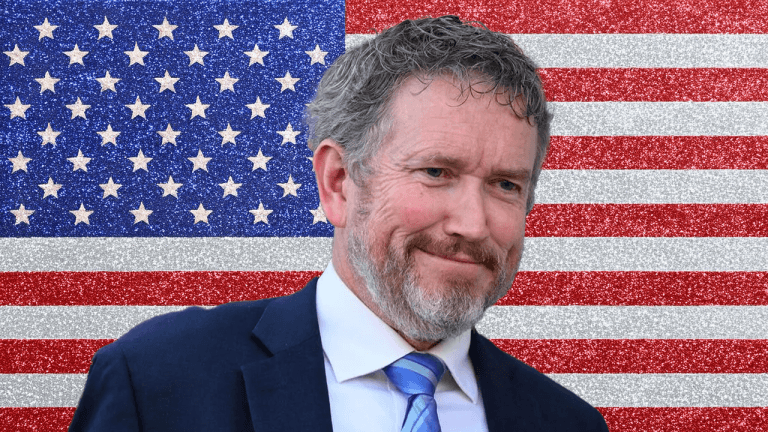

David Sacks sold over $200 million in crypto investments before stepping into his role as the Trump administration’s AI and crypto czar, according to a March 5 White House memo.

The document revealed that $85 million of those assets were personally owned by David, while the rest were liquidated through his firm, Craft Ventures. Despite the sell-off, Craft still holds stakes in funds with crypto exposure.

This disclosure is 11 pages long, making it far more detailed than the two-page filing from Robert F. Kennedy Jr., the new Health and Human Services Secretary. The report stands out in an administration where conflicts of interest have been largely ignored—especially considering Donald Trump, Elon Musk, and other officials continue to hold massive stakes in crypto and related businesses.

Trump and Musk control major crypto assets

While David was dumping his crypto, others in Trump’s inner circle were doing the exact opposite. Trump maintains a major stake in Trump Media & Technology Group, which owns Truth Social. But that’s not all. Three days before taking office, he launched a meme token called $TRUMP through CIC Digital LLC, which controls 80% of the supply. His family also receives 75% of all profits from World Liberty Financial, a crypto bank launched last year.

Then there’s Musk, who now runs the Department of Government Efficiency (DOGE). His companies—including Tesla, SpaceX, X, and xAI—are directly affected by federal policies. SpaceX alone has a $1.8 billion contract with the National Reconnaissance Office for a spy satellite project.

Other Trump cabinet members have deep crypto ties. Howard Lutnick, the Commerce Secretary, made hundreds of millions from Tether (USDT) investments during his time at Cantor Fitzgerald. The level of crypto exposure in the administration raises serious concerns about conflicts of interest and policy influence.

David says he sold to avoid “even the appearance” of a conflict

As criticism poured in, David went on his All-In Podcast to address accusations that he used his position to manipulate the market. “I sold $200 million in crypto because I didn’t want to even have the appearance of a conflict,” he said.

That didn’t stop Senator Elizabeth Warren from going after him. She sent David a letter before the White House Crypto Summit, demanding that he fully disclose his holdings in Bitcoin, Ether, Solana, and other altcoins linked to Trump’s Strategic Bitcoin Reserve proposal.

The day after the summit, Trump signed an executive order establishing the Strategic Bitcoin Reserve—but limited it to Bitcoin only. David confirmed that the reserve would be funded entirely by seized crypto from criminal and civil forfeiture cases. He also confirmed that a separate U.S. Digital Asset Stockpile, managed by the Treasury Department, would hold other confiscated cryptocurrencies.

His ethics disclosure detailed that he and Craft Ventures liquidated all liquid crypto holdings, including Bitcoin, Ether, Solana, and shares in Coinbase and Robinhood. He also pulled out of crypto investment funds, selling his positions in Multicoin Capital, Blockchain Capital, and other private digital asset firms.

Despite this, David still has a few remaining crypto investments. The filing describes these holdings as less than 0.1% of his total portfolio and states that they will be sold soon.

David denies using his office for personal gain

On his podcast, David pushed back hard against allegations that he profited off his government role. “People think that already successful people join the government just to be even more successful. It’s a lazy and stupid narrative,” he said.

He claimed that as soon as he joined Trump’s administration, accusations started flying that he pumped his own crypto holdings or created exit liquidity for himself. Some critics even suggested that he and Trump had been funneling billions into their own pockets, calling their policies a high-level heist.

David dismissed these claims outright. “These aren’t just insults—they’re accusations of actual crimes,” he said. He insisted that he fully divested before taking office to avoid conspiracy theories about his profits. “I could have waited, but I didn’t want the narrative that I was sitting on gains.”

His actions were backed up by Kyle Samani, the co-founder of Multicoin Capital. “David understands the role he’s in. His team reached out to us a few months ago and found a buyer for Craft’s remaining Multicoin-related assets,” Samani said. “David is above board as you can be.”

Still, some—like Senator Warren—aren’t convinced. She has accused him of influencing Trump’s selection of crypto assets for the Digital Asset Stockpile in a way that benefits him financially. David denied this, stating that Trump chose XRP, SOL, and ADA because they have high market caps.

Bitcoin rebounds after weeks of market chaos

While David was busy defending himself, Bitcoin made a comeback from its four-month low. The price surged 6.2% to $85,301 on Friday, following weeks of heavy selling. Smaller cryptos pumped even harder—Solana shot up 9%, Chainlink gained 13%, and XRP climbed 8%.

This rally comes after Bitcoin hit $77,000 on Tuesday, its lowest price since Trump’s election in November. That marked a 30% drop from its all-time high of $109,000 in January, right after Trump’s inauguration. The decline triggered record outflows from Bitcoin exchange-traded funds (ETFs) and forced liquidations of long positions in crypto derivatives markets.

Traders scrambled to hedge against further losses, with Bitcoin options showing increased bets on a drop to $70,000 by late February. But Friday’s bounce suggests that some investors see new opportunities—even as regulatory uncertainty lingers.

Cryptopolitan Academy: Tired of market swings? Learn how DeFi can help you build steady passive income. Register Now

News – Cryptopolitan – Read More