

Belarusian Bengali

Bengali Bosnian

Bosnian Bulgarian

Bulgarian Catalan

Catalan Cebuano

Cebuano Chichewa

Chichewa Chinese (Simplified)

Chinese (Simplified) Chinese (Traditional)

Chinese (Traditional) Corsican

Corsican Croatian

Croatian Czech

Czech Danish

Danish Dutch

Dutch Esperanto

Esperanto Estonian

Estonian Filipino

Filipino Finnish

Finnish French

French Frisian

Frisian Galician

Galician Georgian

Georgian German

German Greek

Greek Gujarati

Gujarati Haitian Creole

Haitian Creole Hausa

Hausa Hawaiian

Hawaiian Hebrew

Hebrew Hindi

Hindi Hmong

Hmong Hungarian

Hungarian Icelandic

Icelandic Igbo

Igbo Indonesian

Indonesian Irish

Irish Italian

Italian Japanese

Japanese Javanese

Javanese Kannada

Kannada Kazakh

Kazakh Khmer

Khmer Korean

Korean Kurdish (Kurmanji)

Kurdish (Kurmanji) Kyrgyz

Kyrgyz Lao

Lao Latin

Latin Latvian

Latvian Lithuanian

Lithuanian Luxembourgish

Luxembourgish Macedonian

Macedonian Malagasy

Malagasy Malay

Malay Malayalam

Malayalam Maltese

Maltese Maori

Maori Marathi

Marathi Mongolian

Mongolian Myanmar (Burmese)

Myanmar (Burmese) Nepali

Nepali Norwegian

Norwegian Pashto

Pashto Persian

Persian Polish

Polish Portuguese

Portuguese Punjabi

Punjabi Romanian

Romanian Russian

Russian Samoan

Samoan Scottish Gaelic

Scottish Gaelic Serbian

Serbian Sesotho

Sesotho Shona

Shona Sindhi

Sindhi Sinhala

Sinhala Slovak

Slovak Slovenian

Slovenian Somali

Somali Spanish

Spanish Sundanese

Sundanese Swahili

Swahili Swedish

Swedish Tajik

Tajik Tamil

Tamil Telugu

Telugu Thai

Thai Turkish

Turkish Ukrainian

Ukrainian Urdu

Urdu Uzbek

Uzbek Vietnamese

Vietnamese Welsh

Welsh Xhosa

Xhosa Yiddish

Yiddish Yoruba

Yoruba Zulu

Zulu