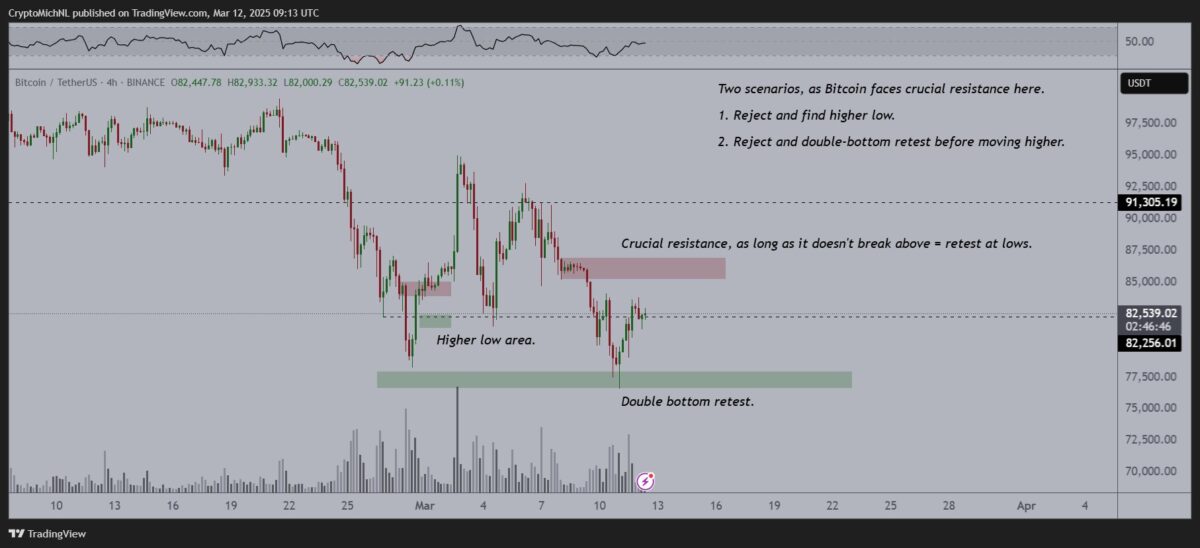

- Analysts remain cautiously optimistic, with Michael van de Poppe pointing to a potential trend reversal if Bitcoin tests $84K again and sets a new high.

- Justin Bennett highlighted Bitcoin’s recovery above $81,500, driven by lower-than-expected inflation data, suggesting it could target $88K or even $92K.

The much-awaited US Consumer Price Index (CPI) report for the month of February is finally out, hinting at cooling US inflation with the CPI numbers dropping to 2.8% from 3% earlier. In response to this, the Bitcoin price gave a quick move past $84,000.

Will US CPI Drop Force Fed Rate Cuts Ahead?

During the last month of February, the core CPI, which excludes the impact of food and energy prices, surged by 0.2% month-over-month, thereby bringing the annual inflation rate down to 3.1% from January’s 3.3%. Despite this decline, economists caution that President Trump’s tariff policies could exert upward pressure on prices in the coming months.

The US inflation number drop comes at a time when the markets have been largely anticipating that the Federal Reserve will maintain its current interest rate levels. As per the FedWatch tool by CME Group, traders see a low probability of a rate cut during the Fed’s upcoming meeting next week.

Fed Chair Jerome Powell, speaking last Friday, warned that the tariffs already enacted, along with those under consideration, could spur a wave of price hikes. This could, in turn, lead to higher inflation expectations among consumers.

After a series of rate cuts, the Federal Reserve has paused further adjustments, keeping the federal funds rate steady within the range of 4.25% % % -4.50 %.

Will Bitcoin (BTC) Resume an Upward Trajectory Soon?

Crypto analyst Michael van de Poppe has shared an optimistic outlook on Bitcoin’s price action. In a recent analysis, van de Poppe highlighted that Bitcoin’s chart remains strong despite current market conditions. “To be honest, the chart isn’t bad on Bitcoin,” he noted. “Test $84K again, make a new high, and we might be reversing the trend.”

However, the Bitcoin price has once again faced a rejection at $84,000. As of press time, TC is trading at $82,503.16 with a market cap of $1.63 billion. Also, the daily trading volume has dropped by 25% to $45.64 billion, showing low investors’ interest in this pump.

Crypto analyst Justin Bennett highlighted Bitcoin’s recent recovery, noting its successful reclaim and retest of the $81,500 level. Bennett attributed the positive market sentiment to the latest US Consumer Price Index (CPI) report, which came in lower than forecast, offering relief to risk assets after January’s higher-than-expected figures.

“I can see $88K and possibly a $92K sweep,” Bennett stated, suggesting potential upside for Bitcoin in the near term, as highlighted in our earlier news article. It will be interesting to see whether the broader crypto market also catches up to the Bitcoin gains moving ahead.

Crypto News Flash – Read More