Both digital assets have attracted significant institutional interest, and recent regulatory developments suggest that ETF approval for either could be on the horizon. However, their paths to approval remain distinct, with legal and market factors shaping the race.

Regulatory Landscape and Market Sentiment

XRP and Solana have each taken significant steps toward ETF approval. On February 6, the SEC officially acknowledged Grayscale’s proposal to convert its Solana Trust into an ETF and opened the doors to an October decision. On the same day, four fund managers filed applications to introduce an XRP ETF amid emerging interest in regulation-friendly investment products related to the assets.

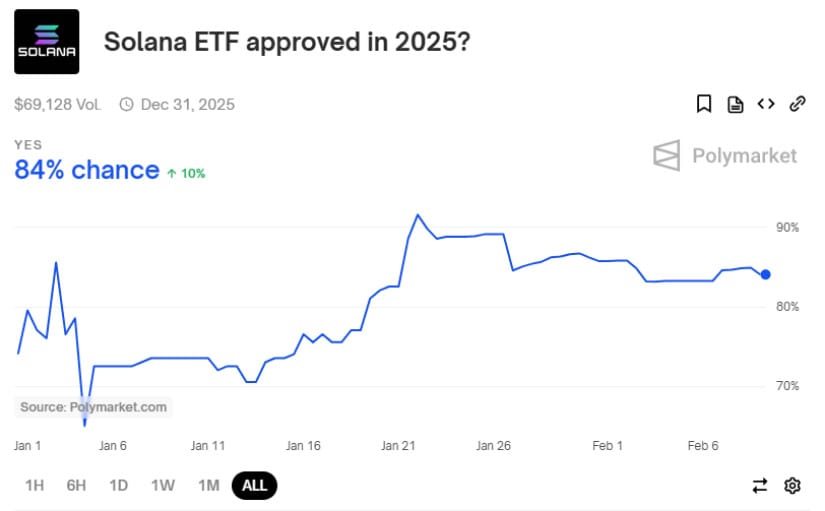

Polymarket bettors giving Solana an 85% chance of ETF approval in 2025. Source: Polymarket

Market sentiment leans slightly in favor of Solana, with Polymarket bettors assigning it an 85% chance of ETF approval in 2025, compared to XRP’s 80%. However, shorter-term expectations tell a different story.

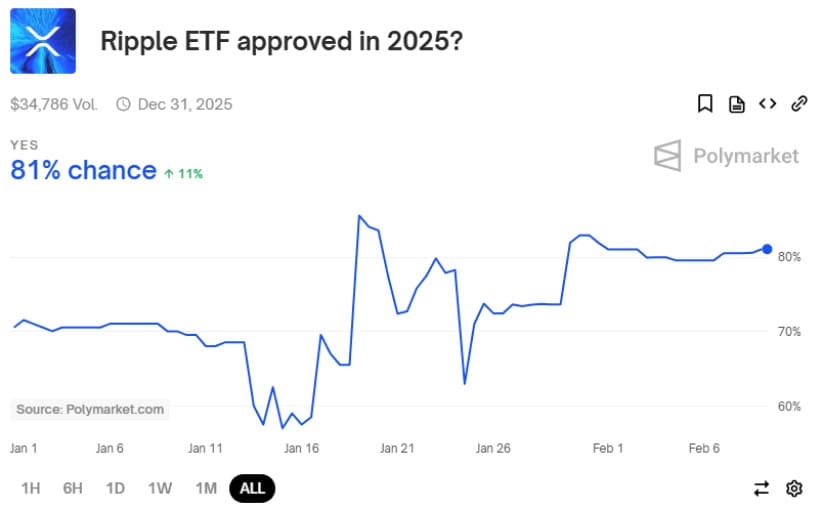

Polymarket indicates an 81% likelihood of Ripple securing ETF approval in 2025. Source: Polymarket

For ETF approvals by July 31, traders have given XRP a 40% probability versus Solana’s 36%. These fluctuating expectations highlight the uncertainty surrounding the SEC’s stance on both assets.

Solana’s Strengths and Challenges

Solana has become one of the most active blockchain networks, especially in DeFi and the meme coin ecosystem. Its network has held strong over the last year, avoiding any major outages while processing billions in trading volume. These elements help make its case for an ETF, underlining real-world applications and institutional-grade stability.

BlackRock Chairman and CEO Larry Fink expects a Solana ETF approval in February. Source: MartyParty via X

Despite its network strengths, Solana has one important regulatory hurdle—the classification of the SEC that keeps SOL as a security. This designation complicates the approval process, as the agency has ongoing lawsuits against major exchanges that list Solana. Bloomberg analyst James Seyffart has suggested that these legal challenges may delay a Solana ETF until at least 2026, as regulatory clarity remains elusive.

XRP’s Legal Advantage and Institutional Interest

XRP’s biggest advantage in the ETF race is its legal standing. In July 2023, U.S. District Judge Analisa Torres ruled that XRP itself is not inherently a security, marking a partial legal victory for Ripple. This ruling gives XRP a regulatory edge over Solana, as there is no equivalent legal clarity for SOL.

Ripple CEO Brad Garlinghouse has been appointed as an advisor to the White House Crypto Council. Source: Kenny Nguyen via X

Institutional interest in XRP-based investment products has surged following this ruling. On February 6, the Chicago Board Options Exchange (Cboe) filed a request with the SEC to approve spot XRP ETFs from major asset managers. However, regulatory concerns remain, as the SEC has previously argued that Ripple’s influence over XRP raises centralization issues. These concerns could slow the approval process despite the legal clarity surrounding the asset.

Which ETF Will Win Approval First?

With both XRP and Solana vying for approval, the decision will likely hinge on regulatory interpretations and market readiness. Solana boasts a robust ecosystem but faces security classification challenges, while XRP has legal clarity but must navigate concerns about centralization.

One final factor in XRP’s favor is Ripple CEO Brad Garlinghouse’s growing White House connections. Garlinghouse is tipped to be on the White House Crypto Advisory panel which would be hugely bullish news for XRP.

Regardless of which asset secures approval first, the growing momentum behind crypto ETFs marks a significant step toward mainstream adoption. Investors will be closely watching the SEC’s next moves, as the outcome could set a precedent for future altcoin ETFs.

Brave New Coin – Read More