![]()

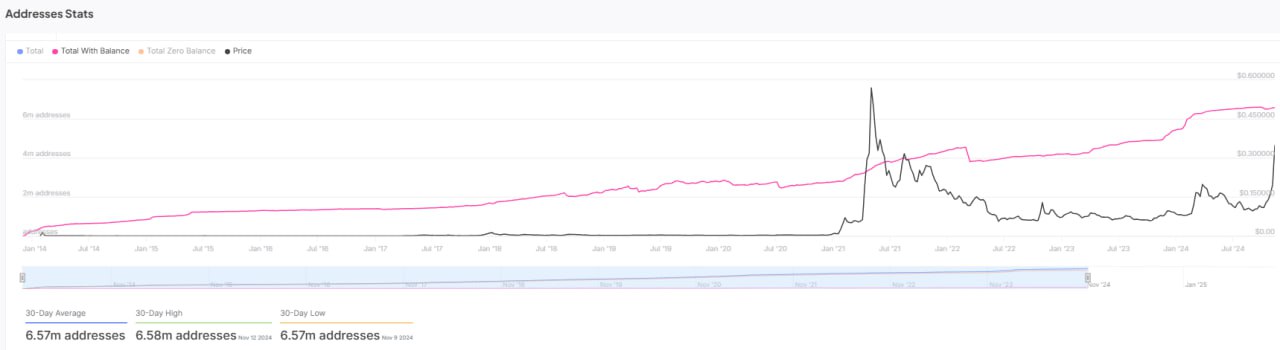

- Dogecoin’s active addresses surged by 34%, reflecting increased blockchain engagement and potential institutional interest in the meme coin.

- Major financial institutions and credit unions are integrating DOGE, expanding its accessibility and mainstream adoption.

Dogecoin is again in the news after its monthly active addresses increased by 34% to 6.57 million, according to IntoTheBlock. Unquestionably, this number shows a spike in involvement. But is this a portent for DOGE’s future or perhaps a passing flutter?

Grayscale and Bitwise Push Dogecoin Into Mainstream Investing

One reason behind the growing adoption of Dogecoins is the calculated moves done by big financial corporations. For instance, Grayscale Investments created the Grayscale Dogecoin Trust, which directly exposes institutional investors to DOGE, as previously reported by CNF.

Not only Grayscale, Bitwise Asset Management has also registered an S-1 with the United States Securities and Exchange Commission (SEC) to start a Dogecoin exchange-traded fund (ETF). This action enhances DOGE’s standing in the space of cryptocurrency investments even further.

DOGE Gains Traction in Banking Sector

Apart from the world of investments, traditional financial institutions are also beginning to accept Dogecoin for use in their operations.

Frankenmuth Credit Union included DOGE, Litecoin, Bitcoin Cash, and XRP to their crypto page in December. The move was in response to increasing member demand for more choices in digital currencies.

Elon Musk and the DOGE Dividend Talk

Among all these changes, Elon Musk has once more attracted attention. Commenting on the DOGE Dividend idea, which would give US taxpayers $5,000 return checks, the founder of Tesla even said he would personally go over the concept with US President Donald Trump. Although the plan is not sure whether it will be carried out, the DOGE community has gotten interested in it.

Is DOGE’s Growth Real or Just a Market Cycle?

Though data suggest a surge in active addresses, Dogecoin’s price has actually been declining over the last week. The recent data show that DOGE’s price declined 11.7% in the past 7 days and 3.7% in the past 24 hours. This raises the question: are there underlying factors at play, or does the surge in network activity genuinely signify a healthy development?

On the other hand, some experts think the meme coin is in a consolidation stage right now before maybe more increase. In the crypto realm, this cycle is not new at all. DOGE had stagnated multiple times before producing an amazing price increase at last. For investors, nevertheless, this kind of speculation still has to be counterbalanced with extensive research.

Dogecoin keeps expanding in terms of acceptance and supporting infrastructure independent of the temporary price dynamics. Encouragement from financial institutions, more active addresses, and support from people like Elon Musk help DOGE’s future to stay intriguing to watch.

Crypto News Flash – Read More