As Donald Trump prepares to take office in 2025, the Digital Chamber, a leading blockchain advocacy group, is calling for significant changes in the U.S. Securities and Exchange Commission’s (SEC) approach to cryptocurrency regulation.

The organization highlights the need for a reset in the historically strained relationship between the SEC and the digital asset industry, citing opportunities for reform under Trump’s administration.

Calls for Transparency and Collaboration

In a recent statement, the Digital Chamber emphasized the importance of fostering a culture of mutual trust. “The digital asset industry needs confidence in the SEC’s intentions, and the SEC must recognize that most participants are striving to operate responsibly,” the statement reads.

Source: X

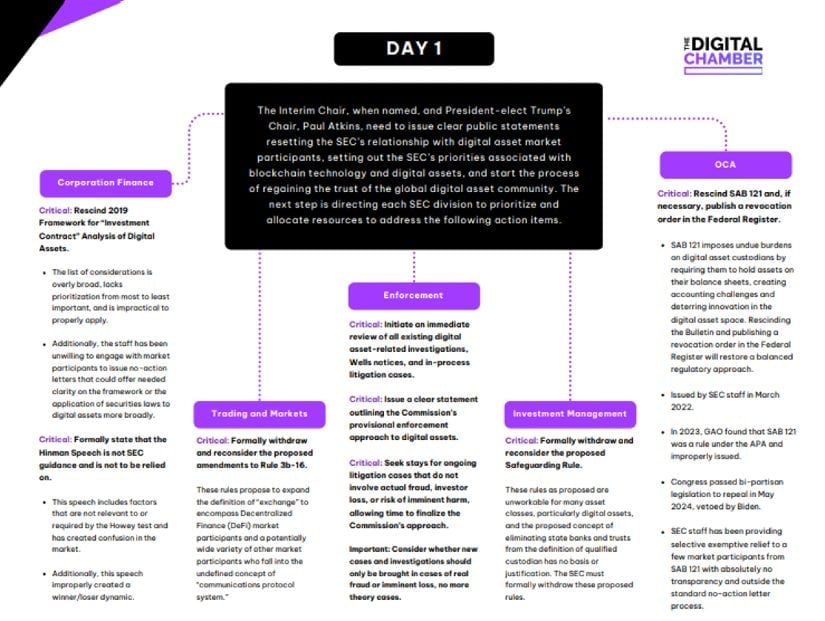

This sentiment was echoed during meetings between the Chamber’s Token Alliance Leadership Committee and current SEC commissioners, Hester Peirce and Mark Uyeda. The discussions outlined the group’s 2025 SEC Digital Asset Policy Priorities, aiming for clarity and well-reasoned regulations during Trump’s initial months in office.

Scrutiny of Past Policies and Trump’s Crypto-Friendly Stance

The advocacy group criticized previous SEC actions, including the controversial Staff Accounting Bulletin 121 (SAB 121). The bulletin requires crypto custodians to record assets as liabilities, a practice the Chamber argues burdens market participants. The group is also urging the rescission of outdated guidance, such as the 2019 framework on the Howey test for digital assets, which has been a point of contention for market clarity.

The Digital Chamber’s plan for an Atkins-led SEC from day one of the Trump era. Source: The Digital Chamber

Another priority is addressing the SEC’s practice of regulation by enforcement, which has led to legal battles with major crypto entities like Coinbase and Ripple. The Chamber suggests halting ongoing lawsuits that do not involve fraud or investor harm, allowing the SEC to develop a more cooperative regulatory approach.

Donald Trump’s presidency is expected to usher in a crypto-friendly regulatory framework. Trump has criticized current SEC Chair Gary Gensler’s stringent policies and vowed to appoint industry-friendly leaders. Gensler’s successor is likely to be former SEC commissioner Paul Atkins, who advocates for a balanced approach to digital asset oversight.

Speaking at the Bitcoin 2024 Conference, Trump said, “Regulations will be written by those who love the industry, not those who despise it.”

Broader Policy Reforms

Beyond SEC restructuring, the Digital Chamber is pushing for legislative action on stablecoins. Cody Carbone, the group’s president, has urged Congress to prioritize stablecoin legislation, citing its role in maintaining U.S. dollar dominance. “The moment is now—legislation needs to move,” Carbone stated.

The Chamber’s report, “How Stablecoins are Extending U.S. Dollar Dominance,” highlights the growing global use of stablecoins, with over 98% pegged to the U.S. dollar. The group calls for bipartisan efforts to pass laws that allow both banks and non-banks to issue stablecoins while ensuring they are not treated as securities.

Opposition to SEC Commissioner Reappointment

The Chamber has also taken a strong stance against the reappointment of SEC Commissioner Caroline Crenshaw, citing her rejection of Bitcoin ETFs and other crypto-related policies. In a letter to the Senate Banking Committee, the Chamber argued that Crenshaw’s actions have stifled innovation and investor confidence.

Brian Armstrong, CEO of Coinbase, echoed these concerns, labeling Crenshaw’s tenure as “more hostile to crypto than Gensler’s.” The Senate’s decision on her renomination is seen as pivotal for the future of U.S. crypto regulation.

A New Era for Crypto Regulation?

As the U.S. crypto industry anticipates a policy shift, the Digital Chamber’s proposals underline the need for a collaborative and transparent regulatory framework. With Trump’s administration poised to take charge, stakeholders are hopeful for a more balanced approach to fostering innovation while safeguarding investors.

The coming months will reveal whether the incoming administration can deliver the clarity and reform the crypto sector has long demanded.

Brave New Coin – Read More