Crypto trading is rapidly outpacing traditional finance, with Coinbase leading the charge thanks to the improved market sentiment sparked by Donald Trump’s election victory.

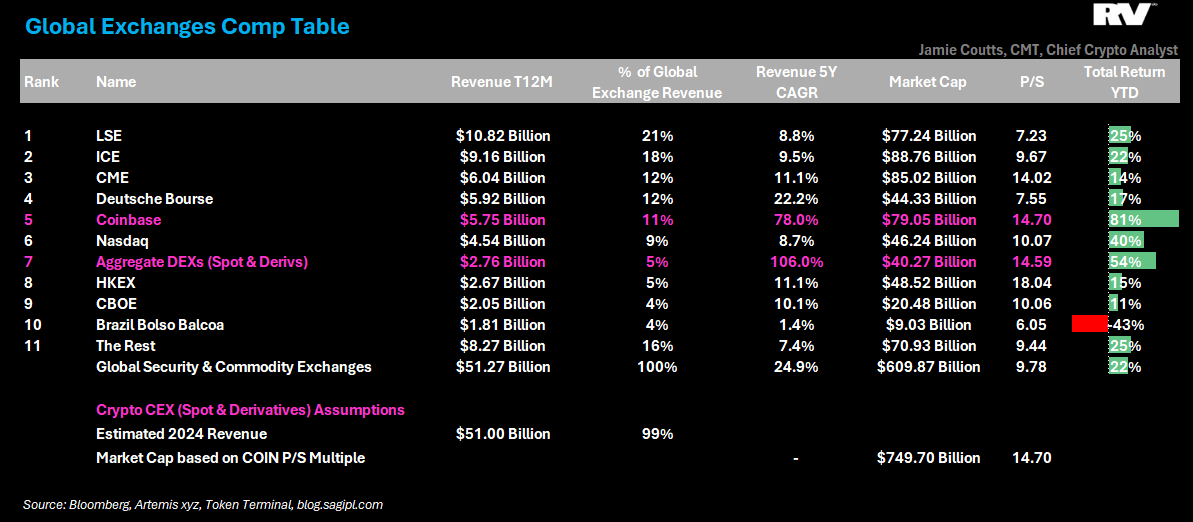

Jamie Coutts, the chief crypto analyst at Real Vision, shared data showing that Coinbase currently ranks fifth globally for exchange revenue, generating $5.75 billion over the past year. This figure outshines the figures from traditional stock market exchanges like Nasdaq and CBOE.

Moreover, Coinbase alone accounts for 11% of the global exchange revenue, more than double that of the decentralized exchange (DEX) sector. Coinbase is the largest crypto trading platform in the US.

However, DEXs are growing quickly and now hold a 5% share, surpassing platforms like HKEX and CBOE. According to Coutts, centralized exchanges (CEXs) and DEXs are expanding 2.5 to 4 times faster than traditional finance.

Meanwhile, if valued using Coinbase’s price-to-sales multiple, the combined CEX market cap could reach $749 billion, compared to TradFi’s $610 billion.

Coutts expects the competition to intensify in 2025 as traditional finance pushes back by integrating crypto-related activities. He also noted that DeFi protocols could potentially outperform top cryptocurrencies like Bitcoin and Ethereum by offering attractive returns.

CryptoSlate – Read More