Financial markets are experiencing an increasing number of unexplained “flash crashes,” with both traditional equities and crypto showing sudden, dramatic price drops without clear catalysts.

In a recent example highlighted by The Kobeissi Letter, S&P 500 futures erased approximately $600 billion in market capitalization between 4:40 AM and 6:20 AM ET without any major headlines driving the move.

This phenomenon isn’t isolated to traditional markets. Crypto markets have faced similar issues, including a $300 billion wipeout over 24 hours on February 25th that occurred without any major bearish news.

Sentiment and Emotion Driving Market Volatility

According to data from the American Association of Individual Investors (AAII) highlighted by The Kobeissi Letter, bearish sentiment has reached 58.1%.

This marks four consecutive weeks where bearish readings exceeded 55%. This is a stark contrast to late 2024, when bearish sentiment consistently registered below 30%.

This level of pessimism is nearly double the historical average of approximately 31%, despite the S&P 500 being down just 7% from its all-time high.

“Sentiment is as if we are in a major bear market,” The Kobeissi Letter noted.

The drop in investor confidence aligns with broader economic concerns. Consumer confidence has dropped in recent months, while recession fears have intensified.

This anxiety appears to be spilling over into investment decisions, with market participants increasingly reluctant to take on risk despite relatively modest declines in major indices.

The emotional component of these market moves creates what The Kobeissi Letter describes as “air pockets” in pricing.

These are zones where normal liquidity and price discovery break down. When sentiment shifts suddenly, these air pockets can lead to quick price movements that appear disconnected from fundamental developments.

The Swiss National Bank’s recent interest rate cut provides the right example. While the central bank reduced rates to their lowest level since September 2022, this move was widely anticipated by market participants.

Institutional vs. Retail Positioning Creates Market Imbalances

According to The Kobeissi Letter, hedge funds have been selling technology stocks at their fastest pace since January 2021 over the past four weeks.

This is a complete reversal from their previous positioning, as these same institutions were buying tech stocks at the fastest rate since the 2022 bear market just weeks earlier.

Meanwhile, retail investors are taking the opposite approach. The Kobeissi Letter reports that retail net inflows into Nasdaq 100 stocks as a percentage of market capitalization reached 0.1%, a one-year high.

JPMorgan’s retail investor sentiment score hit a record 4 points, approximately one point higher than during the peak of meme stock trading in 2021.

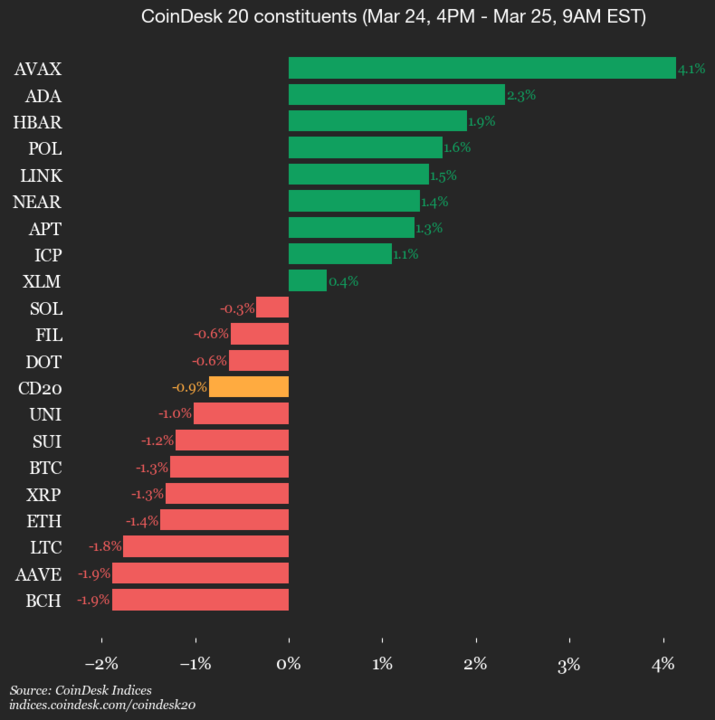

This same pattern appears in cryptocurrency markets, where institutional short positioning in Ethereum has surged 40% since early February and 500% since November 2024.

The Kobeissi Letter states this is an unprecedented level of institutional bearish positioning.

Liquidity Concerns Amplify Crypto Market Disruptions

The structural composition of today’s markets appears increasingly vulnerable to liquidity constraints that can make minor selling pressures into substantial price declines.

When market participants attempt to execute large trades during periods of thin liquidity, the impact on price can be disproportionate to the size of the transaction relative to the overall market.

This liquidity issue has been particularly visible in cryptocurrency markets. The February 25th event erased $300 billion in crypto market value within 24 hours.

This occurred despite no major negative news, suggesting that relatively modest selling pressure encountered insufficient buy-side liquidity, leading to price declines.

Similarly, Ethereum’s 37% drop over 60 hours beginning February 2nd coincided with trade war headlines.

The Kobeissi Letter attributes this partly to liquidity being “drained from Ethereum at a historic pace” during this period.

The Kobeissi Letter points to some potential improvement on the horizon, noting that “after a complete collapse since January 1st, CTAs are beginning to increase liquidity again.”

The post Crypto’s Growing Flash Crash Problem: Report appeared first on The Coin Republic.

The Coin Republic – Read More