Ethereum news has seen a notable surge in ETH whale accumulation, with large holders purchasing over $236 million worth of ETH in just three days.

Despite recent price pressure, these large investors have remained confident and accumulated aggressively.

This activity suggests a potential shift in market dynamics, raising speculation about a possible rally forming soon.

Whale Activity Surges as Ethereum Trades Below $2,000

Ethereum experienced considerable market pressure because its price dropped below $2,000 in the past few weeks.

Despite recent market corrections, whales continue to buy ETH, which suggests their belief that future value appreciation will occur.

The transaction records show that institutional investors purchased more than 120,000 ETH over two days.

Such intensive buying behavior from individuals with high net worth values exceeded $236 million during this accumulation period.

A whale moved their cryptocurrency assets of 4,511 ETH from the exchange platform OKX into the decentralized wallet of Aave.

The whale reused $5 million USDT from borrowing and transferred this money to buy 2,563 additional ETH on OKX.

During the ETH price range of $1,872 to $2,060, the whale conducted these acquisitions to exploit market weakness.

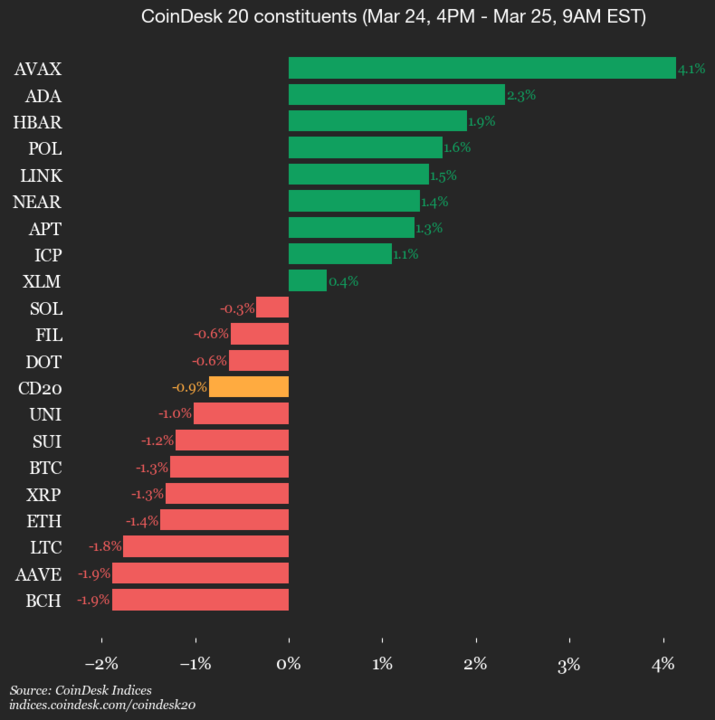

The price of Ethereum maintained its horizontal movement after achieving a 7% increase during the first part of the week.

As of the time of writing, the price of ETH was trading at $1,984, which remains below an essential resistance level.

Ethereum News: Technical Indicators Point to Short-Term Recovery

The Ethereum market surged in early recovery this weekend, settling at $1,991.4 at the time of writing.

Trading at 41.61 on the Relative Strength Index indicates Ethereum presently occupies a neutral position in its market.

The MACD indicator reveals upward momentum because its histogram generates positive readings.

Despite the bounce, ETH trades below key technical resistance levels, particularly the 50-day Exponential Moving Average at $2,067.

Above the current resistance line, the price would approach $2,367 as the next resistance barrier at the 100-day EMA.

Ethereum maintains solid backing at $1,600 as this important level has resisted multi-dated assessment tests this month.

The bearish trend would intensify if the price falls below $1,600, challenging the success of recent whale accumulation investments.

On-chain analytics coupled with technical indicators show reasons to believe market conditions are bettering.

The current trends indicate that whales are preparing to initiate an upward price movement.

Leverage Positions Increase Price Sensitivity Around Resistance

In recent Ethereum news update, the current ETH price sits within a crucial resistance area where short sellers with leveraged positions on Binance’s ETH/USDT perpetual contracts are positioned.

A significant number of short liquidations will activate within the price range of $2,013 to $2,040.

When ETH surpasses this resistance range, a short squeeze event may accelerate price growth to $2,080.

Long liquidations at $1,950 and below $1,920 support ETH price in the approaching short-term period.

Liquidations may trigger contract sellers who drive up market volatility when prices dip under this support level.

Both sides of the price range contain excessive contracts with leverage positioning at 50x and 100x exposure.

The present area appears highly sensitive because traders have taken positions that could cause rapid movements toward or away from their current positions.

Market participants hold a conservative outlook, but whales continue their acquisition patterns, which suggests they anticipate a coming increase in ETH value.

The post Ethereum News: Whales Snap Up $236M in ETH, Rally Brewing? appeared first on The Coin Republic.

The Coin Republic – Read More