The LTC price continues its ETF tailwinds backed by $1.5 billion of volume, pushing the asset up 12% and solidifying itself as a front-running altcoin this February.

With a 25.62% gain over the past week, Litecoin stands out as the biggest beneficiary among the top 100 cryptocurrencies.

These moves are largely bolstered by recent Bloomberg reports citing Litecoin as the most likely altcoin to receive a U.S. Exchange Traded Fund (ETF) approval this year.

The altcoin has been assigned 90% odds, the highest of any other ETFs in consideration.

LTC Price Analysis: How Much Further Could the Rally Go?

This week’s growth affirms the breakout potential of a massive symmetrical triangle pattern that’s been forming since early 2022.

After a breakout in late November, Litecoin has suffered notable volatility amidst wider market fluctuations.

While much of the post-breakout momentum has materialized, the pattern still sets a $180 target, signaling a potential 40% advance from current prices.

However, technical indicators reveal mixed signals.

The MACD line narrowly avoided a death cross, maintaining its position above the signal line— a sign that the bulls remain firmly in control.

Meanwhile, the Relative Strength Index (RSI) sits at 62, edging closer to the oversold threshold at 75.

At this pace, a minor correction is required to prevent buyer exhaustion and keep selling pressure in check, potentially to the next significant support at $121.80.

Without confirming a stable uptrend, the next few days will be crucial in determining if Litecoin can sustain its rally toward the $180 mark.

However, with the introduction of a potential Litecoin ETF this ceiling could be raised much higher, with some forecasts targeting $250.

Litecoin Might Not See the Best of this Bull Cycle

While the LTC price stands to see further tailwinds in 2025, 2024 proved meme coins as the foremost sector driving gains this cycle.

Post-inauguration “meme coin mania” has solidified this trend and made the Solana network a goldmine for 10-100x meme coin opportunities, but the trading volume it brings has taken a toll.

As any user would know, failed transactions are the platform’s biggest gripe.

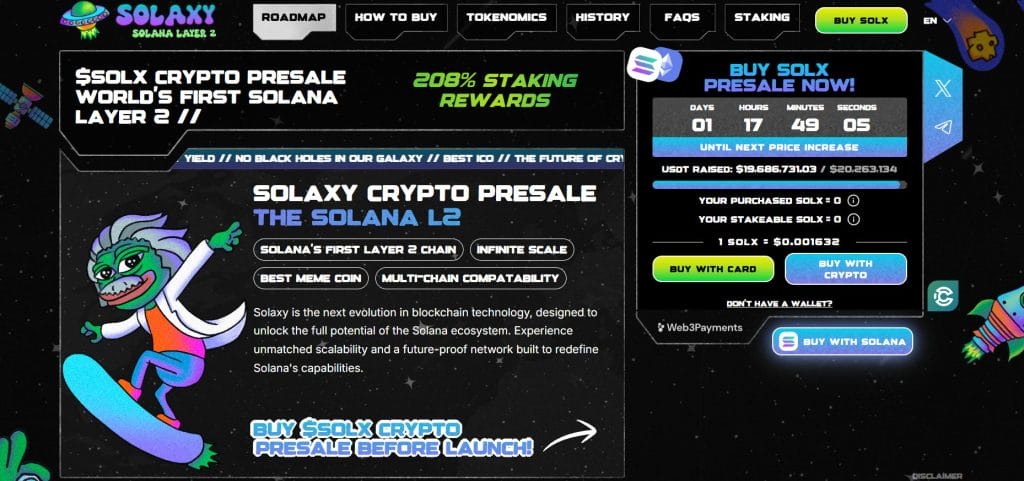

Well, Solaxy ($SOLX), the first-ever Layer-2 solution built on Solana, heeds the answer to this call—all the while riding its tailwinds.

Unlike Ethereum, which boasts several Layer-2 options, Solana has long lacked this capability—until now.

And Investors are flocking, with almost $20 million raised in its presale already.

By processing transactions off-chain and finalizing them on Solana, Solaxy significantly reduces congestion and lowers transaction costs, while offering seamless interoperability across both blockchains.

To reward early adopters, Solaxy currently offers staking yields of 224%, though these rates will decrease as more users stake $SOLX.

For the latest updates on the project, connect with the Solaxy community on X and Telegram.

The post Could Litecoin Be the Next Big Runner? $1.5 Billion Volume Pushes LTC Up 12% appeared first on Cryptonews.

News – Read More