Bitcoin’s recent slide below $100,000 has sparked a significant uptick in online discussions about “buying the dip,” reflecting heightened interest from investors eyeing potential opportunities in the current market downturn.

Data from blockchain analysis firm Santiment reveals that mentions of “buying the dip” across social media platforms reached an eight-month high on December 19, underscoring a renewed wave of investor optimism amid bearish conditions.

Social Dominance Hits New Heights

Santiment’s social dominance score, which tracks mentions of specific terms like “buying the dip,” climbed to 0.061 on December 19. This marks the highest level since April, when Bitcoin tumbled from $70,000 to $63,000. Analysts interpret this metric as a barometer of sentiment, indicating that many investors view the current price correction as a strategic entry point.

Chart showing the frequency of “buying the dip” mentions across social media platforms. Source: Santiment via X

Bitcoin, which has hovered around the psychological $100,000 threshold, briefly dropped to $95,500 on December 19 before recovering slightly. As of now, it trades at approximately $97,700, representing a 3.6% dip in 24 hours. Despite the downturn, Bitcoin remains up 128% year-to-date.

Broader Market Impact and Altcoin Carnage

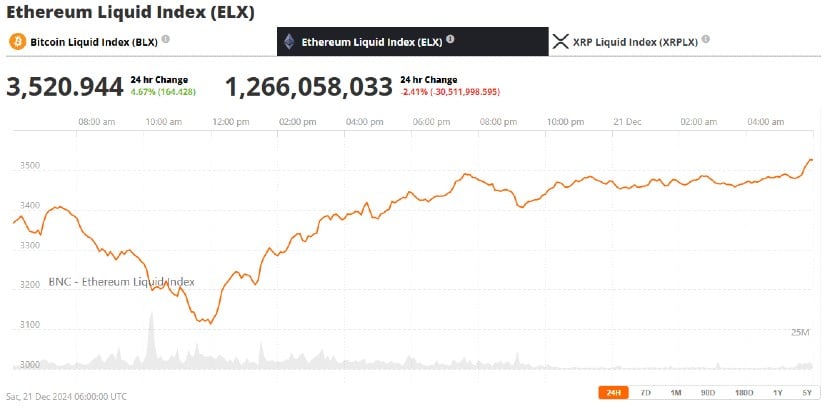

The broader cryptocurrency market hasn’t fared much better. The total crypto market capitalization has plummeted from $3.8 trillion to below $3.6 trillion, with altcoins bearing the brunt of the losses. Major tokens like Dogecoin (DOGE), Solana (SOL), and Ripple (XRP) posted double-digit declines in a single day, with Ethereum (ETH) falling nearly 8% to $3,400.

Ethereum (ETH) price chart. Source: Ethereum Liquid Index (ELX) via Brave New Coin

Santiment highlighted several altcoins, including AVAX, LINK, and LTC, as potential rebound candidates if the recent crash proves to be an overreaction. “If this was indeed an overreaction, there is a reasonable chance that projects with the biggest drops will present the most attractive dip-buying opportunities,” the firm noted in an X post.

The Federal Reserve’s Role in Market Turbulence

The recent turbulence got worse after the Federal Reserve announced its monetary policy update last December 18 with a widely expected 0.25% rate cut, but comments from Fed Chairman Jerome Powell that rate cuts would be slower in 2025 than initially forecast sent markets tumbling. Powell underscored how committed the central bank was to lowering inflation to its 2% target, underlining caution on monetary easing amidst persistent inflationary pressures.

The Fed’s stance, coupled with continued uncertainty regarding economic policy in the U.S. under the administration of President-elect Donald Trump, conspired in a wave of risk-off sentiment. The effect eventually shook traditional markets, as the S&P 500 and the Nasdaq Composite both faced significant declines—and over a $1 trillion loss of value in the global stock market.

Investors Brace for Volatility

Amid the uncertainty, analysts caution that volatility may persist. Capriole Fund founder Charles Edwards said this bear market could be “a recipe for a short squeeze,” where prices rapidly increase and catch short sellers off guard. He warns of potential swings in either direction, advising investors to stay alert.

Interest in searches for phrases like “crypto” and “buy the dip” is still high despite the difficulties. Global searches for “buy the dip” have surged to their highest levels since August, according to Google Trends, indicating ongoing interest from both institutional and individual investors.

Outlook: Risks and Opportunities

After Bitcoin’s decline, the market trajectory remains in doubt with persistent inflation, a hawkish Federal Reserve, and geopolitical uncertainties looming large over the crypto landscape. For long-term investors, however, the current correction may turn out to be a tempting chance to get in at lower prices.

As the market continues through this tumultuous period, one thing is for sure: investor sentiment remains a strong driving force that shapes both the short-term price action and long-term trends in this forever-changing cryptocurrency ecosystem.

Brave New Coin – Read More