- A $332M Bitcoin short at 40x leverage risks liquidation at $85,290, with BTC hovering near $83,245 amid unrealized losses of $1.3M.

- Breaking $85K-$86K could trigger a short squeeze, but 699,200 BTC held at $86,391 may flood markets if holders sell to realize gains.

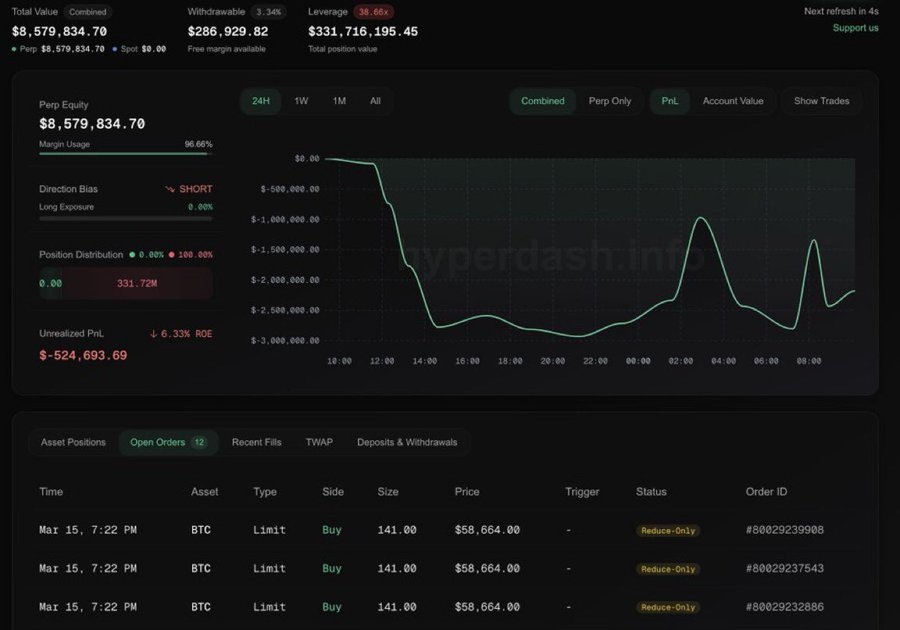

Bitcoin faces a test as a trader’s leveraged short position looms over market stability. A single trader opened a $332 million short position at 40x leverage, risking $8.3 million of their account balance.

The position’s liquidation price stands at $85,290, with Bitcoin currently trading near $83,245. The short holds an unrealized loss of $1.3 million, balancing on shifting price.

While you are enjoying your weekend, this guy shorted Bitcoin on 40x leverage

$8.3 million account created a $332 million short sale

$8.3 million account created a $332 million short sale

Currently w/ $1.3 million unrealized loss (on $8.3m at risk)

Currently w/ $1.3 million unrealized loss (on $8.3m at risk)

Liquidation price: $85,290

Liquidation price: $85,290

Let’s see how this plays out

Never short… pic.twitter.com/rJ2SwuEXpZ

— HODL15Capital  (@HODL15Capital) March 15, 2025

(@HODL15Capital) March 15, 2025

Price action near $85,000-$86,000 could trigger critical market reactions. If Bitcoin climbs above $85,290, the short’s forced closure might spark a short squeeze, pushing prices higher. Conversely, bearish resistance could pull prices lower.

Breaking current ranges would spotlight 699,200 BTC acquired at $86,391, as holders may sell to realize gains. Bulls would need buying pressure to absorb this supply, but historical data shows inconsistencies: a $78,000 dip saw 46,000 BTC outflow, signaling demand, while $84,000 lacked similar inflows.

The Short-Term Holder Net Unrealized Profit/Loss (STH-NUPL) remains in a capitulation zone, indicating many recent buyers hold losses. If prices near $85,000-$86,000, holders might sell to break even rather than hold, amplifying sell pressure and risking a long squeeze.

Derivatives markets reflect heightened volatility. Open Interest (OI) surged $2 billion in two days, yet the Taker Buy/Sell Ratio remains below 1, signaling persistent sell-side dominance in perpetual contracts. This suggests traders anticipate profit-taking, with liquidations likely if momentum weakens.

For a short squeeze to materialize, sustained buying must overwhelm the $332 million position and resistance levels. However, current conditions favor bears. If Bitcoin fails to breach $85,290, a retreat to $80,000-$81,000 becomes probable. Market direction hinges on whether buyers can sustain momentum or sellers dominate near key thresholds.

Prices linger at a volatile crossroads, with trader decisions and liquidity flows dictating the next move.

The post BTC 40x Short Nightmare: Bulls vs. Bears at $85K Resistance appeared first on ETHNews.

ETHNews – Read More