After experiencing a 40% decline from its yearly high, LINK is currently trading around $19.50. Despite this recent downturn, technical and fundamental indicators suggest that the LINK asset could be on the verge of a major price surge.

Analysts are closely watching key developments, including institutional adoption, whale activity, and market trends, to determine the next move for Chainlink.

Fundamental Indicators Point to Strong Upside

Chainlink has gained significant attention due to its integration into major financial and blockchain ecosystems. One of the biggest recent developments is its inclusion in former U.S. President Donald Trump’s World Liberty Financial portfolio, with the fund holding over $730,000 worth of LINK tokens. This association has fueled speculation about increased adoption and long-term growth potential.

Adding to the bullish sentiment, industry analysts anticipate the approval of a spot Chainlink exchange-traded fund (ETF) by the Securities and Exchange Commission (SEC). Such an approval would likely attract institutional investors, driving significant capital inflows. Meanwhile, the number of LINK tokens available on exchanges continues to decline, signaling growing investor confidence and reduced selling pressure.

Chainlink’s Cross-Chain Interoperability Protocol (CCIP) is also positioning it as a crucial player in real-world asset (RWA) tokenization, a sector projected to be worth trillions in the coming years. With major financial institutions like BlackRock, Franklin Templeton, and Apollo embracing blockchain-based tokenization, Chainlink’s role in providing decentralized oracles is becoming increasingly valuable. Additionally, its proof-of-reserve solutions are gaining traction in the stablecoin market, further cementing its dominance in the blockchain data space.

Technical Indicators Suggest a Potential Breakout

From a technical perspective, Chainlink has exhibited several patterns that indicate a potential upward move. The weekly chart highlights a cup-and-handle formation that began in 2022 and recently completed in late 2024, a bullish pattern that often precedes strong price breakouts. Additionally, LINK has formed a falling wedge, a pattern characterized by two converging trend lines that historically lead to bullish breakouts once resistance is surpassed.

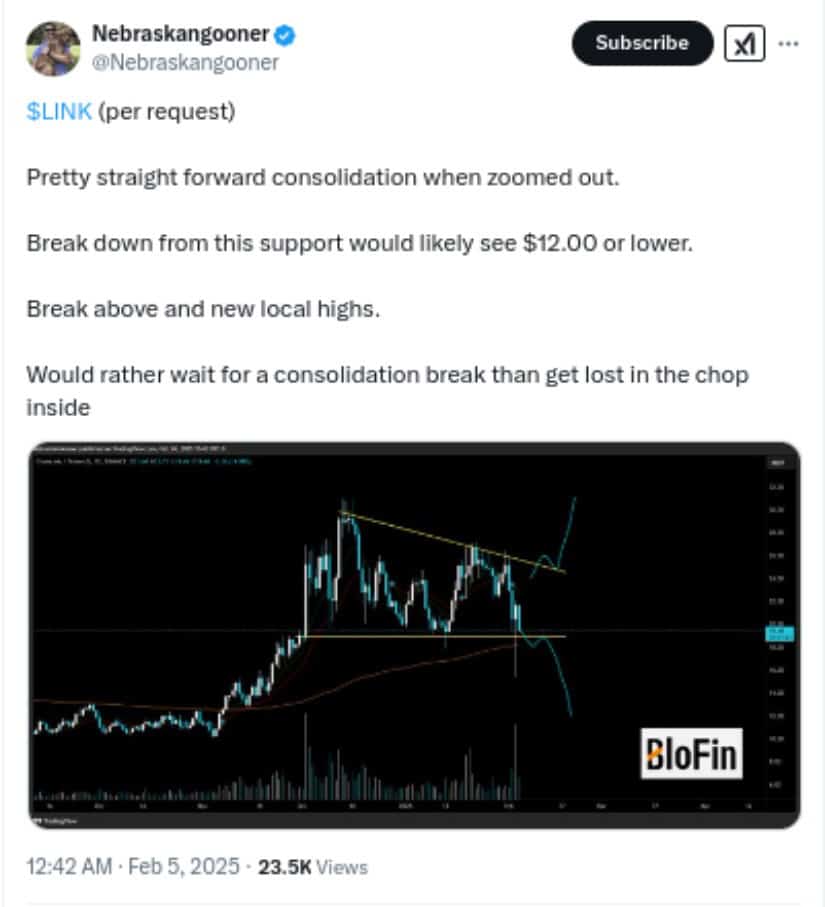

On social media, prominent analysts have echoed these optimistic projections. Crypto trader @Nebraskangooner pointed out that LINK is consolidating within a key range, predicting a potential move to $12 if support fails but an upside breakout if resistance holds.

Chart predicting a breakdown of support could see LINK drop to $12. Source X post analysis

Similarly, @TheFomoLabs reiterated the validity of the cup-and-handle formation, setting a target of $75 should support remain intact.

The Fomo Labs Price analysis showing a cup and Handle. Source: The Fomo Labs on X

Meanwhile, @cryptclay emphasized the opportunity presented by the market correction, noting that the recent dip allows traders to accumulate LINK at lower levels before a possible rally.

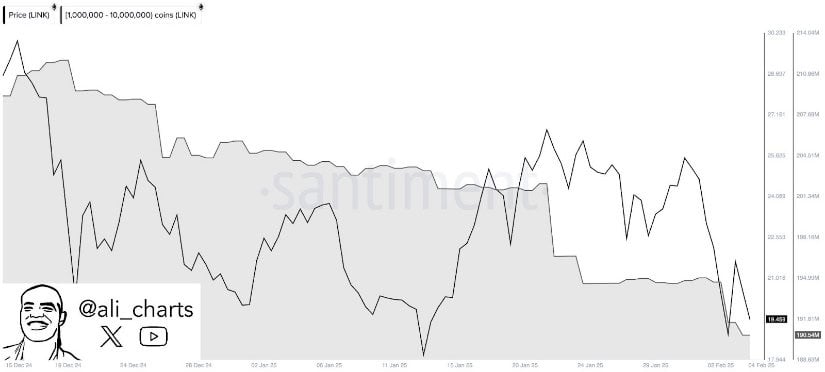

Despite these bullish indicators, recent whale activity has raised concerns. On-chain data from analyst Ali Martinez revealed that large holders offloaded over 4.13 million LINK tokens within 48 hours, contributing to the recent decline.

Santiment Data showing Whales offloading 4.13 Chainlink. Source: Ali on X

Historically, such sell-offs have preceded short-term price drops, but some investors view them as opportunities to accumulate before a rebound.

While Chainlink remains in a period of price consolidation, the combination of strong fundamentals, institutional interest, and bullish technical patterns suggests a potential for a significant LINK price surge if Chainlink news turns positive. Investors will be watching closely for a decisive breakout above resistance levels, which could propel LINK toward new highs.

Brave New Coin – Read More