The recent Bitcoin rally has sparked anticipation for new peak values, driving investors toward secure storage options. The growing institutional involvement and mainstream adoption are increasing demand for reliable crypto wallets.

Non-custodial solutions, like Best Wallet, are becoming preferred due to their user-controlled, verification-free model. With Bitcoin’s bullish trajectory, the importance of safe and convenient storage is paramount.

Bitcoin’s Latest Price Movement: A Step Toward Six Figures?

Bitcoin has captured the spotlight once again, surging past $87,000 before a slight pullback. The rally comes amid increasing institutional interest, renewed state-level adoption discussions, and growing speculation about the four-year Bitcoin cycle.

Source – 99Bitcoins YouTube Channel

Analysts are divided—some see Bitcoin in an accumulation phase, while others predict an extended bull run. With liquidity challenges persisting and major players like MicroStrategy and BlackRock making strategic moves, the market stands at a crucial turning point.

Bitcoin’s jump to $87,000 before correcting to $84,000 has reignited enthusiasm in the crypto space. While the daily gain may seem modest, Bitcoin has remained relatively flat over the past week, contrasting with the broader bullish sentiment.

However, a 13% monthly decline highlights the market’s ongoing volatility. Altcoins have followed Bitcoin’s price movement, with Ethereum briefly reclaiming $2,000 before settling at $1,987.

XRP led the gains with a 7% increase, reaching $2.56 before pulling back to $2.40. While the price action signals renewed investor confidence, concerns about market liquidity and macroeconomic pressures persist.

Institutional Players Fueling Bitcoin’s Ascent

The surge in Bitcoin’s price coincides with major developments from institutional investors. BlackRock’s iShares Bitcoin Trust has witnessed substantial inflows, signaling heightened demand for Bitcoin ETFs.

At the same time, MicroStrategy, led by Michael Saylor, announced plans to acquire an additional $500 million worth of Bitcoin. These moves demonstrate growing institutional conviction in Bitcoin’s long-term potential.

However, despite the increasing involvement of large-scale investors, Bitcoin’s liquidity remains a challenge. The market is experiencing reduced investor participation and leverage trading, compounded by institutional outflows and geopolitical uncertainties.

These factors bring into question the strength of Bitcoin’s current rally and the potential for further gains.

U.S. States Exploring Bitcoin as a Strategic Asset

Several U.S. states are making significant moves toward Bitcoin adoption. North Carolina is considering allocating 10% of its general fund to Bitcoin as a strategic reserve, reflecting a growing trend among states evaluating cryptocurrency as an investment asset.

Minnesota has proposed integrating Bitcoin into its investment, tax, and retirement frameworks, joining states like Texas in exploring the use of crypto assets for financial planning.

Such developments indicate a broader institutional and governmental shift toward Bitcoin, reinforcing the narrative that digital assets are increasingly being viewed as viable financial instruments rather than speculative assets.

Is the Crypto Market Experiencing a Bull Run or Just an Extended Uptrend?

Market sentiment remains divided on whether Bitcoin has officially entered a bull market. Some analysts argue that the 2023-2024 uptrend resembles past cycles, while others believe the traditional four-year cycle may be breaking down.

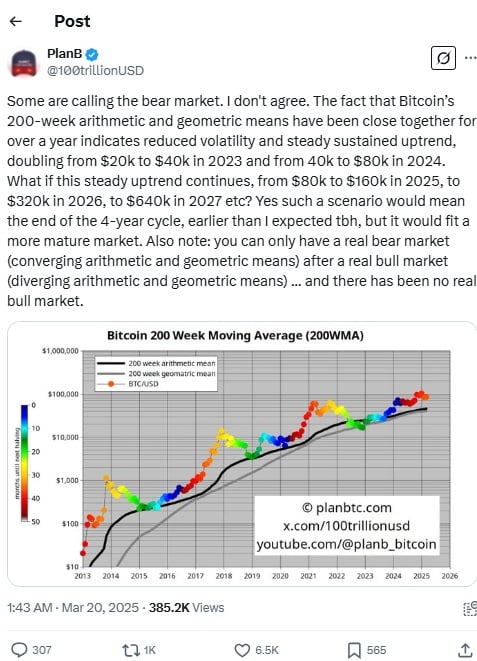

A well-known crypto analyst on X, PlanB, suggests that Bitcoin’s 200-week arithmetic and geometric means staying close for over a year signal lower volatility and a steady uptrend.

His model predicts a potential doubling in Bitcoin’s price each year, suggesting a trajectory from $80,000 in 2024 to $160,000 in 2025 and possibly reaching $640,000 by 2027. If this trend holds, it could mark a fundamental shift in how Bitcoin’s price cycles evolve.

However, he also notes that a true bear market can only occur after a real bull market, and by his metrics, Bitcoin has yet to experience a full-scale bull rally.

The coming months will be crucial in determining whether Bitcoin is in the early stages of a prolonged bull market or if it is merely experiencing another cyclical uptrend.

Best Wallet: The Ultimate Non-KYC Crypto Trading Solution

As Bitcoin continues to dominate headlines, retail investors are looking for secure and convenient ways to trade and store their assets.

Best Wallet has emerged as one of the fastest-growing crypto wallets, offering a seamless, secure, and user-friendly experience without requiring KYC verification.

Source – Best Wallet Twitter

Best Wallet supports over 60 blockchains, enabling users to buy, sell, stake, and swap cryptocurrencies with ease.

Whether an investor is looking to store Bitcoin, Ethereum, or other altcoins, Best Wallet provides a secure environment without the hassle of identity verification. This makes it an attractive option for those who prioritize privacy and efficiency.

Conclusion

Excitement is building in the crypto market as Bitcoin’s price action gains momentum, fueled by growing institutional support and state-level interest.

While some question whether the four-year cycle still holds, there’s no doubt that Bitcoin remains a major force in global finance.

With regulatory shifts and liquidity concerns in play, more investors are turning to secure options like Best Wallet to manage their assets. Whether Bitcoin climbs to new highs or experiences a pullback, the right tools and knowledge remain essential for navigating the market.

The Cryptonomist – Read More