|

Getting your Trinity Audio player ready… |

Australia’s e-commerce is projected to grow at an 8% compound annual growth rate (CAGR) to hit $55 billion this year, with digital payments playing a key part in the growth, a new report says.

The report by GlobalData revealed that in 2024, digital payments accounted for 53% of all e-commerce transactions in Australia, surpassing card payments and cash for the first time. Mobile wallets and buy now, pay later (BNPL) solutions saw the highest growth. Data published by the central bank in December showed that Australians had made over 500 million payments through their mobile wallets, amounting to over $20 billion in October.

Payment cards were the second most popular payment method with a 38.7% market share, with cash accounting for a paltry 3.1%.

GlobalData projects that the sector will grow at a CAGR of 6.5% over the next five years to hit $70.3 billion by 2029, a 37% surge from $51.3 billion in 2024.

“This growth can be attributed to the availability of secure online payment tools, an increasing number of online shoppers, and the rise of online merchants and payment options,” commented GlobalData’s senior banking analyst Shivani Gupta.

Globally, digital commerce has blown up over the past five years, with the 2020 COVID-19 pandemic boosting the number of online shoppers fivefold. One study estimates the sector will record $59 trillion in sales by 2028.

In Australia, the rapid uptake of digital payments is among the key factors for the growth of online commerce, Gupta added.

“The uptrend in e-commerce sales is likely to continue over the next few years supported by evolving consumer preferences, improving payment infrastructure, and proliferation of alternative payment solutions,” said Gupta.

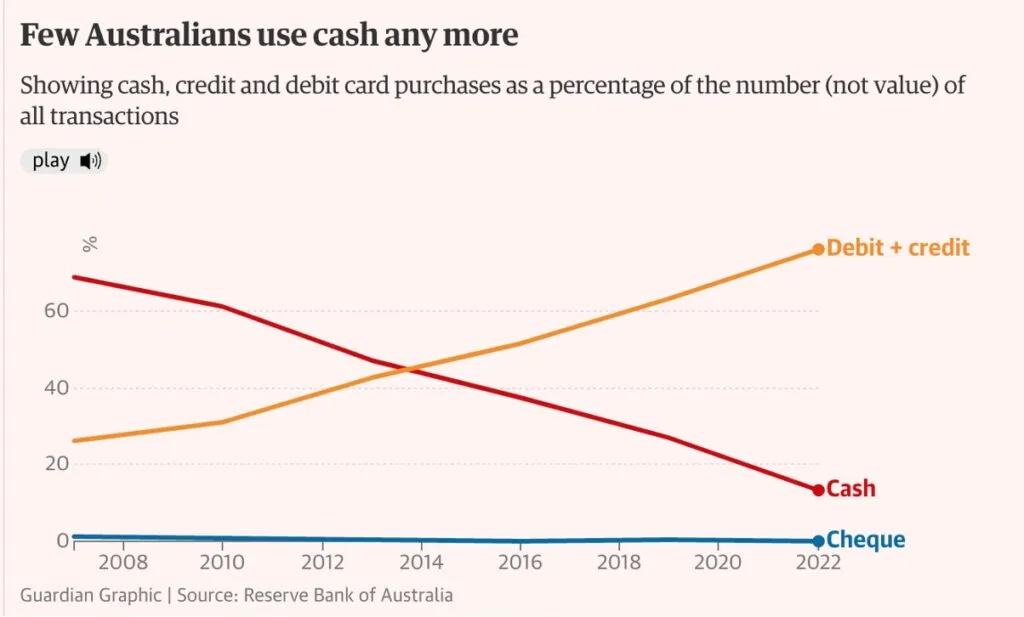

The rise in digital payments is gradually pushing out cash usage in Australia. The country’s central bank conducts a study every three years on cash interest, and in the last study in 2022, Australians reported using cash in only 13% of transactions, down from 69% in 2007. This year’s study will likely reveal even lower cash usage despite a new law enforced last November that forces businesses selling essential goods to accept cash.

Digital asset payments are also gradually taking off in Australia. Most recently, Alchemy Pay obtained a license from the Australian Transaction Reports and Analysis Centre to provide digital assets on- and off-ramps.

“We’re excited to bring our services directly to Australian users,” commented Alchemy Pay’s CMO, Ailona Tsik, adding that the firm will “connect the traditional financial system with the decentralized crypto economy.”

The Reserve Bank is also exploring a digital dollar. However, like most developed economies, Australia is leaning towards a wholesale central bank digital currency (CBDC). In September 2024, RBA launched a three-year CBDC implementation project, Project Acacia, that includes tokenization and the development of a new CBDC settlement infrastructure.

Papua New Guinea completes CBDC trial

In other CBDC news, Papua New Guinea has completed a trial for its digital kina, which involved instant payments and cross-border transfers.

The Bank of Papua New Guinea partnered with the Japanese Ministry of Economy, Trade and Industry and Japan’s blockchain market leader Soramitsu for the trial.

In her speech, Governor Elizabeth Genia said the central bank had delved into CBDC research to keep up with “rapid advancements in digital financial technologies globally, which have opened up opportunities to enhance payment systems and improve financial inclusion.”

The island nation in the southwestern Pacific Ocean, home to 10.6 million people, has been undergoing a digital transformation in its financial landscape, making it crucial for the central bank to explore the feasibility of a digital kina, Genia added.

Papua New Guinea launched the trial in July 2024. In addition to enhancing efficiency and boosting financial inclusion, the central bank said it would also use the CBDC to crack down on financial crime.

In partnering with Soramitsu, Papua New Guinea tapped into the Japanese firm’s vast experience in digital currencies and its turnkey CBDC solution, which other Pacific island nations have leveraged.

“Soramitsu is dedicated to modernising and advancing Papua New Guinea’s financial system while fostering the development of a digital economy. With the support of the Japanese government, we aim to leverage cutting-edge blockchain technology, proven in various countries, to make a meaningful contribution to this mission,” commented Soramitsu Japan’s president, Kazumasa Miyazawa.

Watch: Micropayments are what are going to allow people to trust AI

CoinGeek – Read More