Home » Markets » Bitcoin soars above $84,000 as US inflation cools in February

Fed Chair previously indicated that the central bank is unlikely to cut interest rates in the near term.

Photo: Adam Gray

Key Takeaways

- US inflation in February showed a decrease, with annual CPI dropping to 2.8% from the previous 3%.

- Economists warn that Trump’s tariffs could reverse the cooling inflation trend and lead to further price hikes.

Share this article

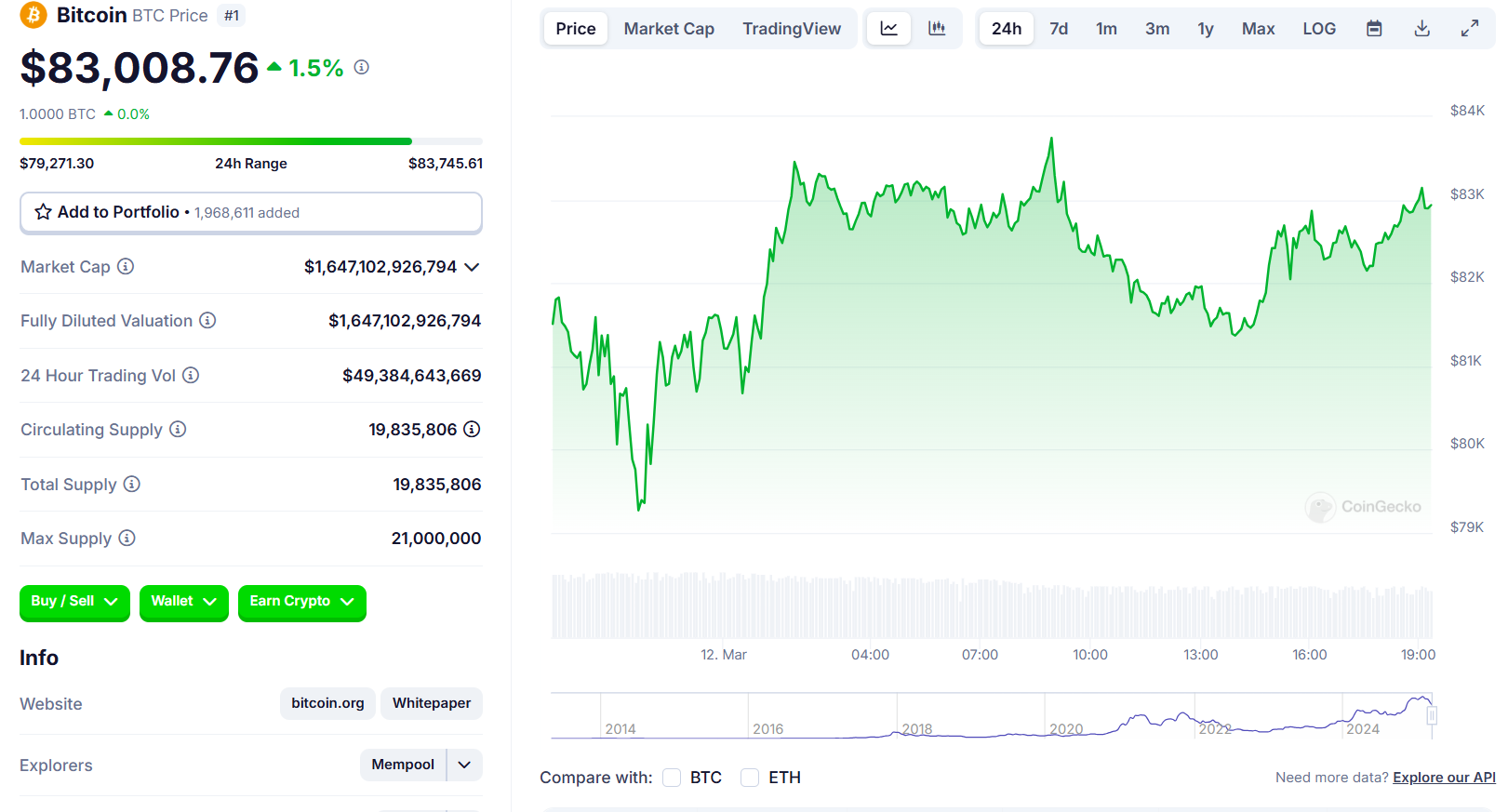

Consumer prices rose 0.2% in February from January, according to fresh CPI data released Wednesday, bringing annual inflation to 2.8%—a decline from 3% in the previous month. Bitcoin spiked above $84,000 in response to the lower-than-expected data.

Core CPI, which excludes volatile food and energy prices, increased 0.2% month-over-month, with the annual rate settling at 3.1%, below January’s 3.3%.

However, economists warn that President Trump’s tariff policies could keep prices elevated in the months ahead.

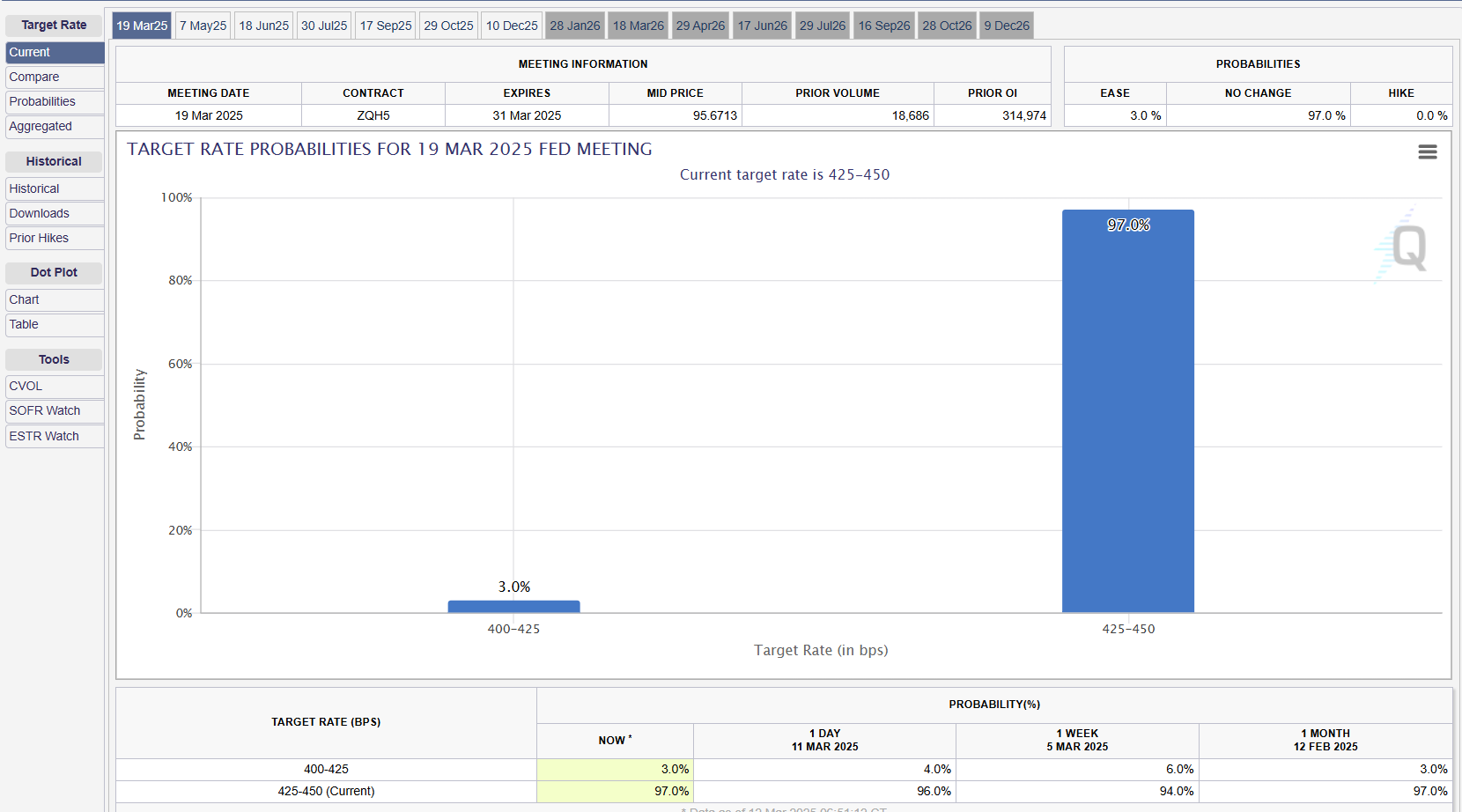

The inflation report comes as markets widely expect the Fed to hold rates steady in the near term. As of the latest data from CME Group’s FedWatch tool, traders were pricing in a low probability of a rate cut at the central bank’s meeting next week.

Fed Chair Jerome Powell warned last Friday that Trump’s enacted and proposed tariffs could lead to a series of price increases, potentially causing consumers to anticipate higher inflation.

The inflation rate appears to have stalled after previous declines, remaining stubbornly above the Fed’s target. While long-term inflation expectations have stayed relatively stable, short-term expectations have increased, partly due to tariff concerns, according to Powell.

The Fed, which had been implementing rate cuts, has paused its monetary policy adjustments, keeping the federal funds rate steady at 4.25%-4.5%.

Unless inflation clearly aligns with the Fed’s target, the Fed will maintain a tight monetary policy. This could keep Bitcoin prices volatile as investors weigh the potential for future rate cuts against ongoing economic uncertainty.

Bitcoin’s observed resilience to short-term macroeconomic shifts indicates that its price may not be heavily influenced solely by inflation data. Yet, general economic conditions and investor sentiment can still impact its value.

Bitcoin traded above $83,000 ahead of the inflation data release, recovering from a recent dip below $80,000. The crypto asset has gained 1.5% in the last 24 hours, per CoinGecko data.

Share this article

Crypto Briefing – Read More