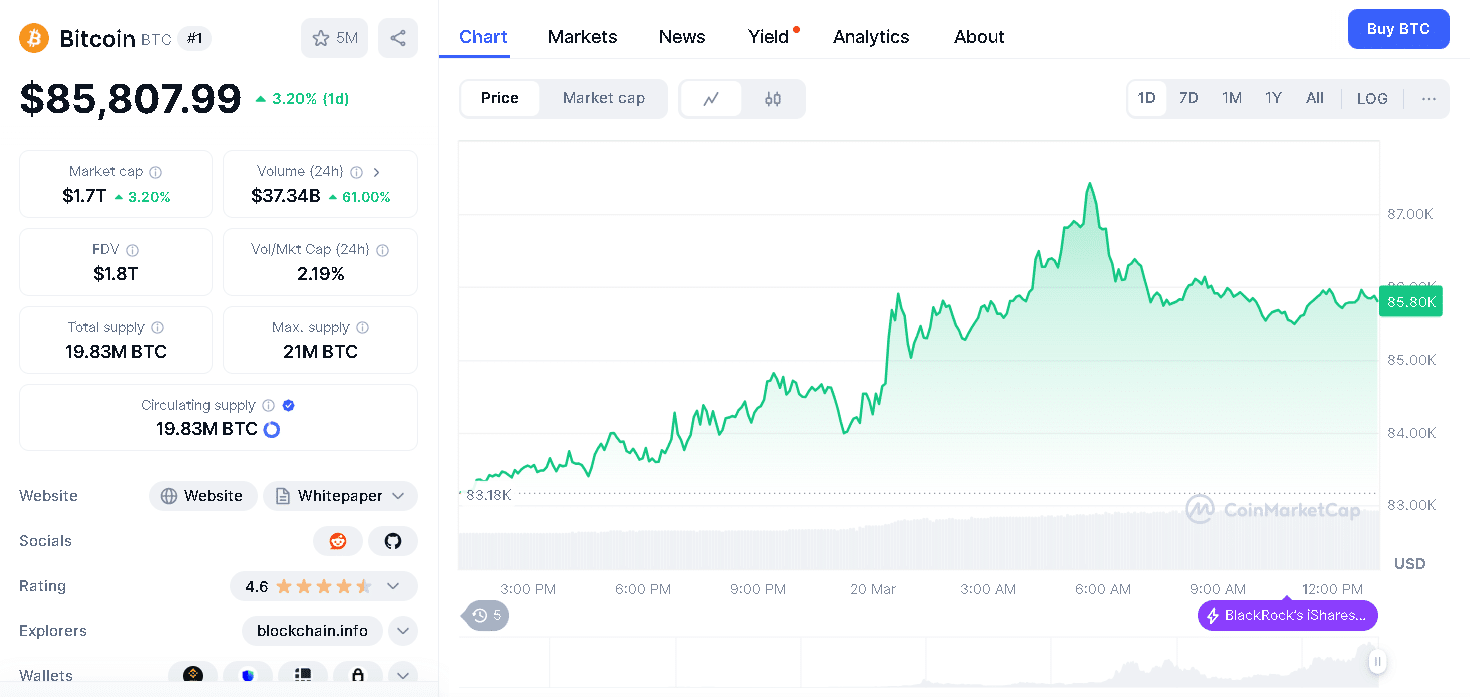

According to recent reports from CoinDesk, in the past 24 hours, the value of Bitcoin has increased by 4.5%. BTC on March 20 reached to value of $85,500. This is the highest value for the coin seen 10 days after March 9. As per the current market analysis, the price of Bitcoin has risen just after the Fed’s recent decision.

Federal Reserve, the central bank in US announced that it would now maintain the base interest rates between 4.25% to 4.50%. The crypto markets reacted positively to this decision. However, many market analysts suggest being careful about the Fed’s view on inflation and economic growth.

Fed’s Decision and Market Response

The Federal Open Market Committee (FOMC) has kept the interest at a stable rate between 4.25% to 4.50%. This decision to maintain a stable interest rate is positively accepted by the overall crypto market. The big stock market indices like the Nasdaq, S&P 500, and Dow Jones have also seen a rise in their values by 1%.

Moreover, before the Fed’s decision, on March 19, Bitcoin was seen trading at a price of $81,600. While on the day of the FOMC decision, the value of Bitcoin rose to $85,500. These growing price stats show the overall cryptocurrency focuses on a positive trend and supports the Fed’s decision.

Moreover, other top Cryptocurrencies like Ether and Solana also saw a rise in price. Both the cryptocurrencies witnessed growth by 7%. Ripple’s XRP token increased by 10% which came after the news of SEC dropping its lawsuit against the company.

Crypto Mining Stocks Rise with Bitcoin

The increased price in crypto has also helped other stocks, along with Bitcoin mining companies Bitdeer (BTDR) and Core Scientific (CORZ) rise by the rate of 10% and 8%.

Bitdeer benefited from its improved technology and news that Tether has increased its stake in the company to 21%. Core Scientific Core Scientific benefitted from its partner CoreWeave, who filed an IPO this month. However, both companies are still down this year.

Analysts Remain Cautious Despite Positive Moves

Though the market showed a positive response, some analysts advise remaining cautious. According to Economist Mohamed A. El-Erian, Feds Outlook on “transitory” tariff-related inflation might be too early. He tweets,” It’s simply too early to say with any confidence that the inflationary effects will be transitory.”

Besides, market strategist Callie Cox pointed out concern that future rate cuts by the Federal can cause harm to the stability of the stock market.

Gold Continues to Set Records

At the same time, Gold reached a new high and is currently priced at $3,050 per ounce. This growth shows the increasing concern of investors towards inflation and market instability. Due to the growing geopolitical tension investors are shifting their approach and turning toward gold as a safe asset during economic uncertainty.

On the other side, Bitcoin termed as a digital gold is not gaining the price momentum of gold. Hence last month the price of BTC didn’t see much growth graphs. But due to Federal Reserves decision, the BTC again saw a hype in its price leading to the positive market trend.

Conclusion

US central bank, Federal Reserve released its decision on March 19. It decided to maintain the stable interest rate. This announcement took a global attention and impacted the values of cryptocurrencies. Many cryptocurrencies including BTC have seen growth in their price. Few analyst says that investors must remain careful towards the rising value of BTC to $85,500 because of the economic uncertainty . The Federal Reserve’s policies will continue to change the market trends, but investors should remain cautious.

Stay tuned for more Bitcoin related updates on The Bit Journal

FAQ

1. How did Bitcoin Price rise to $85,500?

It saw price rise with the Fed’s decision to keep interest rates stable.

2. When did the Fed announce its decision?

The Fed announced its decision on March 19, 2025

3. What interest rate did the Fed maintain?

Fed kept the rates between 4.25% to 4.50%.

4. How stock market Indices found Fed’s decision?

Indices mainly Nasdaq, S&P 500, and Dow Jones saw growth by 1%.

5. Why is gold at a new high than digital gold?

Global investors are seeing gold as a safe asset during uncertainty.

Glossary

Federal Reserve (Fed) – The central bank of the United States

FOMC- A group in the U.S. that decides interest rates.

Nasdaq, S&P 500, Dow Jones – Indices in the U.S.

Digital Gold – A term used for Bitcoin

Mining Stocks – Shares of companies that mine cryptocurrencies.

Sources

Read More: Bitcoin Surges 4.5% As Market Reacts to Fed’s Decision“>Bitcoin Surges 4.5% As Market Reacts to Fed’s Decision

The Bit Journal – Read More